Bretton Woods Three is a Process, Not an Event

Today:

CFTC Commentary

Premium: Full analysis and Technical excerpts from Michael Oliver

Yesterday’s Activity:

The S&P 500 and Dow closed at record highs on Thursday

Market Commentary:

Bloomberg Takes Note:

Those bets on Fed easing are juicing a rally in gold, which hit a fresh record. Bullion jumped to as much as $2,265.73 an ounce on Monday, up 1.6% from Thursday’s close, after setting a series of peaks in recent sessions. A host of other drivers have helped push up the metal by around 14% since the middle of February, including elevated tensions in the Middle East and Ukraine and strong buying by central banks, particularly in China.

MSA Updates: Silver and GDX

Similar set ups as he and we noted in November for gold are upon us. Specifically, price action for this month will likely determin Silver’s next $4 move as well as Miner direction.

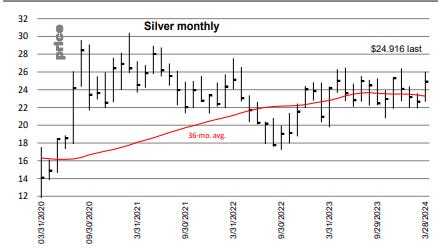

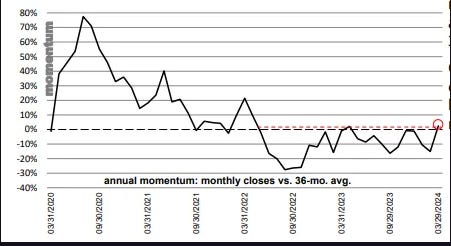

Silver: annual momentum

For April we want to see a monthly close at $25.25 or higher. Often with such structures —when they ’re so clear, large, and ripe —waiting for a monthly close can mean missing a lot….

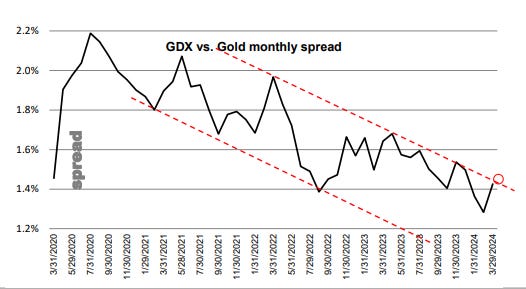

GDX (VanEck Gold Miners ETF): annual momentum

GDX: For this momentum chart, we’d specified that a monthly close for March at 31.55 or higher would do. So in the final hours of the month GDX got above 31.55 and hung in there to close 31.62….

Relative performance of gold miners vs. gold.

We specified a monthly spread close for March at 1.46% as a breakout. There was a sharp gain this month in the spread, but the close was 1.426% (GDX’s price expressed as a percent of gold’s)….

For complete insights go to Micheal Oliver’s MSA Website

Price Action

Gold- The buyer is back

Silver-

Miners-

Oil-

BTC/ETH-

Stocks-

Bonds-

Dollar-

Market News:

Markets around the world are getting a boost from improving sentiment in China, where data today showed factory activity beat expectations in March.

AT&T resets account passcodes after millions of customer records leak online. US telco giant takes action after 2019 data spill - better late than never

OpenAI and Microsoft reportedly planning $100 billion datacenter project for an AI supercomputer openAI is microsoft

"Home Depot is placing an $18 billion bet that will take the retailer beyond its big orange stores. Source: WSJ- upstream model, retail is dead

"Plunging demand for commodity offices in the US is driving growth for the highest-quality properties, a Morgan Stanley executive said. Source: Bloomberg- lower demand means lower demand

"Bruce Carnegie-Brown, chair of insurance giant Lloyd’s of London, told CNBC that the payout from the Baltimore bridge collapse and its knock-on effects could be “the largest-ever marine insured loss.” Source: CNBC- lobbying for govt help

"Xiaomi CEO Lei Jun said the standard version of the SU7 will sell for 215,900 yuan ($30,408) in the country — a price he acknowledged would mean the company was selling each car at a loss. Source: CNBC- Sayonora Tesla

GEOPOLITICS

Turkey’s main opposition party was poised to control most of the country’s largest cities while claiming a surprise victory in local elections that represent a rebuke to President Erdogan, reflecting discontent with the country’s turbulent economy.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 1 9:45 am S&P U.S. manufacturing PMI

TUESDAY, APRIL 2 10:00 am Factory orders Feb, speakers

WEDNESDAY, APRIL 3 10:00 am ISM services March 52.6% 52.6% 12:00 pm, speakers

THURSDAY, APRIL 4 8:30 am Initial jobless claims March , speakers

FRIDAY, APRIL 5 8:30 am U.S. nonfarm payrolls am U.S. unemployment rate 1

Premium:

MONDAY, APRIL 1 9:45 am S&P U.S. manufacturing PMI (final) March 52.5 52.5 10:00 am Construction spending Feb. 0.7% -0.2% 10:00 am ISM manufacturing March 48.1% 47.8% 6:50 pm Fed Governor Lisa Cook speaks TUESDAY, APRIL 2 10:00 am Factory orders Feb. 1.0% -3.6% 10:00 am Job openings Feb. 8.8 million 8.9 million 10:10 am Fed Governor Michelle Bowman speaks 12:05 pm Cleveland Fed President Loretta Mester speaks 1:30 pm San Francisco Fed President Mary Daly speaks TBA U.S. auto sales March 15.8 million WEDNESDAY, APRIL 3 8:15 am ADP employment March 158,000 140,000 9:45 am S&P U.S. services PMI (final) March 51.7 51.7 9:45 am Fed Governor Michelle Bowman speaks 10:00 am ISM services March 52.6% 52.6% 12:00 pm New York Fed President John Williams moderates discussion 12:10 pm Fed Chair Jerome Powell speaks 1:10 pm Fed Vice Chair for Supervisions Michael Barr speaks 4:30 pm Fed Governor Adriana Kugler speaks THURSDAY, APRIL 4 8:30 am Initial jobless claims March 30 210,000 210,000 8:30 am U.S. trade balance Feb. -$67.4B -$67.4B 10:00 am Philadelphia Fed President Patrick Harker speaks 12:15 pm Richmond Fed President Tom Barkin speaks 12:45 pm Chicago Fed President Austan Goolsbee speaks 2:00 pm Cleveland Fed President Loretta Mester speaks 2:00 pm Minneapolis Fed President Neel Kashkari speaks 7:30 pm Fed Governor Adriana Kugler speaks FRIDAY, APRIL 5 8:30 am U.S. nonfarm payrolls March 200,000 275,000 8:30 am U.S. unemployment rate March 3.8% 3.9% 8:30 am U.S. hourly wages March 0.3% 0.4% 8:30 am Hourly wages year over year 4.1% 4.1% 9:15 am Richmond Fed President Tom Barkin speaks 11:00 am Dallas Fed President Lorie Logan speaks 12:15 pm Fed Governor Michelle Bowman speaks 3:00 pm Consumer credit March $12.5B $19.5B

Share this post