Housekeeping: Good Morning.

“Comex is Dying”

Topic:

Gold Still Isn’t Money

Silver Chart Analysis

Market Analysis: Gold Isn’t Money

Gold is Tier1 capital as many now know. But many do not know that Gold, despite this new designation is still not considered money for liquidity purposes. This misplaced (ridiculous) designation persists despite recent evidence to the contrary. In our weekend post Special: Basel 3 Still Doesn't Recognize Gold as Money! we note…

Special: Basel 3 Still Doesn't Recognize Gold as Money!

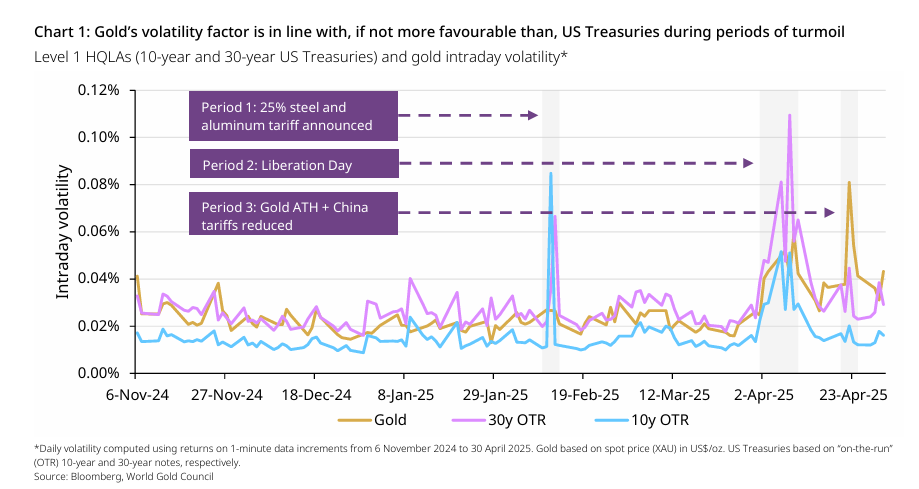

During the three most recent periods of extreme market volatility gold traded i) the same or more volume as 10 year US Treasuries ii) at lower volatility and iii) with narrower more consistent bid/ask spreads than bonds. Yet according to Basel 3 Liquidity Coverage Ratio (LCR), Gold is still excluded from EU Bank liquidity buffers while US Treasuries remain more trustworthy for liquidity— Therefore undermining Gold’s status as Tier 1 Capital. We explore why this is happening and why it is not justified.

February 2025: Trump’s 25% tariffs on steel and aluminum prompted sharp Treasury selloffs. Gold remained steady.

April 2025: A sweeping tariff escalation ("Liberation Day") triggered widespread bond volatility.

Late April: A partial de-escalation led to market relief and a dip in gold. Still, gold’s volatility remained inside Treasury ranges.

The exclusion of gold from Basel’s liquidity framework is difficult to justify to those familiar with the EU banking situation in general and the LBMA franchise issue specifically.

Against this backdrop we say from a regulatory perspective, gold may not be an HQLA. From a market perspective, it already is. We intend to explore this more in coming days.

Continues here

Related Posts:

Data on Deck: CPI/ PPI

MONDAY, JUNE 9 10:00 am Wholesale inventories

TUESDAY, JUNE 10 6:00 am NFIB optimism index

WEDNESDAY, JUNE 11 8:30 am CPI

THURSDAY, JUNE 12 8:30 am Core PPI

FRIDAY, JUNE 13 10:00 am Consumer sentiment

Summary and Final Market Check…

MONDAY, JUNE 910:00 amWholesale inventoriesApril0.0%0.4%

TUESDAY, JUNE 106:00 amNFIB optimism indexMay96.095.8

WEDNESDAY, JUNE 118:30 amConsumer price indexMay0.2%0.2%8:30 amCPI year over year2.5%2.3%8:30 amCore CPIMay0.3%0.2%8:30 amCore CPI year over year2.9%2.8%2:00 pmMonthly U.S. federal budgetMay-$318B-$347B

THURSDAY, JUNE 128:30 amInitial jobless claimsJune 7242,000247,0008:30 amProducer price indexMay0.2%-0.5%8:30 amCore PPIMay---0.1%8:30 amPPI year over year--2.4%8:30 amCore PPI year over year--2.9%

FRIDAY, JUNE 1310:00 amConsumer sentiment (prelim)June55.052.2

Share this post