Outline:

1. Introduction and Context

Market Sentiment:

Not bullish or bearish but neutral amidst changing behaviors.

Bullion banks are active again, joined by producers selling.

2. Key Topics for Analysis

Short Squeeze from Trump Tariff Rumors:

Market dismissed the alleged short squeeze as unfounded.

Implications for positioning and strategy.

Upcoming Interviews and Industry Insights:

Planned discussions with notable figures (e.g., Michael Oliver, Brynne Kelly).

Topics include gold market trends, oil insights, and equity strategies.

3. Behavioral Analysis: Weekly Market Activity

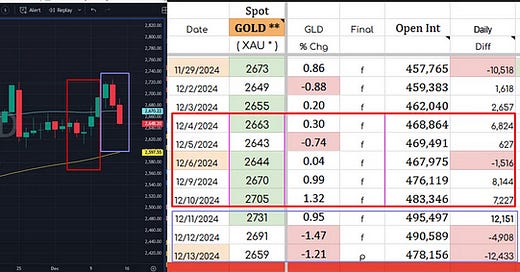

Open Interest and Price Trends (Last Week):

Red arrows denote five trading days analyzed in the chart.

Weekly movement summary:

Day 1: Market marginally up as new longs bought from new shorts (+6,800 contracts).

Day 2: Market down with new shorts entering

Day 3: Spinning top day, balance between longs and shorts.

Days 4-5: Upward movement driven by speculative fund buying and bank selling.