We want to buy cheaper and look for capitulation signs given weakness in India, the lack of follow through from Shanghai, and time spent at $2000 being so long - May 17th

Good morning.

Here’s a 13 minute walkthrough and analysis of the gold trade in the title.

Contents:

Podcast analysis

Related content

Overview:

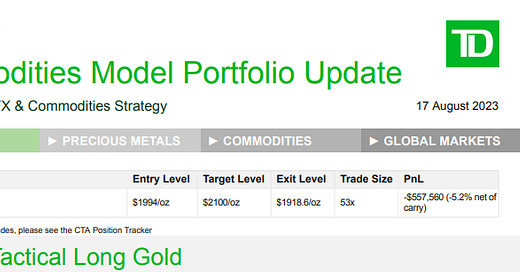

TD Bank exited their long gold position on Aug 17th. They said as much in a report on the same date explaining their rationale for exiting and the P&L

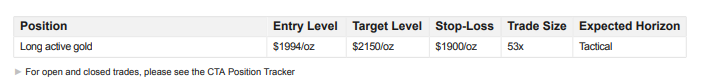

From our May 17th post when they entered the trade:

Their closing price reported on Aug 17th was $1918.60.

There are several key topics for traders. Including:

Changing Targets

Contango tax at 5% rates is real

Tactical vs. longer term

Difference between a bank and us

Managing isolated vs aggregated position risk

When the Bank put this position on we did a detailed analysis. A summary of that post is also included at bottom. (That original post)

The Podcast also covers how this fits in with the sell season risk…

Here then, are the notes and slides to accompany our proprietary podcast analysis above: