Housekeeping: Good Morning.

Remember the Toilet paper panic during Covid?

Now imagine that for Gold…

Today:

Premium Analysis: JPM Warns of Gold’s overbought status

News: BRICS Gets Spicy as India Begins Negotiating With China

Premium Markets:

JPM Looks Closely at Gold’s Current Investment Situation

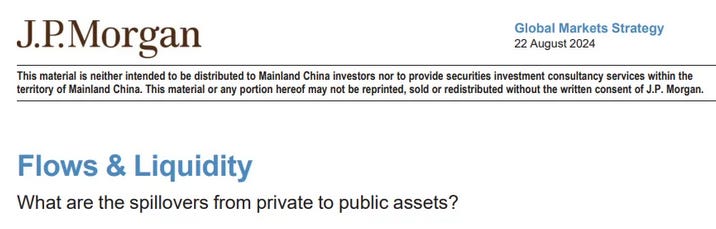

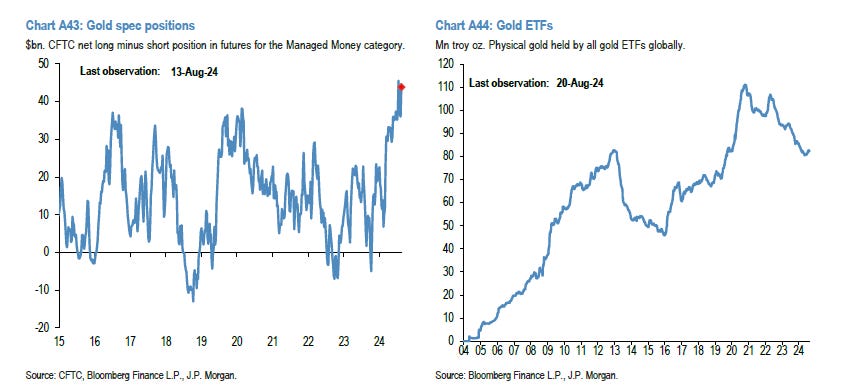

This is the current situation in Gold: Overbought, crowded, yet noone going to sell it short, and something new… there are likely options shenanigans afoot.

Being overbought is not new for Gold since December 4th and so we are not too worried about that with the the BRICS summit and presidential election coming. These types of indicators are something to worry about afterwards however, and as such they warrant clsoer inspection, which we glaly do at bottom

Too Many Futures Longs, But Few ETF Buyers….

We break out and break down the information behind the statements highlighted and discuss the potential risks associated with their observations

Continues in Premium at bottom

Equity Recap:

US equities closed lower on Wednesday as Nvidia (-2.10%) sold off ahead of its latest earnings report after the bell. Large caps and small caps retreated: S&P 500 (-0.60%) vs. Russell 2000 (-0.65%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) fell 0.62% and 0.35% respectively.

Market News: Brics Spice

BRICS Gets Spicy: India Begins Negotiating With China

From: India may consider proposal to use national currencies

India raises the question: If we will use a centralized notional currency for commodity trade, how will it be weighted relative to national money adn will it also obviate our ability to do national bilateral deals? In asking those questions India is pushing back against the potential of a China and Russia dominated basket.

BRICS 2024: 126 Nations Eyeing US Dollar Exit

From: BRICS 2024: 126 Nations Eyeing US Dollar Exit

Around 126 nations are set to attend the BRICS Municipal Conference, showing increasing interest in joining the bloc and moving away from reliance on the US dollar. This growing momentum among developing countries reflects a broader ambition to strengthen local currencies and diminish the dominance of the US dollar in global trade. Source: GoldFix

Other News

"Nvidia delivered strong quarterly revenue growth and a robust financial outlook, indicating persistent momentum in the nearly two-year-old AI boom despite concerns that investment has surged ahead too quickly. The AI chip giant on Wednesday said sales in the three months through July more than doubled from a year earlier to $30 billion. Nvidia’s profit also more than doubled to $16.6 billion." Source: WSJ

"Berkshire Hathaway became the first US company outside of the tech sector to surpass $1 trillion in market value....Source: Bloomberg

"OpenAI is in talks to raise several billion dollars in a new funding round that would value the startup behind ChatGPT above $100 billion... Source: WSJ

"China’s largest electric vehicle maker BYD reported a sharp slowdown in earnings growth for the first half of 2024, as a prolonged price war has hit companies in the world’s largest car market... Source: FT

"China’s epic housing bust has crushed big developers, bond-market investors and homeowners, causing billions of dollars in losses. Now Chinese regulators are zeroing in on another important player: PricewaterhouseCoopers, the auditor of choice for many of China’s biggest property firms." Source: WSJ

Politics/Geopolitics:

Nothing new to report today

Some headlines via NewSquawk or DataTrek

Data on Deck: PCE, Housing, and Gaggle of Fed Speakers

MONDAY, Aug. 26 Durable-goods orders Daly interview

TUESDAY, Aug. 27S&P Case-Shiller home price index

WEDNESDAY, Aug. 28 6:00 pm Atlanta Fed President Raphael Bostic speech

THURSDAY, Aug. 29 Trade, inventories, home sales 3:30 pm Atlanta Fed President Raphael Bostic speech

FRIDAY, Aug. 30 PCE1

Final Market Check…

Premium:

***DO NOT SHARE THIS***

Big JPM Gold Flows Analysis

Intro: This is a good snapshot of how things current are. Overbought, crowded, noone yet going to sell it short, and something sneaky going on in options. We will use this and updates on it as the elections approach to see if people added or subtracted headed to the big day. Otherwise, it is not predictive yet.