Housekeeping: Good Morning.

“The reset is a process, not an event”

Topic:

Bullion Bank Says Gold over Bonds for Next 5 Years

Analysis: Gold over Bonds for Next 5 Years

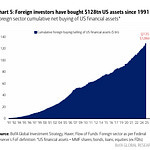

Following the failure of U.S. bonds to hedge equity downside and rising borrowing costs, Goldman Sachs notes investors are reevaluating long-term portfolio hedges.

Two conclusions emerge from their analysis:

First, gold and oil historically reduce risk and tail losses over 5+ years by hedging inflation shocks—gold against fiscal and monetary credibility, oil against supply disruptions. Second, a higher allocation to gold is recommended due to institutional risk and central bank demand.

Founders: Bullion Bank Makes Case for Gold and Oil over Bonds

Housekeeping: The audio is the rudiments of our thesis on how the US will solve its deficit problem as it pertains to weakening the USD without manufacturing anything new.

For strategic hedging over long horizons (5+ years), Goldman recommends the following:

Go long and overweight gold to protect portfolios against shocks to US institutional credibility.

Go long but underweight enhanced oil futures to protect against hard-to-predict tail negative oil supply shocks.

GoldFix Comment: Anti-Goldilocks has gone mainstream. Wall Street is now shifting its stance, with firms beginning to recommend gold over bonds—validating what we’ve been saying for the past three years. They're right. This is a long-term strategic shift, and we agree with the underlying analysis. The traditional 60/40 portfolio model is being redefined. Importantly, Goldman has been ahead of the curve on gold, and other banks are likely to follow, urging pension funds and 401(k) holders to increase exposure. While this may sound familiar to GoldFix readers, it’s breaking news for much of the West. That said, the easy gains are likely behind us.

Premium post this weekend

This Weekend:

Related Posts:

Data on Deck: FRIDAY, MAY 30

8:30 am Core PCE index April 0.1%0.0%

8:30 am Core PCE (year-over-year) 2.6% 2.6%

8:30 am Advanced U.S. trade balance in goodsApril

9:45 am Chicago Business Barometer (PMI) May

10:00 am Consumer sentiment (final) May

4:45 pm San Francisco Fed President Mary Daly speech

Summary and Final Market Check…