Housekeeping: Good morning.

Bretton Woods Three is a Process, Not an Event

Today:

Yesterday’s Activity:

US equities mostly fell on Monday after data showed manufacturing activity expanded last month for the first time since September 2022.

"US factory activity unexpectedly expanded in March for the first time since September 2022 on a sharp rebound in production and stronger demand, while input costs climbed. The Institute for Supply Management’s manufacturing gauge rose 2.5 points to 50.3 last month, according to data released Monday. While barely above the level of 50 that separates expansion and contraction, it halted 16 straight months of shrinking activity." Source: Bloomberg

Premium Excerpt:

GoldFix Comment:

34 page report with copious helpful slides we have also broken out at bottom

Treasure trove of industry information from the financials, to the industry fundamentals, to the geopolitical drivers

Frankly, its all you need if you want to get familiar with the investment potential, and if you already understand the industry, you can compare your assessments with theirs.

One thing is certain, this is a coming-out report, not an end of the rally report. And it’s must read for anyone interested. And we have it.

Goldman Goes Nuclear

We are initiating coverage on CCJ/CCO.TO with a Buy rating and US$55/C$74 price targets, implying ~30% upside from current levels.

Point 1. We see Estimate Change Potential from Better Realized Prices vs Consensus Estimates Longer Term

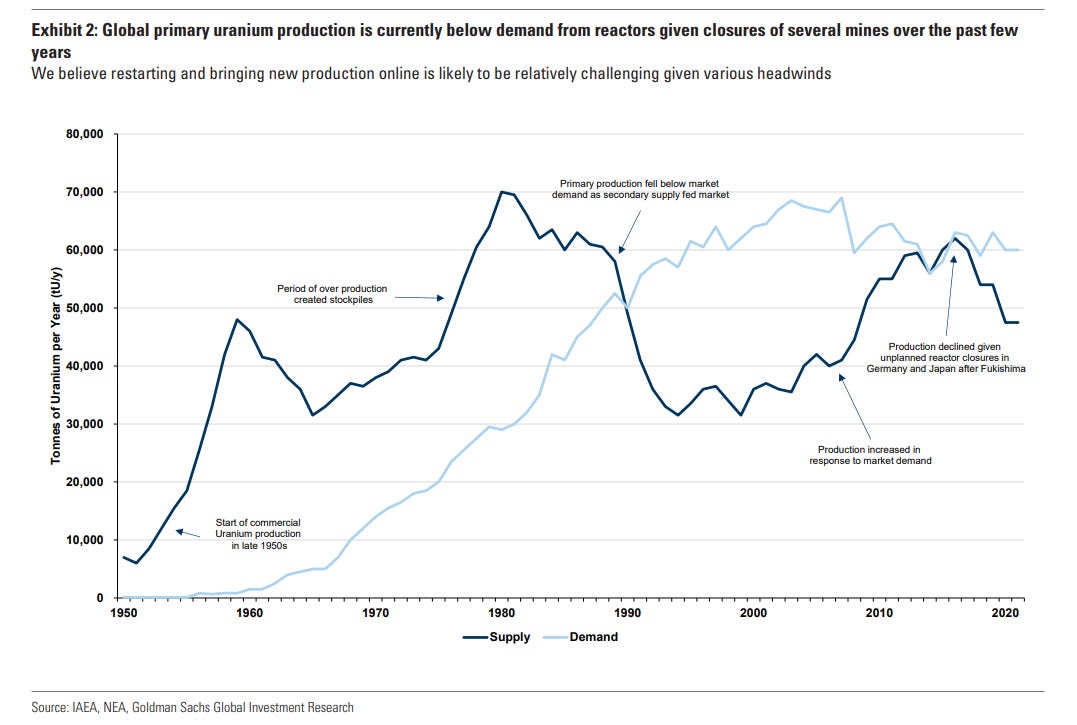

Now that supply overhang is gone, demand is outstripping production…

Point 2. Integrated Business Model Provides Exposure to Entire Value Chain vs more Isolated Peers

Vertical integration to the whole value chain…

Point 3. Estimate Revisions Should Be Aided by the Migration of Demand to Cameco

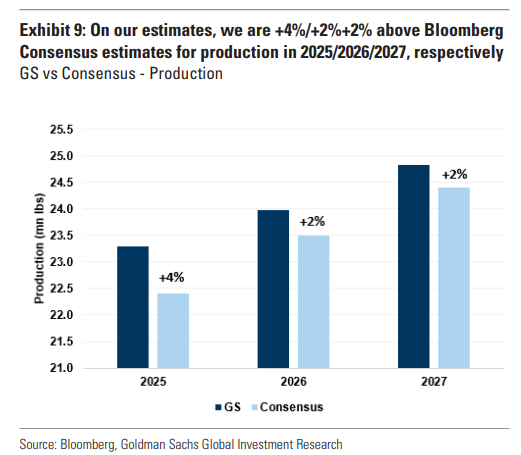

Consensus estimates for production are low…

Macro Market Recap: Gold and Bonds

-PMI comes out strong at 9:45 implying the economy is not only strong but has handed off leadership from consumer back to manufacturing. (Commodity strength is warranted in these; Hartnett observation 2 weeks ago)

-June rate cut hopes fade some - everything does what you’d expect given a drop in expectations of a Fed cut: dx higher, stocks lower, bonds soft. -except bonds have an exaggerated move, suggesting more exacerbated concerns about debt and debt service.

-Gold seeing this, gets back on its own horse despite dx strength. Gold and bonds are one market right now.

The dx continues to not be important for gold pricing in this backdrop and buyers use macro/data driven dips to add to secular positioning implying either large fund players or physical demand. We shall see.

Price Action

Gold- new highs = new buyers.. new sellers are profit takers

Silver- above 25.25 is Michael Oliver’s level

Miners- GDX is in play

Oil- should go much higher

BTC/ETH- not sure

Stocks- if they do not make new highs along with gold. be careful of both

Bonds-behaviorally not very good.. Gold/Bonds are one asset now

Dollar- goes up as bonds go down

Market News:

"Google plans to destroy a trove of data that reflects millions of users’ web-browsing histories, part of a settlement of a lawsuit that alleged the company tracked people without their knowledge. Source: WSJ

"Banks will have to cut their exposure to commercial real estate because of a $2tn “wall” of property debt coming due in the next three year Source: FT

"Microsoft will sell its chat and video app Teams separately from its Office product globally Source: CNBC

"Chinese electric-vehicle maker BYD’s sales jumped in March amid increasing competition from Chinese auto companies in the global EV market. Source: WSJ

"Companies racing to develop more powerful artificial intelligence are rapidly nearing a new problem: The internet might be too small for their plans. Source: WSJ

GEOPOLITICS- encroachment and tipping points

US told Iran it had no involvement or advanced knowledge of the Israeli strike on a diplomatic compound in Syria, according to Axios citing a US official.

Israeli shelling on a car of the World Central Kitchen organization in Gaza caused the death of 4 foreigners, according to Al Jazeera.

White House said US and Israeli teams had a constructive engagement on Rafah on Monday and agreed that they share the objective to see Hamas defeated in Rafah. US expressed its concerns with various courses of action in Rafah, while the Israeli side agreed to take the concerns into account and to have follow-up discussions between experts on Rafah with follow-up discussions to include an in-person strategic consultative group meeting as early as next week, according to Reuters.

US President Biden’s administration is reportedly considering the approval of a USD 18bln sale of aircraft and other munitions to Israel including F-15 jets.

Attempted drone attack on an oil refinery within Russia's Nizhnekamsk, via Tass; attack was thwarted, no damage occurred.

Ukrainian intelligence source says attacks on Russian refineries will continue in order to reduce Russia's oil revenue, according to Reuters

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 1 9:45 am S&P U.S. manufacturing PMITUESDAY, APRIL 2 10:00 am Factory orders Feb, speakers

WEDNESDAY, APRIL 3 10:00 am ISM services March 52.6% 52.6% 12:00 pm, speakers

THURSDAY, APRIL 4 8:30 am Initial jobless claims March , speakers

FRIDAY, APRIL 5 8:30 am U.S. nonfarm payrolls am U.S. unemployment rate 1

Premium:

Goldman report excerpts, and complete presentation slide deck