Housekeeping: Good Morning.

Gold revaluation is a process, not an event

Today:

Commentary: Follow the money

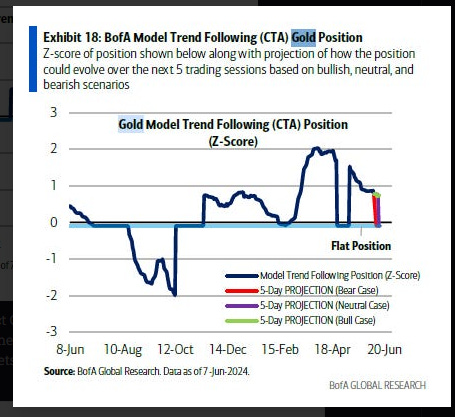

Premium: BOA CTA Analysis

Session Recap:

US equities closed at record highs on Monday ahead of the Fed's 2-day monetary policy meeting.

Premium / Markets: Follow the Money

About the epicenter of gold in the far east now: CNBC is about 10 years late on this statement. This process has been going on since 2014. When China stepped up on its gold and oil exchanges, when western banks started building vaults in Singapore, when demand started increasing post 2008 great financial crisis. That’s when it started.

This process has been going on since 2014…

Feel bummed? Don’t You are the first to know, and now you know they knew, and the best part, the whole world has no clue what you know. its like the lightbulb being invented and the rest of the world is using gaslights.. you are ahead of 99.9% of the world in knowledge on this topic. So.. lets look ahead knowing what we know now.

Here’s the Path for gold for the next 10 years.

Unless demand subsides in the east (via genuine deflationary economic crisis, or some overnight tier one assets substitute for gold) all privately held gold will move to the east from London and Switzerland prorated based on global economic power and wealth moving from Europe to Asia.

Here’s a comprehensive podcast documenting the dynamics on the topic…

How will that happen?

Well if, you’re in Europe and your standard of living is dropping and you’re forced to liquidate some of your wealth, like any declining power needs to, you sell your gold. And when you sell your gold, it’s bought by an Easterner.

That gold gets shipped to the east, (it may or may not get re-smelted depending on who bought it) into local specifications, and then it’s owned by someone else.

If you happen to be a wealthy westerner with your gold in Switzerland who doesn’t have to sell… and you get a return on it by leasing it out through your UBS banker in Switzerland… and you find that you can no longer do that because all the demand for the gold is in Asia, and only locally held gold gets leased out quickly, you will move your gold to Singapore so that you can lease it out to the Eastern demand and continue getting return on it.

(Geographic Demand determines business and pricing power in all raw materials commodity trade)

Gold and Silver will continue moving east for economic reasons. Gold is moving east because it’s a manifestation of wealth. Silver will move east becuase it is a manifestation of added value industry growth, and wealth.

Ideology will make way for economic prosperity. Those who cling to their beliefs, and do not adapt to the changing world will be left behind.

Think about how you can make money knowing that. Think about how you can protect your family and wealth knowing that… And act on it.

BOA CTA Analysis

Continues in Premium…

Market News:

"Apple joined the AI arms race, saying Monday it plans to bring a more personalized version of artificial intelligence to its 2.2 billion device users—including striking a deal with ChatGPT-maker OpenAI. Source: WSJ

"Elliott Investment Management has built a stake of nearly $2 billion in Southwest Airlines and wants to overhaul the company’s leadership to boost its financial and stock performance." Source: WSJ

"CrowdStrike shares jumped 7% on Monday after an announcement that the cybersecurity software vendor was joining the S&P 500, replacing financial firm Comerica Source: CNBC

"Billionaire Elon Musk said he would ban Apple devices from his companies if OpenAI’s artificial intelligence software is integrated at the operating system level, calling the tie-up a security risk." Source: Bloomberg

Geopolitics:

MIDDLE EAST

Israel conducted raids on the Hosh al-Sayed Ali area of the Hermel district near the Lebanese-Syrian border, according to Al Jazeera.

US State Department said Secretary of State Blinken discussed with Israeli Defence Minister Gallant on Monday the Gaza ceasefire proposal.

"Hamas ready to implement ceasefire agreement: Senior official", via IRNA; Senior Hamas official Mahmoud al-Mardawi said that the Hamas movement is ready to cooperate for the implementation of the ceasefire agreement.

"Israeli media: About 40 rockets were launched from southern Lebanon and one landed in the Upper Galilee", according to Sky News Arabia.

US President Biden is to lift the ban on allowing a controversial Ukrainian unit to use US weapons, according to The Washington Post.

South Korean military said it fired warning shots after North Korean soldiers briefly crossed the border on Sunday, according to Yonhap.

Some headlines via NewSquawk or DataTrek

Data on Deck: CPI and Fed Day

MONDAY, JUNE 10 None scheduled

TUESDAY, JUNE 11 6:00 am NFIB optimism index

WEDNESDAY, JUNE 12 8:30 am Consumer price index 2:00 pm FOMC

THURSDAY, JUNE 13 8:30 am Producer price index

FRIDAY, JUNE 14 10:00 am Consumer sentiment (prelim) June 72.3 69.11

Premium:

***DO NOT SHARE THIS***

Later today we will send out a podcast describing Gold’s likely path from here using this chart as the map