Housekeeping: Good Morning.

“US national debt rising $1tn every 100 days ($32tn to $33tn took 92 days, $33tn to $34tn 106 days, $34tn to $35tn will take 95 days); financing domestic bliss & overseas wars. US budget deficit past 4 years = 9.3% of GDP...little wonder "debt debasement" trades closing in on all-time highs, i.e. gold $2077/oz, bitcoin $67734.”- Michael Hartnett

Today:

Powell Will Not Discuss Gold Repatriation

Premium: Hartnett’s Flow Show

Yesterday’s Activity:

US equities rallied on Thursday as the Nasdaq closed at a new all-time high. Gold was stronger as was the dollar and Bitcoin. Oil finished weaker after a strong start

Market News:

NOTABLE HEADLINES

Fed Chair mum on foreign nations’ evacuation of Gold from US

Concerned about a weaponized financial system, many countries have signaled plans to remove their gold and other assets from the U.S. in the wake of the unprecedented Western sanctions imposed on Russia over its invasion of Ukraine.

And at least one congressman is demanding answers from the Federal Reserve as to how much foreign gold has actually been removed from U.S. shores so far.

But amidst the geopolitical angst, Fed Chairman Jerome Powell is refusing to divulge information about the U.S. central bank’s gold holdings. Insiders say such information could be highly damning.

GATA: The questions CFTC and Fed won't answer expose gold price suppression policy

Fed still thinking publicly inflation is not a problem despite supercore spike

"The Federal Reserve’s preferred gauge of underlying inflation rose in January at the fastest pace in nearly a year, helping explain policymakers’ patient approach to start cutting interest rates.

Fed's Williams (voter) said the Fed can take time to deliberate on the next policy move and he expects the Fed to cut interest rates later this year but doesn't see a sense of urgency to cut rates

GEOPOLITICS

The Biden administration on Thursday announced an investigation into possible security risks of Chinese-manufactured autos, saying that modern vehicles are full of sensors, cameras and software that China could use for espionage or other malign purposes.

Israeli PM Netanyahu said Israel won't fold to the delusional demand of Hamas

More1

Some headlines via NewSquawk or DataTrek

Data on Deck:

FRIDAY, MAR 1 S&P U.S. manufacturing PMI

Markets/Metals Commentary (Charts):

Comment:

Gold- Sideways was bullish 2055 breached GCJ. EOW settlement- 2085 next

Silver- Gold did its job, Silvers turn to lead.. and it is not doing that yet

Oil- selloffs on data, rallies on flows. dips being bought

Stocks- Regional banks, NVDA etc

BTC/ETH- HK ETFs are coming, natural selling halving, GB TC swapover has been handled like a champ, Sellers keep retreating, bids not chasing, no season, JPM tells clients to sell for the halving….

Bonds

Premium Attached:

Market discounting fed cuts vs hikes

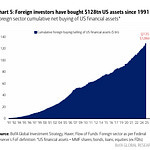

Hartnett on the deficit