Housekeeping: Good Morning.

Weaker dollar if Trump is right, Weaker dollar if Trump is wrong

Today:

Premium: Written summary and analysis of the TRUMP Bloomberg interview

Commentary: Trumponomics Broken down with video insights

Equity Recap:

US equities advanced on Tuesday amid the ongoing rotation into small caps and sectors outside of tech. Large caps lagged small caps: S&P 500 (+0.64%) vs. Russell 2000 (+3.50%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) gained 0.57% and 0.48% respectively.

Premium / Markets: Trumponomics 2.0

Bottom Lines for Economics

Mercantilism- sound money, high tariffs, anti financialization

Classic Corporatism- not banks, businesses that create and innovate and do. Deregulation

Protectionist Tariffs- Consumption taxes

Lower business tax- attract companies, opposite of Germany

Bottom lines for Markets

Inflationary at first

Weaker dollar

Higher commodities

Higher stocks

Gyrating bonds

Bullish Gold

Trump outlined the core tenets of Trumponomics 2.0 in an interview with Bloomberg. Key highlights:

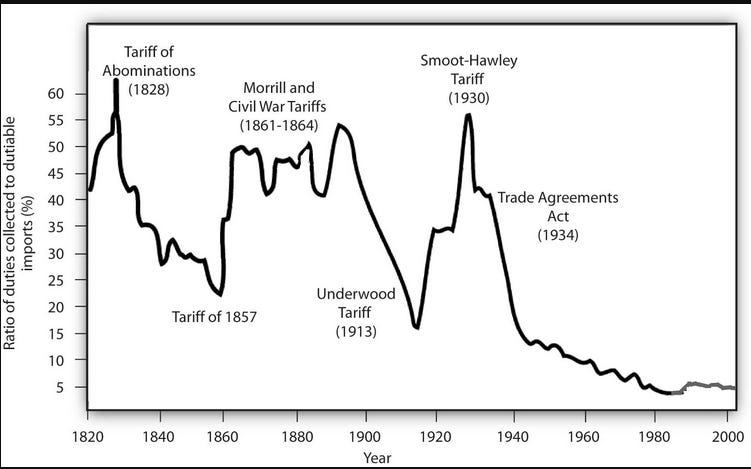

Sanctions and Tariffs: Despite his dislike for sanctions, Trump plans to enforce extensive bilateral sanctions and draw inspiration from William McKinley’s tariff policies to generate revenue.

Federal Reserve: Jerome Powell will be allowed to complete his term as chair, ending in May 2026

Corporate Tax: Trump intends to lower the corporate tax rate to 15%.

TikTok: He no longer plans to ban TikTok.

Treasury Secretary: Jamie Dimon is considered for the role of Secretary of the Treasury'.

Foreign Policy: Trump is ambivalent about protecting Taiwan from China and punishing Russia for the Ukraine invasion.

Trump believes he now better understands the levers of power and the importance of selecting the right personnel. His policies focus on tax cuts, more oil production, deregulation, higher tariffs, and fewer foreign commitments, aimed at appealing to swing state voters. This approach appears to be gaining traction, especially among Black and Hispanic men.

Energy

Trump’s approach to inflation includes increasing oil and gas drilling, which he believes will lower prices despite the potential inflationary impact of tariffs. He also emphasizes harsh immigration restrictions to boost domestic wages.

Tariffs, not taxes

Regarding the budget deficit, Trump’s tax cuts and protectionist policies are expected to exacerbate the national debt. However, his other policies may attract business leaders.

Cutting Bait With Externalities and pay for play

Trump’s proposed economic agenda includes maintaining tariffs, potentially increasing them, and reconsidering the US commitment to defending Taiwan. He has a favorable stance towards Saudi Arabia, citing personal relationships.

Much much more in Premium

Market News:

Bloomberg interviewed Donald Trump on his plans for taxes, tariffs, and Fed Chair Powell among other issues should he win a second presidential term. Trump wants to lower corporate tax rates to 15% and said he would allow Chair Powell to serve out his term which ends in May 2026. He also said he'd consider Jamie Dimon to serve as Treasury Secretary. You can read the full interview here in Bloomberg.

"Morgan Stanley’s profits increased more than 40 per cent in the second quarter, but the bank reported a slowdown in growth in its cornerstone wealth management business." Source: FT

Geopolitics:

Israeli media reported more than 80 rockets were fired from Lebanon on Tuesday night, according to Sky News Arabia.

Lebanon's Hezbollah chief says Israel persistence in targeting civilians will push Lebanon to target "new colonies" that were not previously targeted.

Russian Deputy PM Novak says the latest EU sanctions targeting Russia's LNG industry are illegal, according to TASS.

Hungarian Foreign Minister said efforts are being made to hold a second peace conference on Ukraine this year, according to RIA.

Some headlines via NewSquawk or DataTrek

Data on Deck: RNC Convention 15th-18th

MONDAY, JULY 15 12:00 pm Fed Chairman Powell speaks

TUESDAY, JULY 16 8:30 am U.S. retail sales June -0.2% 0.1%

WEDNESDAY, JULY 17 8:30 am Housing starts June 1.30 million 1.28 million

THURSDAY, JULY 18 U.S. leading economic indicators June -0.3% -0.5%

FRIDAY, JULY 19 10:40 am New York Fed President Williams speaks 1

Premium:

Trump Bloomberg Interview Broken Down

This is a dry uninterprtted breakdown trying to reflect the tone of the Bloomberg interview, which showed slight signs that they are changing allegiances politically. Interpretive analysis will follow in the coming days. Up top we gave broadstrokes to get you started.

***DO NOT SHARE THIS***