Housekeeping: Good Morning.

Gold revaluation is a process, not an event

Today:

Commentary: FOMC Prep and the end of the selloff

Premium: Goldman report: “Why Wait until September” to Cut?

Equity Recap:

US equities closed mostly flat on Monday ahead of a slew of corporate earnings reports and the start of the Fed's two day meeting.

Premium Markets:

This is Fed Week, and as such there is much debate over the Fed’s potential for a rate cut. The financial press is throwing around phrases that we feel only muddy the waters. As this is an important season because of the BRICS summit and the US Election, we wanted to give you a better way.

First off, most think the Fed will announce a September cut on Wednesday. Some think the Fed may actually cut on Wednesday. As it stands right now, markets almost 100% believe there will be a rate cut in September. Some think a rate cut can possibly go into effect as early as this week. That would make it a July Cut.

July 28th, Nick Timiraos said:

“The Fed's July meeting is all about September”

Bill Dudley, Fed

I Changed My Mind. The Fed Needs to Cut Rates Now. Waiting until September unnecessarily increases the risk of a recession. Full article footnoted1

Goldman’s Chief Economist Jan Hatzius

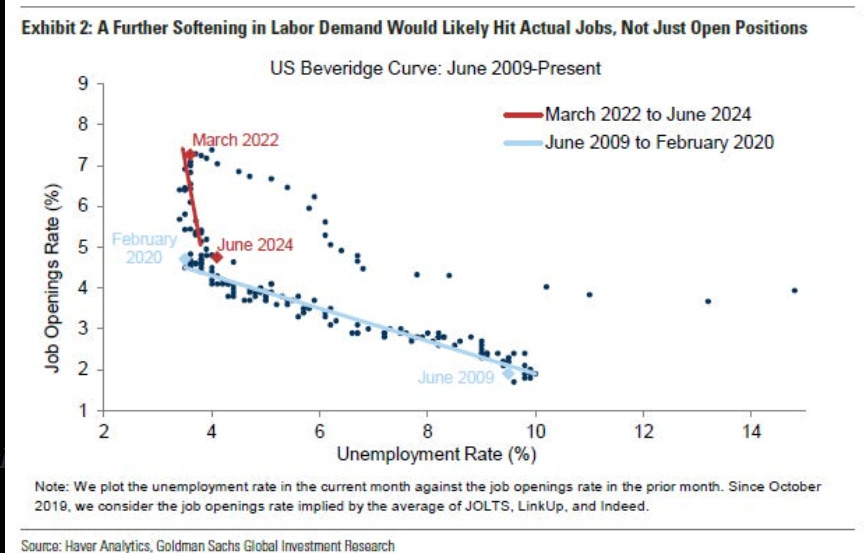

Using the latest unemployment and inflation numbers, we estimate that the median of the Fed staff’s monetary policy rules now implies a funds rate of 4%, well below the actual rate of 5¼-5½%. Based on this observation, the encouraging June CPI, and Chair Powell’s congressional testimony last week, we expect adjustment cuts to start soon.

If the case for a cut is clear, why wait another seven weeks before delivering it?

Continues at Bottom

Michael Oliver Sunday July 28th

They will probably cut in July. Too many voices within the Fed (led by Powell a few weeks ago) are arguing that “too high for too long” is not acceptable. Even the term “recession” was used in one Fed Governor’s concerns.

For Monday that requires the August future to settle at $2397, and by Tuesday around an estimated $2384 will do it. That sort of daily momentum shift to a positive zigzag will indicate, at least to MSA, that this latest short-term selloff is wrapping up

More at bottom

Market News:

"McDonald’s has suffered its first global drop in sales since 2020, as consumers around the world balk at the higher cost of burgers, fries and soft drinks. Source: FT

WSJ’s Timiraos wrote “The NY Fed's measure of inflation persistence (the "multivariate core trend" rate) fell again in June, to 2.1%”, while he added "With meaningful shelter disinflation arriving in June, the declines in inflation are broadening".

"Earnings reports from Amazon, Meta and eBay could all raise questions about the ongoing impact of discount retailers Temu and Shein. Source: CNBC

"Banks and other lenders are seizing control of distressed commercial properties at the highest rate in nearly a decade, a sign that the sector’s punishing downturn is entering its next phase and approaching a bottom.Source: WSJ

"On a soybean farm in Ohio, America’s largest solar manufacturer is trying to beat China to the next breakthrough in clean energy. This month, First Solar opened the country’s largest solar research facility in the Rustbelt state, where it has manufactured panels since 2002. The objective: to commercialise the next generation of technologies to harness power from the sun before Beijing does. The company’s push into research comes at a tumultuous time for US solar manufacturing, and is motivated by the belief that to compete on clean technologies, the US must innovate rather than replicate China." Source: FT

Politics/Geopolitics:

Venezuelan opposition leader Machado said the opposition has the ability to prove truth of election results, while a US senior official accused Venezuela's Maduro government of "electoral manipulation". It was also reported that Uruguay's Foreign Minister said the country will never recognise Maduro's win due to a clear victory of the opposition and Peru's Foreign Ministry ordered Venezuelan diplomats to leave the country within 72 hours.

Former US President Trump said he would probably end up debating VP Harris but added that he could also make a case for not debating.

US is leading a diplomatic push to deter Israel from targeting Beirut and southern suburbs in response to the Golan strike, according to Reuters citing sources.

Russia's Navy started drills involving 20,000 personnel and 300 ships, while drills involve Russia's Northern, Pacific and Baltic fleets and Caspian Sea flotilla, according to Interfax

Some headlines via NewSquawk or DataTrek

Data on Deck: Two Fed Decisions

MONDAY, JULY 29 None scheduledTUESDAY, JULY 30 10:00 am Consumer confidence July

WEDNESDAY, JULY 31 2:00 pm FOMC interest-rate decision

THURSDAY, AUG 1 PMI July ISM manufacturing July 48.8% 48.5%

FRIDAY, AUG. 2 8:30 am U.S. employment report July 190,000 206,000 8:30 am U.S. unemployment rate July 4.1% 4.1% 1

Premium:

***DO NOT SHARE THIS***