Housekeeping: Good Morning.

Bretton Woods Three is a Process, Not an Event

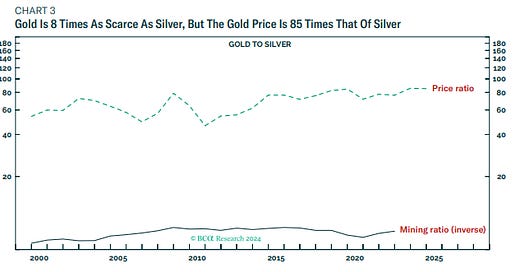

For centuries, the gold price tracked its scarcity versus silver multiplied by the silver price. But when the world moved to a fiat monetary system the gold price surged to well above its scarcity versus silver.

Today:

Yesterday’s Activity:

US equities retreated on Wednesday as investors weighed a hotter than expected inflation report and the timing of rate cuts by the Fed.

Market Commentary

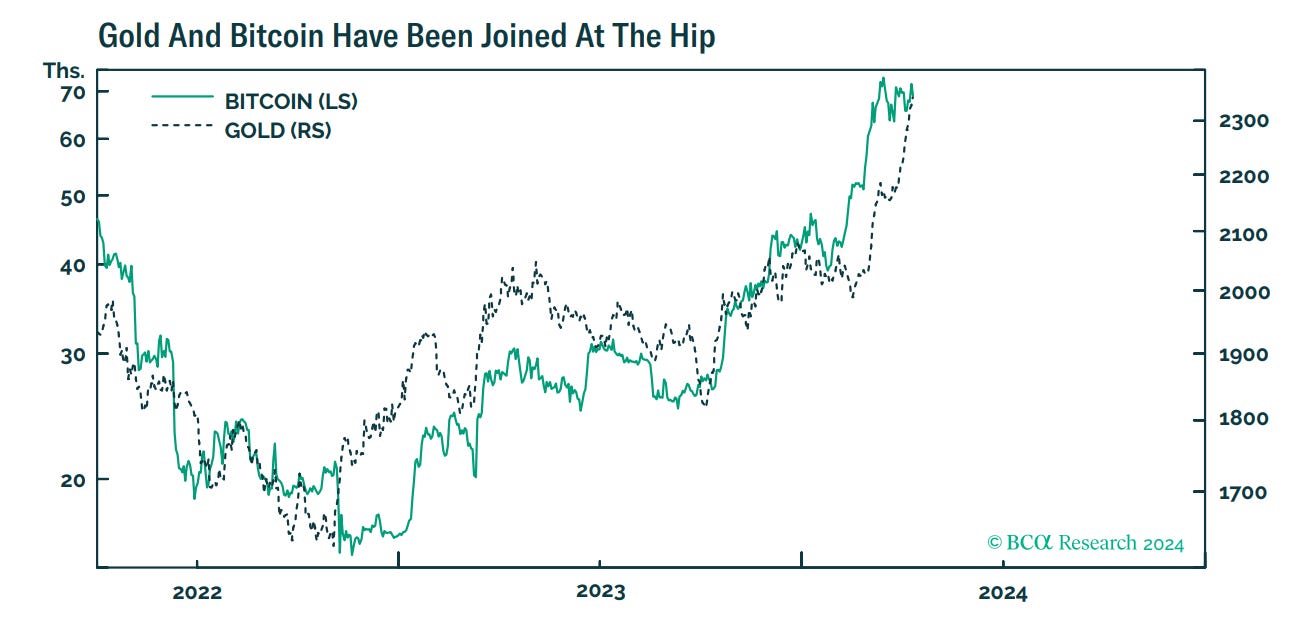

Gold and bitcoin [and Silver] are conceptually joined at the hip because some of their value comes from their non-confiscatability by inflation, by bank failure, and to an extent state expropriation

Gold and Bitcoin have been similar of late

Both are tactically set for a retracement

Silver exists on earth in a ratio of 8 to 1, yet its price is 85 to 1.. why?

Gold and Bitcoin have been highly correlated recently…

If you backed out leverage, their profiles are very similar…

Other precious metals that are gold’s neighbours in groups 10 and 11 of the periodic table – silver, platinum, and palladium – can substitute for gold’s physical properties. So, we can quantify the part of gold’s value that comes from its physical properties, as being gold’s relative scarcity versus, say, silver (as captured by the so-called ‘mining ratio’) multiplied by the price of silver (Chart 3).

Nevertheless, gold and bitcoin have already rallied sharply and reached collapsed short-term complexities that make them vulnerable to tactical consolidation or reversal.

Much more in premium

Price Action

Gold- weak but not dead

Silver- rotation into silver by value players

Miners-

Oil- doesn’t care about your opinion

BTC/ETH-

Stocks- no more hope

Bonds- YCC is coming

Dollar- steady as she goes.

Market News:

BoE's Greene wrote in the FT that markets must stop comparing the UK and the US, as well as noted that inflation persistence is a greater threat for the former than the latter and that rate cuts are a way off.

"Federal Reserve policymakers “generally favored” slowing the pace at which they’re shrinking the central bank’s asset portfolio by roughly half, minutes from their latest gathering showed. " Source: Bloomberg

"Stubborn inflation pressures persisted in March, derailing the case for the Federal Reserve to begin reducing interest rates in June and raising questions over whether it can deliver cuts this year without signs of an economic slowdown. Source: WSJ

"The 88th playing of the Masters arrives at a precarious moment in golf: Its defending champion has since departed for the Saudi-backed LIV Golf League, its greatest winner not named Jack Nicklaus has played only five full rounds of golf this year, and the sport's overall ecosystem remains fractured and its future uncertain. Yet once the first tee shot is hit Thursday, all eyes will be on the best players in the world navigating the sport's most historic venue over 72 holes." Check out ESPN's "six storylines to watch at Augusta" here.

GEOPOLITICS

Pax Americana is over, and US is financing local nations to build their own defenses

US Secretary of State Blinken made it clear in a call with Israeli Defence Minister Gallant that the US will stand with Israel against any threats by Iran and its proxies.

US senior general is to visit Israel to coordinate on Iran attack threat with CENTCOM commander Gen. Kurilla

Israeli officials said they are preparing for a possible, unprecedented direct attack against Israel from Iranian soil using ballistic missiles, drones and cruise missiles against Israeli targets

Saudi Arabia, Qatar, UAE and Iraq's Foreign Ministers spoke by phone last night with the Iranian Foreign Minister to discuss regional tensions, according to Axios's Ravid.

"Israeli Finance Minister: Rafah and Deir al-Balah and Nuseirat must be entered starting today", according to Al Arabiya; "The army is preparing to deepen operations in Rafah".

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY1 pm Chicago Fed President Austan Goolsbee radio interview None scheduledTUESDAY, APRIL 96:00 am NFIB optimism index March 89.7 89.4WEDNESDAY, APRIL 108:30 am Consumer price index March 0.3% pm Minutes of Fed's March FOMC meetingTHURSDAY, APRIL 11 8:30 am Initial jobless claims April 6 215,000 221,000 8:30 am Producer price index March

FRIDAY, APRIL 12 10:00 am Consumer sentiment (prelim) April 78.6% 79.4% 2:30 pm1

Premium:

more analysis