Housekeeping: Good Morning.

Gold revaluation is a process, not an event

Today:

Commentary: French Conservative Change

Premium: CITI on Gold

Session Recap:

Dip then late day rally in US stocks

Premium / Markets: The Future is Now

French bonds and bank stocks rocked by political turmoil

French markets endured another brutal sell-off on Friday as political uncertainty unleashed the biggest weekly jump in the premium investors demand to hold French government debt since 2011 and bank stocks tumbled.

France's Finance Minister Bruno Le Maire warned the euro zone's second-biggest economy faced the risk of a financial crisis if the far right were to win parliamentary elections in the coming weeks.

Marine Le Pen's eurosceptic National Rally (RN), is leading in opinion polls following President Emmanuel Macron's surprise decision at the weekend to call a snap election.

Le Pen's party is calling for a lowering of the retirement age, cuts in energy prices, increased public spending and a protectionist "France first" economic policy approach. French banks were hit hard.

CITI’s Wealth Outlook 2024

Lately, gold has appreciated despite rising US real interest rates. Historically, the metal has moved in the opposite direction to inflation-adjusted rates.

But since the US Federal Reserve began tightening monetary policy in March 2022, the gold price is up 23%. What is behind this breakdown in its relationship with real rates, which was last seen in 2006 when gold was in the middle stages of a bull run?

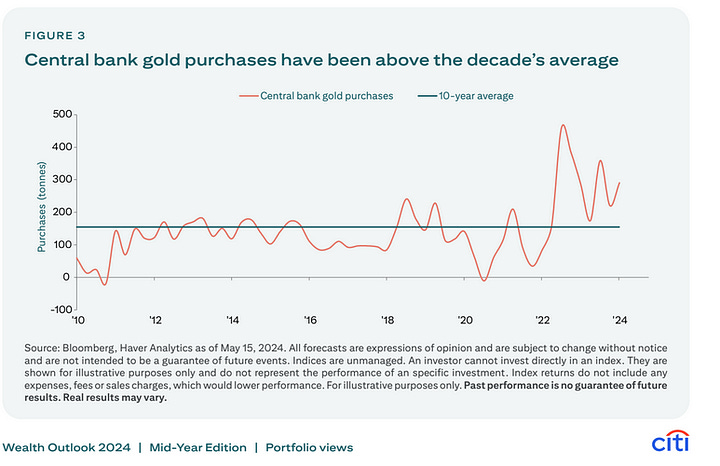

We believe the answer lies partly in unusually large central bank purchases of the precious metal – FIGURES 2 AND 3.

Foreign reserves data shows a $35.6 billion jump in China’s official gold holdings over the past year alongside some selling of US Treasuries. Another source of demand has been from Asian retail investors. Both these buying trends may continue, but we would not simply assume that they will

Continues in Premium…

Market News:

US Treasury Secretary Yellen said strong US growth is lifting global growth and that the labour market remains strong, while she added that US labour market pressures have eased and wages are rising more slowly.

China Market Regulator says Tesla (TSLA) China recalls 5826 imported Model 3, Model S and Model X vehicles.

Adobe Inc (ADBE) Q2 2024 (USD): Adj. EPS 4.48 (exp. 4.39), Revenue 5.31bln (exp. 5.29bln). Sees Q3 Adj. EPS USD 4.50-4.55 (exp. 4.48).Shares +15% pre-market

Geopolitics:

Hamas leader Osama Hamdan told CNN that neither they nor anyone has any idea how many live hostages there are, according to Al Jazeera.

US President Biden said he hasn't lost hope but Hamas has to step up regarding a Gaza ceasefire.

US State Department said the recent report issued by the IAEA makes it clear that Iran aims to continue expanding its nuclear program in ways that have no credible peaceful purpose

US President Biden vowed that the US will support Ukraine ‘until they prevail in this war’, while he said Washington will send more Patriot air defence systems to Kyiv as G7 steps up support, according to FT.

Japanese Chief Cabinet Secretary Hayashi said they are poised to soon officially announce a new sanctions package against Russia

Finnish border guard suspects four Russian planes violated Finnish airspace on June 10th.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, JUNE 10 None scheduled

TUESDAY, JUNE 11 6:00 am NFIB optimism index

WEDNESDAY, JUNE 12 8:30 am Consumer price index 2:00 pm FOMC

THURSDAY, JUNE 13 8:30 am Producer price index

FRIDAY, JUNE 14 10:00 am Consumer sentiment (prelim) June 72.3 69.11

Premium:

***DO NOT SHARE THIS***