Housekeeping: Good Morning.

Bretton Woods Three is a Process, Not an Event

Today:

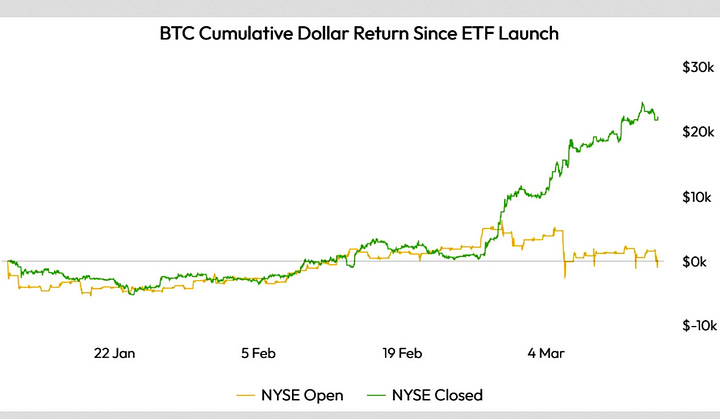

BTC and Ca. Jobs Data

Premium: Goldman Gets Nervous

Yesterday’s Activity:

US equities retreated on Thursday after the producer price index for February came in hotter than expected.

Market Commentary:

Bitcoin Behavior and Jobs Data

If you feel like we’re in a recession, you may not be wrong

If you think the prosecution of Gold and Silver spoofing ended manipulation, think again.

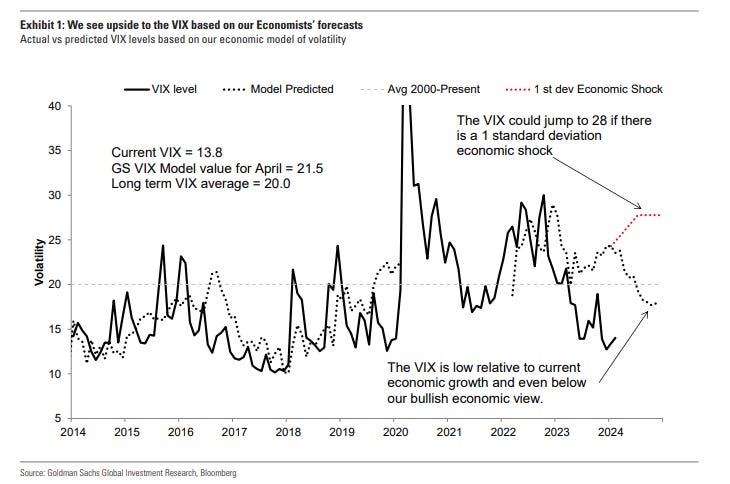

Goldman Tells Clients to “Buy VIX Calls”

With equity markets close to all-time highs and low volatility levels, we see potential upside to VIX levels from here based on the current macro-economic environment & upcoming macro/micro catalysts and recommend investors to hedge the potential for higher volatility using VIX calls. - GS Mar 14th

Risks Perceived

Market Risk: With S&P 500 close to its all-time high and low volatility levels, we highlight attractive options to hedge a potential near-term drawdown.

Tech drawdown Risk: Tech stocks have rallied sharply over the past year (XLK +50%), and we highlight the most attractive options to hedge a potential drawdown risk in Tech stocks.

China Risk: We believe upcoming election-related catalysts can lead to higher volatility in stocks with China exposure and identify stocks with high correlation/beta to China but low option prices.

Relative Value Reasons…

We believe the upcoming analyst days, earnings season and macro events, led by the FOMC meeting (3/20) and election-related catalysts could drive volatility higher from here. Call buyers risk losing their premium paid if shares close below the strike price at expiration.-

Continues at bottom including special contextual comment

Price Action

Gold- slave to the data, constructive action

Silver- relative value and CTA buyers are in the market. Beware of brief silver slams to buy gold now

Miners- sideways is bullish now as long as bullion doesn’t dive

Oil- inflation handoff, driving season, goods inflation… told ya

BTC/ETH- see the graph above

Stocks- plate juggling broadening.. but choppy

Bonds- doing well despite Golds rally… risk off?

Dollar- ditto

Market News:

Japan's unions win biggest wage hike since 1991 TOKYO -- Japan's largest labor confederation said Friday that its member unions won an average 5.28% increase in wages this year, the biggest raise since 1991, providing impetus for a possible interest rate hike by the Bank of Japan next week.- Nikkei

"The producer price index, which measures pipeline costs for raw, intermediate and finished goods, jumped 0.6% on the month, double the Dow Jones estimate. Source: CNBC

SpaceX launched the third test flight of its Starship rocket on Thursday and reached space, as the company pushed development of the mammoth vehicle past new milestones.

More companies have defaulted on their debt in 2024 than in any start to the year since the global financial crisis as inflationary pressures and high interest rates continue to weigh on the world’s riskiest borrowers Source: FT

Former Treasury secretary Steven Mnuchin said he’s putting together a consortium to try to buy TikTok, as a bid to divorce the popular social-media platform from its Chinese owners gathers momentum in Congress.Source: WSJ

GEOPOLITICS

Hamas said it presented a comprehensive vision of truce deal to mediators based on stopping 'aggression' against Palestinians in Gaza, providing relief and aid to them, return of displaced Gazans, and withdrawal of occupation forces from the enclave.- how many hostages are alive still?

Israeli senior official said the number of prisoners demanded by Hamas is still too high but added they are in a place where more serious negotiations could begin.- they are not serious

UKMTO received a report of an incident 76NM west of Yemen's Hodeida and announced a merchant vessel was struck by a missile and sustained some damage, although the crew were reported safe and the vessel is proceeding to its next port of call.- inflation

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, MAR 11 None scheduled - BTFP outlookTUESDAY, MAR 12 CPI Feb.WEDNESDAY, MAR 13 None scheduledTHURSDAY, MAR 14 U.S. retail sales, PPI Feb.FRIDAY, MAR 15 8:30 am Empire State manufacturing survey

1

Premium Attached:

Goldman’s Trade pdf

GoldFix interpretation