Housekeeping: Good Morning.

“We remain H1 buyers of dips in bonds, international & gold, sellers of SPX/US$ rallies…”

- Michael Hartnett, April 25

Today

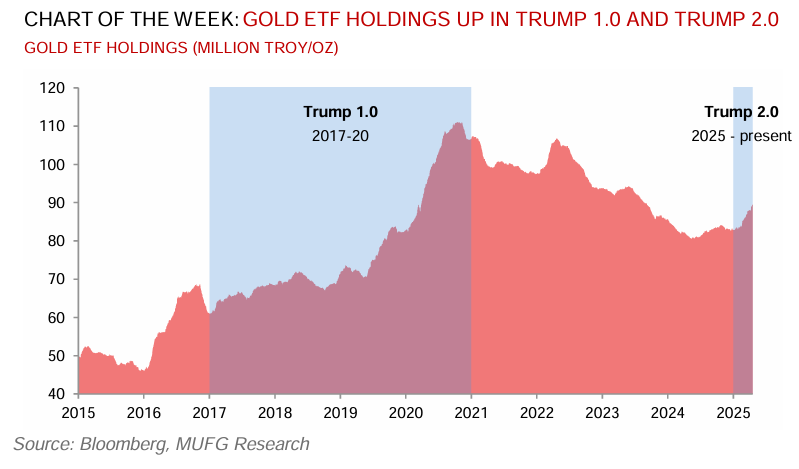

Discussion 1:MUFG: Gold’s steamroller rally is far from overblown

Discussion 2: Risk—Trading Plan for Today through Sunday

Analysis:

MUFG: Gold’s steamroller rally is far from overblown

Gold’s history-making rally looks ferocious. The breakneck surge has witnessed bullion check off another box in its extraordinary rally, surpassing the USD3,500/oz threshold this week and up ~30% year-to-date. Yet, despite persistently notching fresh peaks, our conviction remains resolute that we are a distance away from overextended or bubble territory, and maintain our above consensus forecasts for gold to catapult even higher and hit USD3,850/oz by yearend and breach north of the USD4,000/oz threshold by Q2 2026.

China holds ~9% of its reserves in gold. The global average is ~20%, which could be perceived as a pragmatic medium-term target for large emerging markets central banks, based on historical precedent and current positioning. Indeed, Russia increased its gold share from 8% to 20% between 2014 and 2020, and repatriated its gold holdings ahead of sanctions impositions.

We’d add that BOA agrees wit htis assessment and has gamed it out taht CB buying will last another 2 to 5 years if 20% is to be achieved in an ordely fashion. But these are not orderly times.

Full analysis available to Premium subscribers…

Featured:

Markets Recap:

Wall Street closed higher, boosted by tech stocks amid easing U.S.-China tariff tensions. Treasury yields fell on hopes of lower U.S. tariffs and Fed rate cuts. The dollar weakened against major currencies, while gold gained on bargain buying. Oil rose as markets assessed mixed economic data and conflicting tariff signals.

Canadian stocks ended higher as falling bond yields and rising commodity prices boosted investor sentiment, while markets also weighed evolving U.S. tariff policies. The Toronto Stock Exchange's S&P/ TSX Composite Index climbed 1.04% to 24,727.53 points.

Market News:

-PepsiCo cuts annual profit forecast as tariffs set to drive up costs

-American Airlines pulls 2025 forecast on travel demand worries

-Nestle, rivals ease US price hikes in bid for anxious American shopper

Full stories and recaps in premium…

Data on Deck:

MONDAY, APRIL 21 10:00 am U.S. leading economic indicators March -0.3%

TUESDAY, APRIL 22 9:30 am Philadelphia Fed President Harker speaks

WEDNESDAY, APRIL 23 S&P flash U.S. services PMI

THURSDAY, APRIL 24 Core durable orders (business investment) March

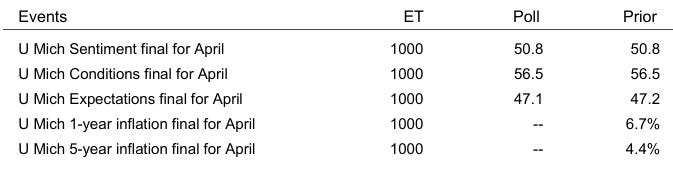

FRIDAY, APRIL 25 10:00 am Consumer sentiment (final) April 50.81

Summary and Final Market Check