Housekeeping: Good Afternoon.

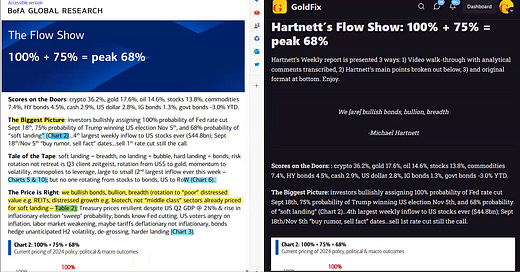

Hartnett’s Flow Show: 100% + 75% = peak 68%

Hartnett’s Weekly report is presented 3 ways: 1) Video walk-through with analytical comments transcribed, 2) Hartnett’s main points broken out below, 3) and original format at bottom. Enjoy.

We [are] bullish bonds, bullion, breadth

-Michael Hartnett

Scores on the Doors: : crypto 36.2%, gold 17.6%, oil 14.6%, stocks 13.8%, commodities 7.4%, HY bonds 4.5%, cash 2.9%, US dollar 2.8%, IG bonds 1.3%, govt bonds -3.0% YTD.

The Biggest Picture: investors bullishly assigning 100% probability of Fed rate cut Sept 18th, 75% probability of Trump winning US election Nov 5th, and 68% probability of “soft landing” (Chart 2)…4th largest weekly inflow to US stocks ever ($44.8bn); Sept 18th/Nov 5th “buy rumor, sell fact” dates…sell 1st rate cut still the call.

Tale of the Tape: soft landing = breadth, no landing = bubble, hard landing = bonds; risk rotation not retreat is Q3 client zeitgeist, rotation from US$ to gold, momentum to volatility, monopolies to leverage, large to small (2nd largest inflow ever this week – Charts 5 & 10); but no one rotating from stocks to bonds, US to RoW (Chart 6).

The Price is Right: we bullish bonds, bullion, breadth (rotation to “poor” distressed value e.g. REITs, distressed growth e.g. biotech, not “middle class” sectors already priced for soft landing – Table 2);

Treasury prices resilient despite US Q2 GDP @ 2¾% & rise in inflationary election "sweep" probability; bonds know Fed cutting, US voters angry on inflation, labor market weakening, maybe tariffs deflationary not inflationary, bonds hedge unanticipated H2 volatility, de-grossing, harder landing (Chart 3)