During an Anti-Goldilocks situation, when corporate profits rise, unions get emboldened to ask for pay raises. It also means consumers are ok with paying higher prices as companies raise them passing through costs to increase profits.

Happy Labor Day.

Inflation reacceleration risk

Week’s stories reports

some report excerpts

Today we have the week’s posts, with a few curated ones we did not release. Then some light-reading on the report side. We found the TS Lombard one interesting. More on that below.

Bear in mind, we look at everything we can get our hands on… And this is frequently the second lowest week for activity in the year in trading as well as bank research. You have what we saw.

Enjoy the Holiday!

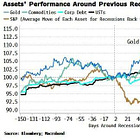

Inflation Re-Acceleration Risk is Real

TS Lombard noted that unless employment breaks soon, inflation will likely reaccelerate. This would be due to corporate profits turning a corner after a slight slowdown

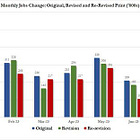

Surprise upturn in Q2 nonfinancial profits (taxes fell) stabilizes wages and hiring.

One quarter is not a trend, and Q3 sees raised capital costs for firms.

Employment trends, mixed for now, have added importance – if they do not bend soon, it means profits are improving and more hikes are coming.

Up, Up, and Away:

Inflation is not over by a longshot. In fact, it is getting baked into the mindset of unions (unafraid to ask for profits), corporations (unafraid to pass through increased costs) , and consumers (who keep paying them).

Bottom line:

While unemployment may indeed be turning a corner for the worse signalling the Fed should stop hiking and maybe even ease, there are problems. Oil has turned markedly upward. Now corporate profits are growing again. Those two things most definitely signal an inflation uptick is in the wings. Anti- Goldilocks is just getting warmed up.

-VBL

Week’s Stories

The first post below is our Sunday Market discussion. We discuss the CoT report in extreme detail. The market had definitely turned a corner this week, but Silver is overbought.