Housekeeping: Good Morning.

Bretton Woods Three is a process, not an event

Today:

What ING Thinks About Gold at $2200

Premium: UBS expects a dip, they are likely buying it for clients, WGC’s February analysis, Citi Pays attention

Yesterday’s Activity:

US equities were mixed on Monday ahead of February's consumer price index report out today

Market Commentary:

Excerpted from the report:

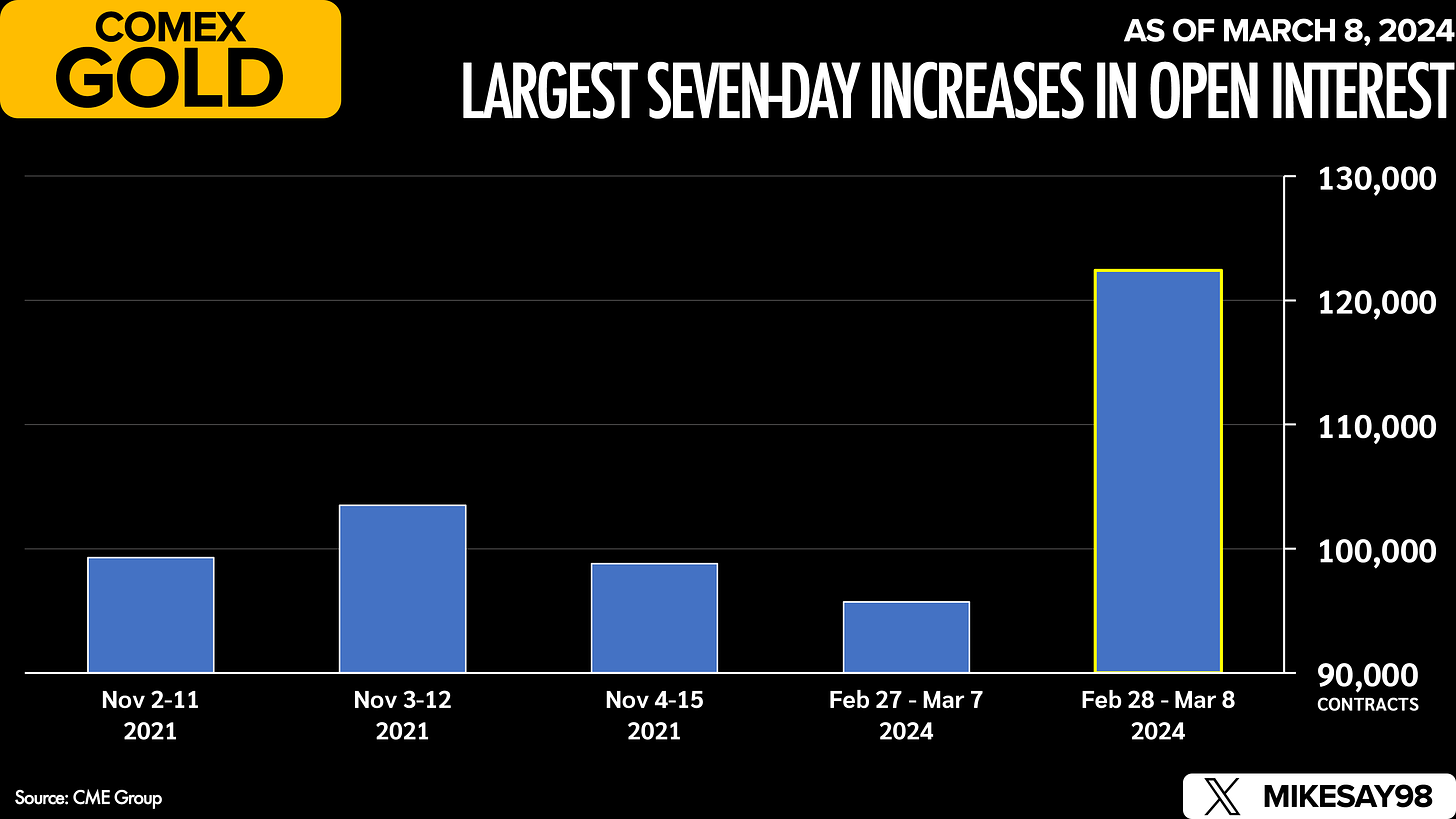

Gold surges to fresh record highs Gold prices jumped on Friday to trade just below $2,200/oz before giving back some of the gains this morning. Gold rallied almost 5% last week, setting a nominal high on four consecutive sessions.

We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with ongoing wars and the upcoming US election. We have revised our 2024 gold forecast higher, and we now expect fourth quarter prices to average $2,150/oz.

**Full report attached at bottom

Price Action

Gold- overbought

Silver- waiting

Miners- no feel

Oil- crabby but bullish

BTC/ETH- buyers of all dips.. until FUD resumes

Stocks-

Bonds-

Dollar-

Market News:

"Reddit and selling shareholders aim to raise about $750 million as part of the company’s upcoming IPO, according to a corporate filing on Monday. The company and some existing stakeholders plan to sell about 22 million shares in the range of $31 to $34 per share. Investors are closely watching Reddit’s IPO, which will be this year’s first major tech debut and the first social media IPO since Pinterest went public in 2019." Source: CNBC

"Private equity groups globally are sitting on a record 28,000 unsold companies worth more than $3tn, as a sharp slowdown in dealmaking creates a crunch for investors looking to sell assets. The numbers, revealed in consultancy firm Bain & Co’s annual private equity report, show how rapidly the industry has grown over the past decade, as well as the challenges it faces from higher interest rates that have increased financing costs." Source: FT

"Oracle reported an earnings beat in its quarterly results. However, revenue came in a bit light of expectations. The company’s cloud services and license support segment, its largest business, saw a 12% increase in revenue." Source: CNBC

GEOPOLITICS- Cold War 2.0

Islamic Resistance said it targeted Ben Gurion Airport with drones on Monday evening, according to Al Jazeera.

Yemen's Houthis said they targeted 'American ship Pinocchio' in the Red Sea and their operations are to escalate during Ramadan.

EU leaders to urge Israel to refrain from ground operations in Rafah, via Reuters citing draft summit text; calls for "immediate humanitarian pause leading to sustainable ceasefire" in Gaza

Ukrainian military intelligence said they are preparing to launch serious offensive operations in Crimea, according to Al Arabiya.

US President Biden responded there was no need for that when asked if he would support US troops at the Polish border.

China Maritime Safety Administration announced live firing drills in some areas in the East China Sea from March 12th-14th.

Russian Defence Ministry says Russia, China and Iran are to begin joint navy drills in the Gulf of Oman.

European Commission Chief von der Leyen says considering new sanctions on Iran if reports of supplying Russia with missiles is true

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, MAR 11None scheduled - BTFP outlookTUESDAY, MAR 12 CPI Feb.

WEDNESDAY, MAR 13 None scheduled

THURSDAY, MAR 14 U.S. retail sales, PPI Feb.

FRIDAY, MAR 15 8:30 am Empire State manufacturing survey 1

Premium Attached:

UBS expects a dip, they are likely buying it for clients, ING, Citi Pays attention to Gold again