Housekeeping: Good Morning.

“Comex is Dying”

Topic:

JPMorgan: Iran Attack Could Spike Oil to $120

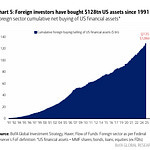

US Bullion Banks Reap $500 Million in Profits From US Gold Buys

Market Analysis:

Last night Israel sent airstrikes into Iran targeting nuclear capabilities and leadership domiciles:

Just prior to the airstrikes by Israel on Iran last night, Oil prices had already surged by as much as 5% to $70 JPMorgan’s chief commodity strategist Natasha Kaneva put out a note. In it, the bank estimated that oil prices at $70 currently reflect only a portion of the geopolitical risk premium. Oil prices are now at $75 a barrel

JPMorgan: Iran Attack Could Spike Oil to $120

·

Last night Israel sent airstrikes into Iran targeting nuclear capabilities, and leadership:

In particular, the note highlights the possibility of Iranian oil exports falling by over 2.1 million barrels per day (mbd), as well as broader regional disruptions if military activity spreads. Of primary concern is the potential closure of the Strait of Hormuz. Under such circumstances, JPMorgan forecasts crude oil prices could surge to between $120 and $130 per barrel.

Full Analysis in the Premium post JPMorgan: Iran Attack Could Spike Oil to $120

Related Posts:

Coming Soon:

Data on Deck: CPI/ PPI

MONDAY, JUNE 9 10:00 am Wholesale inventories

TUESDAY, JUNE 10 6:00 am NFIB optimism index

WEDNESDAY, JUNE 11 8:30 am CPI

THURSDAY, JUNE 12 8:30 am Core PPI

FRIDAY, JUNE 13 10:00 am Consumer sentiment

Summary and Final Market Check…