Housekeeping: Good afternoon. Here is Part 1 of the GoldFix discussion with Eric Yeung and Dave Kranzler as hosted by Vince Lanci

Dave, Eric and Vince Discuss Metals, Miners, and More

Topics Part 1:

Current Situation in Gold Deliveries:

Differentiation between "Delivery" vs "Possession":

Gold Movements and Repatriation:

COMEX & LBMA Relationship and "EFP":

Underlying Reason for U.S. Gold Repatriation (Partial)

(Detailed topics downpage)

About:

David Kranzler

Dave is a respected veteran in the precious metals industry. He is Managing Owner of Golden Returns Capital and Publisher of the well known Mining Stock Journal published twice monthly.. He is known for insightful market analysis and decades of experience investing in gold, silver, and especially in mining stocks He is also an active contributor to GATA for over 10 years.

Contact Info:

Website: The Mining Stock Journal

Social Media: InvResDynamics

Eric Yeung

Eric, aka King Kong on X.com is out of Hong Kong with strong ties to both mainland China and the US. Eric’s roots are as an entrepreneur in manufacturing with a deep knowledge-base ofsupply chains mgt and family fund portfolio manager focused heavily on metals and miners. Eric, like David is also known for advocating transparency in bullion markets

Contact Info:

Social Media: King Kong

Detailed Topics Part 1:

1. Current Situation in Gold Deliveries:

Increasing repatriation of gold by countries (U.S., China, India, Poland).

London (LBMA) identified as the key epicenter.

Heightened concerns over asset seizure (Russia’s frozen assets as a catalyst).

2. Differentiation between "Delivery" vs "Possession":

"Taking delivery" (official claim) vs "Taking possession" (physical control).

Importance of central banks and sovereign nations demanding physical possession.

3. Gold Movements and Repatriation:

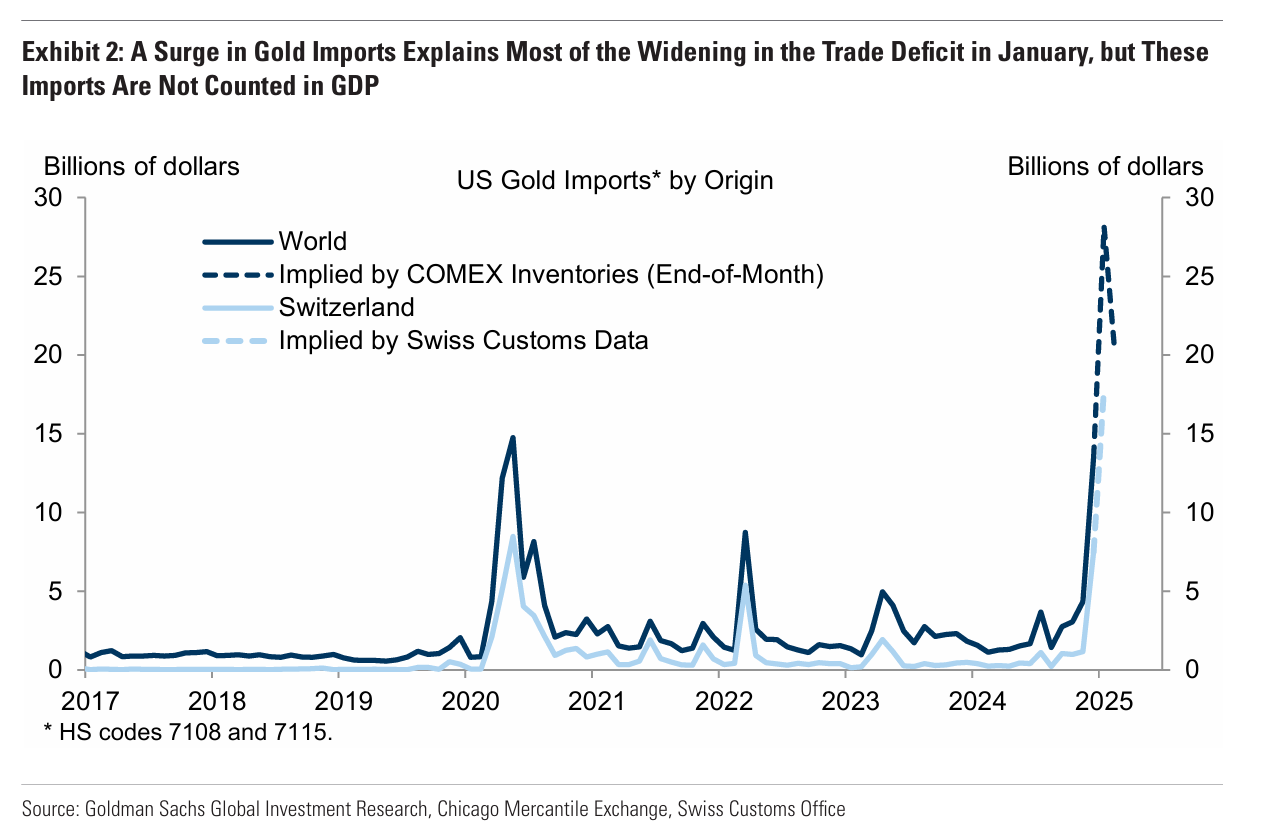

Massive imports into the U.S. (approx. 2,000 metric tons recent months, per StoneX).

Large discrepancy between COMEX/LBMA import figures.

Hypothesis: Significant gold imports into the U.S. potentially monetary gold.

4. COMEX & LBMA Relationship and "EFP":

Explanation of Exchange-for-Physical (EFP).

COMEX short positions often offset by LBMA long positions.

LBMA noted as a manipulated paper-heavy market.

5. Intro Underlying Reason for U.S. Gold Repatriation:

***Continues in Part 2 on Monday***

Topics for Part 2 Monday

Underlying Reason for U.S. Gold Repatriation:

GLD ETF Structural Manipulation:

Why the Urgency to Repatriate Gold Now?

Silver Market Dynamics:

Mining Sector Analysis:

Specific Mining Stock Recommendations:

Strategic Investment Advice (Final Thoughts):

SLIDES

Share this post