Housekeeping: Good Morning. Transcript tabbed.

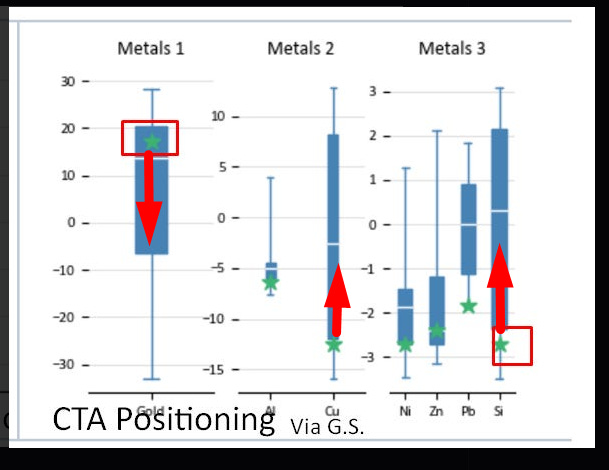

*** Silver CTAs buy gold, sell silver **

Contents

Yesterday’s Activity

Today’s Prices

Today’s Data

Markets/Metals Commentary

Attached- Miners, MUFG Analysis, Trump part2

Markets Covered:

Metals, Energy, Crypto, Bonds, Stocks

Yesterday’s Activity:

China Bounce

Commodities- Gold down, Silver and industrials up

US equities- slightly stronger. Energy outperformed

Bonds- slightly weaker

DX- weaker

h/t DataTrek

Quick Look:

chop and roll

Week’s Data:

Earnings, LEI, PMI, PCE, and GDP

MONDAY, JAN. 22 10:00 am LEI

TUESDAY, JAN. 23 None scheduled

WEDNESDAY, JAN. 24 9:45 am PMITHURSDAY, JAN. 25 8:30 am Q4 GDP

FRIDAY, JAN. 26 8:30 PCE

Total Calendar1

News:

NOTABLE HEADLINES

Fed announced the Bank Term Funding Program will cease making new loans as scheduled on March 11th and it adjusted the interest rate on the emergency loan program to prevent arbitrage.

Swaps contracts now show about a 36% chance the Fed lowers its benchmark that month, tumbling from 86% odds seen in March but the BOJ is now seen as hiking rates in April.

GEOPOLITICS- MUFG Report

New US-led operation “Poseidon Archer” in Yemen will degrade but not eliminate the Houthi threat. The corridor to invasion?

The Strait of Hormuz, not the Bab El Mandeb, matters more for energy markets Balancing geopolitical risk premia against abundant spare capacity in oil

some headlines via NewSquawk

Markets/Metals Commentary:

Chart walkthrough

Gold-

Silver- CTA unwinds are fast and furious, and if they do not attract fresh momentum money, they are short lived.

Oil-

Stocks- Tesla is in focus again- slowdown in sales

Bonds- Fed may wait for BOJ to see how market reacts. Fed is coordinating behavior to do what upsets markets least. Between BOJ raising ( which right now is bearish for their bonds), and US not easing (also bearish), and the ECBs expected hawkishness.. we could very well be in a coordinated moment for an uptick on global bond yields again. The rising tide of debt

Americas gold, IAMGOLD, and MUFG