Housekeeping: Good Morning. Expect more activity in the Substack comments answering questions now.

“Bubbles are the gallows for asset preservation”

-GoldFix Premium Subscriber

Today:

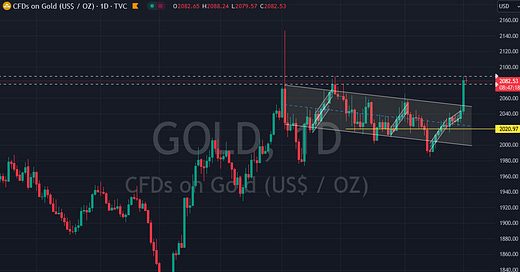

Gold is poised for greatness above $2088

Premium: Bitcoin, Stocks, and CTA positioning

Yesterday’s Activity:

US equities rallied on Friday, with the Nasdaq closing at an all-time high. Gold roofed on fresh buying

Market News:

NOTABLE HEADLINES

Fed Chair Powell is expected to double down on his message that there’s no rush for the Fed to cut rates when he delivers in semi-annual testimony to the House committee and a Senate panel on Wednesday and Thursday, respectively, according to Bloomberg.

US congressional leaders released the text of a bill to fund the government through September 30th and avert a government shutdown- kicking less

Former US President Donald Trump won the Michigan Republican caucuses

Fitch affirmed the US at AA+; Outlook Stable.- POTUS

Fitch downgraded New York Community Bancorp’s (NYCB) rating

GEOPOLITICS

"Opec+ members led by Saudi Arabia and Russia have extended the latest round of voluntary cuts to oil production for another three months

US official said on Saturday that the outlines of a Gaza peace deal are in place and it depends on Hamas agreeing to release hostages, according to Reuters.

More1

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, MARCH 4 12:00 pm Philadelphia Fed President Tom Harker

TUESDAY, MARCH 5 10:00 am ISM services Feb.

WEDNESDAY, MARCH 6 10:00 am Fed Chair testifies to Congress

THURSDAY, MARCH 7 Fed Chair Jerome Powell testifies to Congress

FRIDAY, MARCH 8 U.S. NFP unemployment rate 2

Markets/Metals Commentary (Charts):

Comment:

Gold- What we’d like to see next

Silver- 25.27 basis May Contract now according to Michael Oliver is key

A final long -term “On board!” signal will be rendered with a monthly close this month at $25.27 (that trigger adjusts down monthly). It ’s based on 36 -mo. avg. momentum. That chart was in a February 18th report. Again, that is not an initial signal to be long, recent action justifies that. But a final table pounder buy signal. Tonal change in silver upside is highly likely at that point forward.

Oil-

Stocks-

BTC/ETH-

Bonds-

Premium Attached:

DB CTA Analysis

BOA raises their 2024 S/P Target