Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: FOMC Minute Flip-Flop

Premium: RBC Gold Equity Analysis

Discussion:

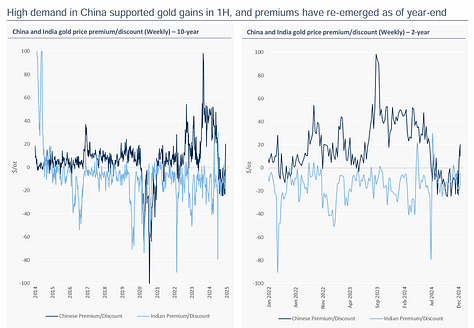

Our view: Shifting monetary policy and election volatility presented a turbulent finale for gold prices in 2024. Nonetheless, we forecast positive gold performance to emerge again in 2025 as demand remains supported by central banks and investment. We maintain a positive view on the outlook for the gold equity sector, although this is now anchored by our valuation views, rather than our commodity outlook previously.

• We forecast positive but more moderate gains for gold in 2025. RBC Global Mining previously issued its 2025 average gold price forecast of $2,823/oz in November, supported by our RBC Elements™ gold price model.-rate cut factors

• Gold equities had a challenging 2024 vs. gold; we see valuation as supportive today. Despite gold’s positive performance in 2024, gold equities increased by a lacklustre 9%, underperforming gold as equities were challenged by multiple compression and increasing costs vs. expectations. Today, we think equity valuation is attractive with large-cap gold producers at spot trading at 7.0% FCF/EV, 4.9x EBITDA, and 1.0x P/NAV8%. We view valuation and the sector’s growing emphasis on return of capital as a potential opportunity to kick-start returns

• Our top ideas include Agnico Eagle, AngloGold Ashanti, Gold Fields, Osisko Gold Royalties, G Mining Ventures, Torex Gold, Coeur Mining, Adriatic Metals, Hochschild Mining, Westgold Resources, and Bellevue Gold. (Separate report)

News/Analysis:

Equity Recap:

US equities advanced on Wednesday as investors considered the impact of inflationary pressures on the Fed's rate decisions this year. Large caps bested small caps: S&P 500 (+0.16%) vs. Russell 2000 (-0.48%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) dropped 0.48% and 0.16% respectively.

Market News: The Fed Lies to Itself

"Federal Reserve officials saw risks of higher-than-expected inflation, due in part to potential tariffs by President-elect Donald Trump, when they made a “finely balanced” decision last month to lower interest rates WSJ

"UK 10-year borrowing costs rose to the highest level since the global financial crisis and sterling sank on Wednesday as an intensifying bond sell-off threatened the Labour government’s ability to meet its self-imposed budget rules. FT

"Constellation Energy is in advanced talks to acquire Calpine in a deal valued at up to $30bn, in what could be one of the largest takeovers in the power generation industry... : FT

"The shares of IonQ and other companies linked to quantum computing tumbled on Wednesday, after Nvidia Chief Executive Officer Jensen Huang said that “very useful” quantum computers are likely decades away... Bloomberg

"President Joe Biden’s administration plans one additional round of restrictions on the export of artificial intelligence chips from the likes of Nvidia just days before leaving office Bloomberg

Geopolitics/ Politics

US official says President Biden is set to announce new sanctions targeting Russian economy this week. Likely to also sanction more Chinese entities for supporting Russia. US official says long-range ATACMS missiles, F-16 fighter jets and Abrams tanks have not been a game changer for Ukraine against Russia. US is studying North Korean military operations in Ukraine to "understand lessons for Asia"

US and Arab mediators have made some progress in Gaza peace talks, no deal yet, according to Reuters sources. Breakthrough when it comes to narrowing old existing gaps, but there is still no deal yet, says a Palestinian official

Houthi media reported US-British bombing of targets in Sanaa, Amran and Hodeidah with six raids, while the Pentagon later confirmed that Central Command carried out strikes against two Houthi facilities and said that strikes were carried out in Yemen as part of efforts to weaken Houthi capabilities.

Russia's Kremlin says there have been no contact between US President-elect Trump and Russia President Putin yet

Data on Deck: Unemployment Rate

MONDAY, JAN. 6 S&P final PMI

TUESDAY, JAN. 7 Speakers, ISM

WEDNESDAY, JAN. 8 Minutes of Fed's December FOMC meeting

THURSDAY, JAN. 9 Wholesale inventories

FRIDAY, JAN. 10 U.S. unemployment rate1

Final Market Check