Housekeeping: Good Morning.

“The reset is a process, not an event.”

Today

Discussion 1: MS Calls The Top for Now

Discussion 2: China Gold Positioning..Early Signs of stability

Analysis:

Morgan Stanley Argues for Trading Range

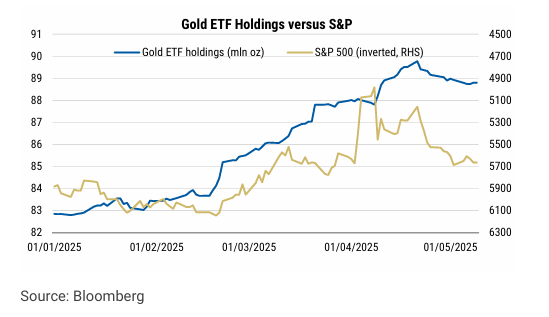

After touching $3500/oz intra-day in late April (a $500/oz rise in about 9 business days), MS Notes gold has settled into a range, which they expect to hold for now.

Key Takeaways: i) Uncertainty on tariffs and global growth supported gold prices via investment demand, with very strong ETF inflows through Q1 and most of April. ii) But high prices are starting to hurt gold demand elsewhere, with jewellery demand falling and central bank purchases slowing. iii) For gold to keep moving higher, investment demand (and uncertainty) need to stay high, as gold faces competition from other asset classes.

Continues in Premium at Bottom…

Market Recaps:

Wall Street ended higher, and Treasury yields rose as the U.S. and China agreed on a 90-day tariff relief. A surge in the dollar tempered gold prices, while oil climbed on hopes of increased demand. Canada's main stock index ended higher as the United States and China reached a deal to reduce tariffs, boosting investor optimism and easing fears of an all-out trade war disrupting global markets

Data on Deck:

TUESDAY, MAY 13 8:30 am Consumer price index1

Related Posts:

Summary and Final Market Check…

Premium: Gold Risk-Off

Topics discussed:

Physical demand strong, but mixed trends

ETF inflows key to watch from here.

Investment drives demand; competition from other asset classes becomes the biggest threat

How is Gold Demand Evolving?

Where next?

Central banks slowing