Housekeeping: Good Morning.

Bretton Woods Three is a Process, Not an Event

The temper and tone of this phase will shatter all technical norms that have prevailed over the past three years.- Michael Oliver

Today:

Premium: Definitive Update by Goldman on Ukraine’s Geopolitical risks

Commentary: Michael Oliver on Silver

Markets Yesterday:

US equities advanced on Tuesday after strong corporate earnings reports.

Premium: Goldman Does Geopolitical

This Goldman piece provides an excellent assessment of the latest developments in the Russia-Ukraine conflict,

the key actors involved, as well as a summary of their probability tree of 2024 outcomes and potential macro-economic and market implications.

Commentary: “Get Ready or Get Out”

A few days of volatility are not a meaningful correction

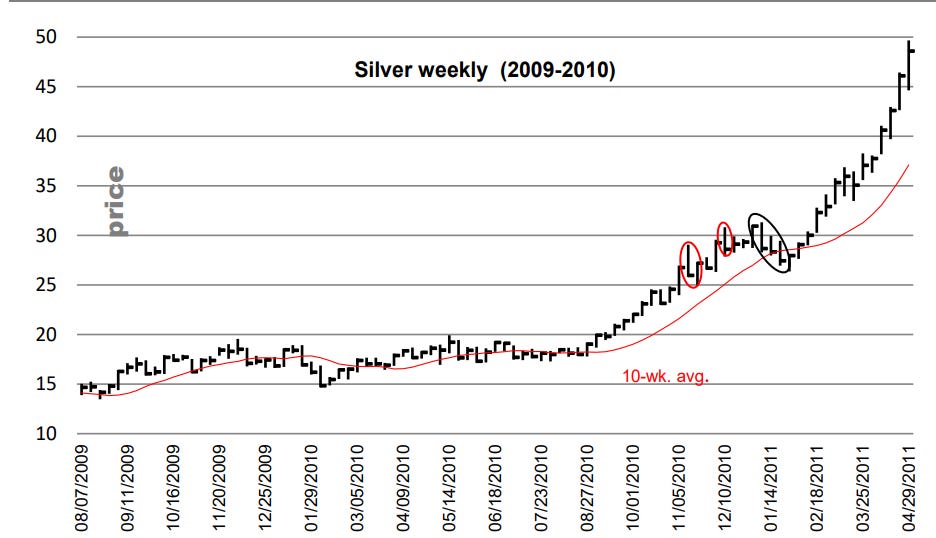

The 2009 parallel says all is fine so far.

Excerpt courtesy of MSA Technical Analysis

MSA is focused on trying to define the onset of a reasonable correction, one that spans a month, not just days. They don’t see technical evidence of that.

We suspect it will occur this summer. As we argued in the April 14th weekend report: “Get ready or get out!” The temper and tone of this phase will shatter all technical norms that have prevailed over the past three years.

“Chart above shows what followed that first gut-punch selloff (first red ellipse) that we showed on the prior page. Yet another selloff occurred a month later, and then one you might have chosen to hedge against in January 2011, a full month of declines.”

Subscribe to Michael Oliver’s work here

Market News:

"Tesla reported a 9% drop in first-quarter revenue on Tuesday, the biggest decline since 2012, as the electric vehicle company weathers the impact of ongoing price cuts... Source: CNBC

"Cathie Wood’s investors are jumping ship... Investors have pulled a net $2.2 billion from the six actively managed exchange-traded funds at her ARK Investment Management this year, a withdrawal that dwarfs the outflows in all of 2023. Source: WSJ

"Apple announced plans for a special event on May 7, when it’s expected to unveil new iPads and accessories after a long lull. Source: Bloomberg

"Walmart’s majority-owned fintech startup One has begun offering buy now, pay later loans for big-ticket items at some of the retailer’s more than 4,600 U.S. stores..." Source: CNBC

Geopolitics:

***See Premium below***

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 22None scheduledTUESDAY, APRIL 239:45 am S&P flash U.S. services PMIWEDNESDAY, APRIL 24 8:30 am Durable-goods orders March

THURSDAY, APRIL 25 8:30 am GDP Q1

FRIDAY, APRIL 26 PCE1

Premium:

***DO NOT SHARE THIS***