Bretton Woods Three is a Process, Not an Event

Today:

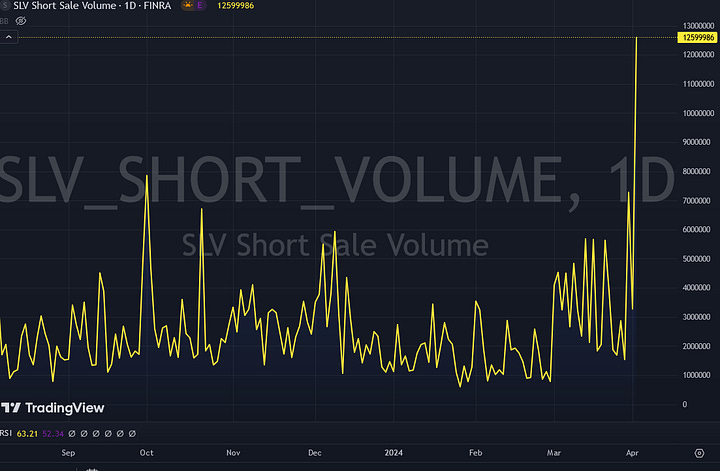

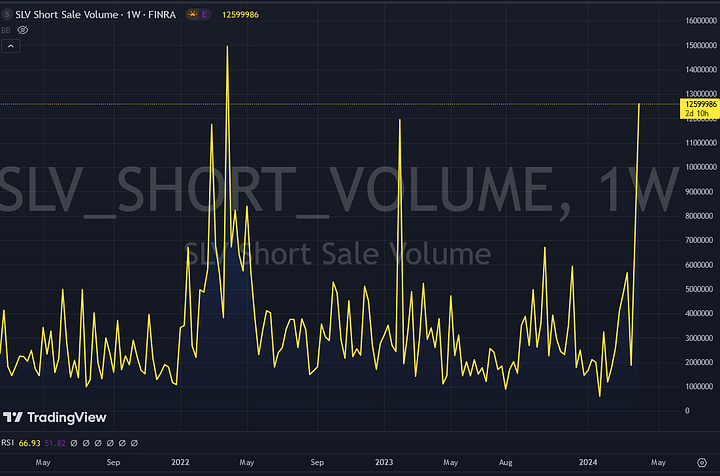

Show and Tell in Silver

Premium: How to Value Gold at bottom

Yesterday’s Activity:

US equities retreated on Tuesday amid concerns about rising oil prices and bond yields.

Market Commentary:

Silver Show and Tell

Why short SLV

Bearish

Arb of Another Venue

Hedging SLV Option length

Taking delivery of physical (and/or unwinding a hedge)

what’s the reason, what’s the risk, whats the back end trade1

how would a player prepare the ground for something like that to make sure noone gets in the way.. and to get good levels?2

2011 background: Spread trading

Price Action

Gold-

Silver- financial short squeeze

Miners-

Oil-

BTC/ETH-

Stocks-

Bonds-

Dollar-

Market News:

"Cleveland Fed President Loretta Mester said Tuesday she still expects interest rate cuts this year but ruled out the next policy meeting in May. Source: CNBC

Amazon’s grab-and-go checkout system, Just Walk Out, has been a centerpiece of its ambitions to transform bricks-and-mortar supermarkets.- bodega decentralization, mercantilism, big box death, complexity collapse, and small self sustenance, 15 minute cities

"Oil prices settled higher on Tuesday after a session in which Ukrainian attacks on Russian energy facilities and escalating conflict in the Middle East pushed the Brent benchmark above $89 a barrel for the first time since October. Source: Reuters

"German inflation fell to its lowest level since May 2021, Source: WSJ

GEOPOLITICS

US President Biden criticized Israel for failing to adequately protect civilians and is pushing for an immediate ceasefire as part of a hostage deal, according to Bloomberg and AFP.

Ukraine bombings are making things difficult for Biden. Zelensky is making play for continued aid.. playing chicken with Biden

Deep divisions between the US and Israel over an operation in Rafah were evident in a virtual meeting between senior officials.

NATO Foreign Ministers will meet on Wednesday to discuss how to put military support for Ukraine on long-term footing including a proposal for a EUR 100bln five-year military fund, according to Reuters.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 1 9:45 am S&P U.S. manufacturing PMI

TUESDAY, APRIL 2 10:00 am Factory orders Feb, speakers

WEDNESDAY, APRIL 3 10:00 am ISM services March 52.6% 52.6% 12:00 pm, speakers

THURSDAY, APRIL 4 8:30 am Initial jobless claims March , speakers

FRIDAY, APRIL 5 8:30 am U.S. nonfarm payrolls am U.S. unemployment rate 3