Housekeeping: Good Morning.

Gold Revaluation is a process and an event.

Today:

Commentary: Silver and Gold Market Comment

Premium: Crescat Chart Walkthrough

Session Recap:

US equities were mixed on Monday amid falling oil prices.

Premium / Markets:

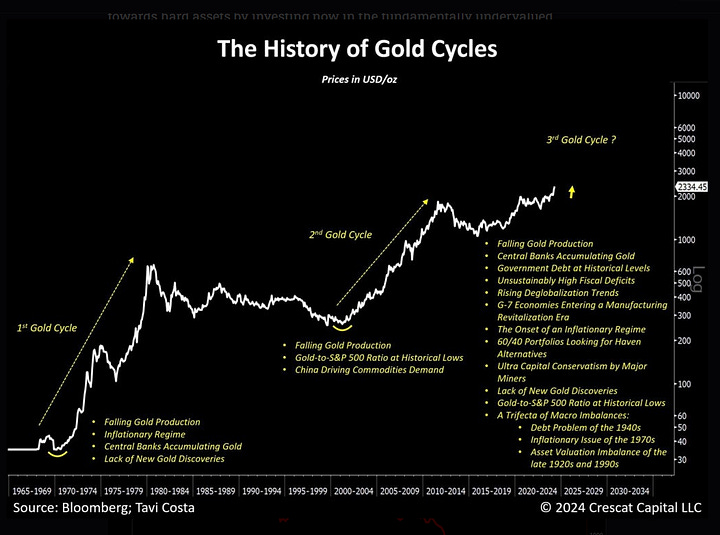

Crescat Charts/ Silver Charts

Historical analogs, industry, and price performance…

Much More at bottom…

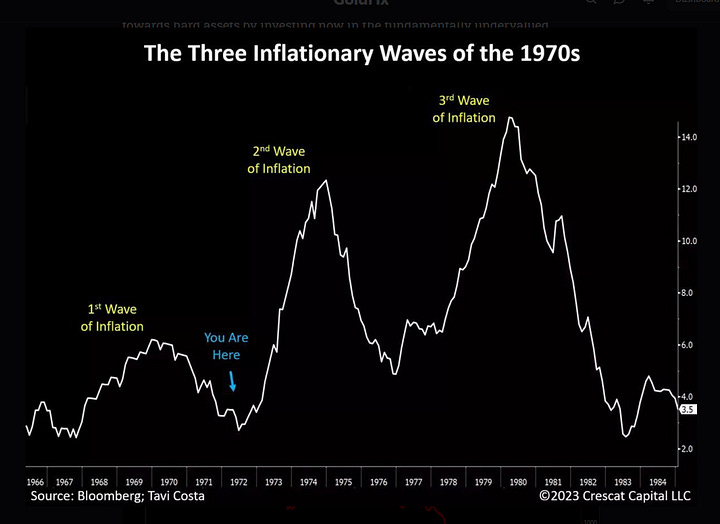

Source: Crescat Capital’s The Rise of Hard Asssets

Silver is best example of things now…

Market News:

"U.S. manufacturing activity slowed for a second straight month in May as new goods orders dropped by the most in nearly two years, " Source: Reuters

"AMD on Monday announced new artificial intelligence chips as it seeks to establish itself as a leader amid competition with the likes of Nvidia and Intel.. Source: CNBC

"An apparent glitch at the operator of the New York Stock Exchange triggered volatility trading halts shortly after the open in about a dozen companies Source: Bloomberg

Geopolitics:

"Major differences between Israel and the United States over the second phase of the truce deal", according to Sky News Arabia quoting an Israeli official cited by local press.

"Lebanese media: Renewed fires in the forests of several border towns in southern Lebanon as a result of the throwing of Israeli phosphorus bombs", according to Sky News Arabia.

Israeli PM Netanyahu's office said "No date has yet been set for Prime Minister Netanyahu's speech to both houses of Congress. In any case, the speech will not take place on June 13 due to the second holiday of Shavuot".

Some headlines via NewSquawk or DataTrek

Data on Deck: Unemployment

MONDAY, 9:45 am S&P flash U.S. manufacturing PMI May 50.7 50.9

TUESDAY, JUNE 4 10:00 am Factory orders April 0.7% 1.6%

WEDNESDAY, JUNE 5 8:15 am ADP employment May 179,000 192,000 10:00 S&P flash U.S. services PMI May 54.7 54.8

THURSDAY, JUNE 6 8:30 am Initial jobless claims June 1 216,000 219,000

FRIDAY, JUNE 7 U.S. employment report May 178,000 175,000 8:30 am U.S. unemployment rate May 3.9%1

Premium:

Chart Presentation and Market Implication Walkthrough

***DO NOT SHARE THIS***

Each chart is described and analyzed in the accompanying video