Housekeeping: Posted yesterday as **Special: Global Recession Incoming (WTF is Going On?) for Founders

What is this?

It is an explanation of what is going on right now in world markets using a Goldman Sachs institutional daily brief report as starting point, why it is significant, and what it could mean for everything.

The last 2 days have seen markets succumb to a convergence of events catalyzed to a mini-tipping point by Yen behavior, US Earnings reports, and China rate cuts. The net effect has been stock selling worldwide, Commodity selling, and violently mixed bond behavior.

This podcast tries to put these events and the market reactions to them in true macroecononics fashion.

More-so: Those reactions described above may just be getting started.

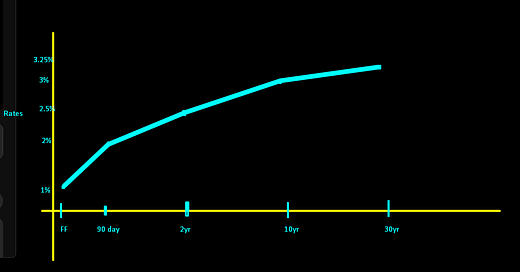

Specifically: The analysis includes Detailed commentary on US, China, and Japan markets, a detailed explanation of Yield Curve Steepening, and how the Fed may react.

Podcast Notes:

Overview

Implications for U.S. Stocks

Global Economic Context:

Drilling Down:

Yield Curve Dynamics: The See Saw and Anti-Goldilocks

Yield Curve Slides

Housing Market Impact:

Pigs: Three different Types

PDF

1- Overview

Global stocks and commodities are very weak. Bonds are mixed. The Yen is strong. What is going on? Turns out alot.. and it may continue. Here’s a framework to understand before most anyone else will and act accordingly.

The institutional brief "GS Basics Earnings Soggy, Bank of Japan, JPY Moves, New Home Supply Spike" covers why the market dropped. We add detailed color