Housekeeping: Good afternoon

Lots of questions by Founders, with long responses. Michael Oliver’s MSA Weekly 360 came out as we finished this. Find a couple comments from the metals section attached at bottom.

Cheat Sheet

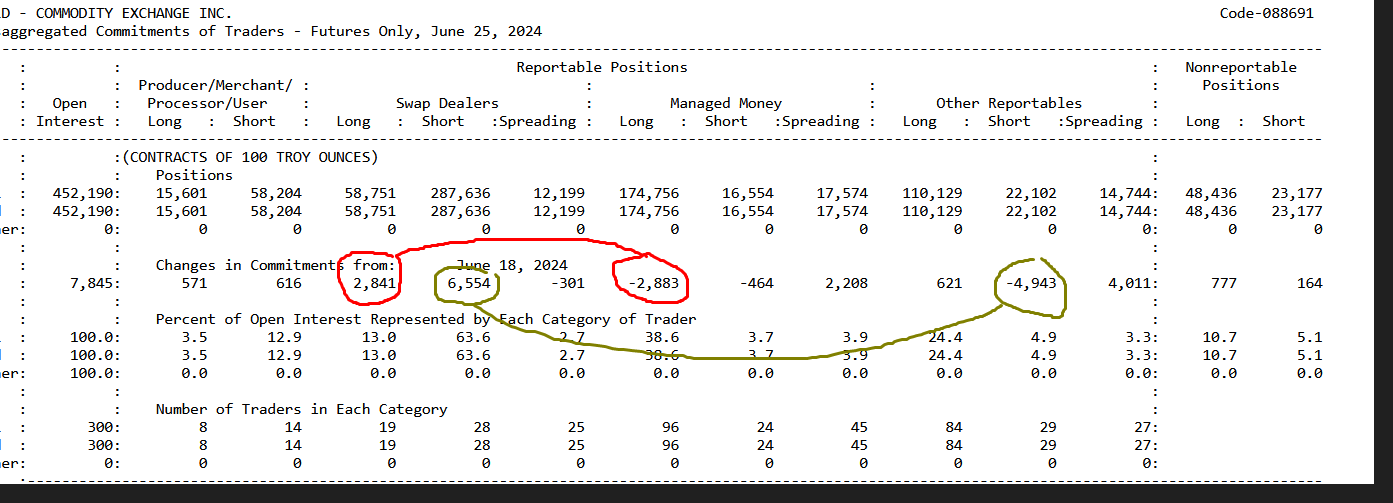

COT: 6/20 to 6/25 inclusive

6/20 up, long funds buy. short banks add

6/21- down, long funds sell, short banks close, new longs BTD

6/24- up, UNCH OI.. new long buy/ old long funds sell OR shorts buy/ shorts sell

6/25- down, long funds sell, short banks buy

NON COT: 6/26 to 6/28

6/26 -down, long funds sell, short banks buy

6/27- up, long funds buy, short banks sell

6/28- unch, small two way.

Futures only:

F&O:

Gamma Implied options related activity

OI UPDATE:

Small noise is bigger.. bigger false starts. what was definitely turning a corner may not be.. means: better for trading older indicators shorter term, not making bigger bets on old indicators…higher time frame noise

Quad Candle Analysis.

The day itself was bearish.. no doubt.. but tepidly so. Nobody wants to play chicken

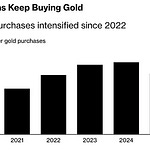

The week was bullish for our returning buyer at 2 points. 1 Macro Discretionary.. 2- CB/ SWF maybe.. that level matters alot

Bottom Lines, and MSA excerpts next.