Housekeeping: Good Morning. —

“The Gold reset is a process, not an event”

Today

Discussion: The World Did Not End…

War fear positioning piles in…

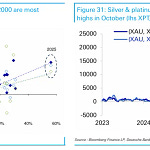

The GOLD/CHF link…

From **Geopolitical Comment:

The pattern is strong between CHF and Gold in GeoPol type events. Geopolitical risks historically for only short durations Trump macro economic problems; but that was during Pax Americana times. We are no longer in those times…… This is Cold (Hot) War stuff

But Europe Determined fight Recession Fears…

It feels like speculative investors have bought a lot of CHF this week on the escalation of geopolitical risks, while flows on Friday have been mostly CHF selling both versus EUR and USD and mostly for wealth management and real money names.

But Nothing has changed…

From Geopolitical Comment

If however, the Friday selling is predicting Monday interventionist behavior… then the opposite is true.

But either way.. gold is resetting higher geopolitically now

News/Analysis:

Equity Recap:

US equities advanced on Friday, while the Dow Jones Industrial Average closed at a record high. Large caps lagged small caps: S&P 500 (+0.35%) vs. Russell 2000 (+1.80%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) rose 0.02% and 0.39% respectively.

Market News: Trump’s Picks..

"President-elect Donald Trump signaled Friday his intention to nominate hedge fund executive Scott Bessent as his Treasury secretary, in a move that puts a seasoned market pro and a close Trump loyalist in a critical economic position... Like Trump, Bessent favors gradual tariffs and deregulation to push American business and control inflation. In addition, he has advocated for a revival in manufacturing as well as energy independence." Source: CNBC

"Howard Lutnick is moving to strengthen his alliance with one of the most important and controversial names in the digital-asset business: Tether Holdings. Lutnick is in talks to deepen the financial ties between his businesses and the company behind the world’s largest stablecoin... Cantor Fitzgerald is discussing receiving support from Tether for its planned multibillion-dollar program to lend dollars to clients who put up [BTC] as collateral... Lutnick is co-chair of president-elect Donald Trump’s transition team and Trump’s pick to run the Commerce Department." Source: Bloomberg

"Round-the-clock trading is becoming a reality... WSJ

"US retailers are extending their one-day seasonal Black Friday discount offers into a sales event lasting weeks in a bid to tempt US consumers to keep spending, as data suggests that their spree which has driven economic growth is beginning to falter. FT

"Artificial intelligence cloud platform CoreWeave, is aiming for a valuation of more than $35 billion in its U.S. initial public offering that is expected to occur next year..CNBC

"TikTok is reaching out for insight about the U.S. from Elon Musk, who is both owner of a rival social-media platform and one of President-elect Trump’s closest confidants. WSJ

"The Silicon Valley dream is to build a tech startup that is such a unique idea it alters the commercial universe and turns its founders into billionaires. Participating in the Valley’s most famed startup factory, Y Combinator, is often part of that dream. TechCrunch

Politics/Geopolitics:

Israeli senior official said Israel's direction is to move towards a ceasefire agreement in Lebanon, while Israeli and US officials stated that Israel and Lebanon are on the cusp of a ceasefire agreement, according to Axios. It was separately reported by Asharq News that Israeli media stated Israel agreed in principle to the proposal for a ceasefire in Lebanon.

Ukraine launched a mass attack on Russia's Kursk region with foreign-made missiles, according to a military analyst via Reuters.

Data on Deck: GDP, PCE, Holiday

MONDAY, NOV. 25 None scheduled

TUESDAY, NOV. 26 New home sales

WEDNESDAY, NOV. 27 GDP PCE

THURSDAY, NOV. 28 None scheduled, Thanksgiving holiday

FRIDAY, NOV. 29 Chicago Business Barometer

FINAL MARKET CHECK…

**Premium:

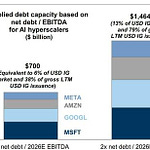

A few billion doesn’t buy you much these days…

Don’t worry Elon, that title doesn’t apply to an individual with billions to spend. We’re referencing what this week’s “multi-billion” package from Canada’s federal government might mean for the economy and its growth rate ahead.