Housekeeping: Good Morning. There will be multiple premium posts today as we share the new topical analysis worth viewing

Bretton Woods Three is a Process, Not an Event

Today:

Premium: Why Mining Stocks Now.

Commentary: UBS on Miners with Commentary

Markets Yesterday:

US equities were mixed on Wednesday ahead of the Q1 reading of US gross domestic product.

Premium: How We are Staying Golden

Summary

GoldFix Comment: Mining Catalyst?

About UBS Andrew Garthwaite

Time frame

What makes us wrong

Adding

More at bottom…

Comment UBS: Seven Reasons to Own Mining Stocks

With global risks escalating and geopolitical tensions rising, central banks around the world are implementing diversified allocations.

As U.S. fiscal risks increase, investors are moving funds into gold.

Concerns about gold being replaced by cryptocurrencies are no longer valid.

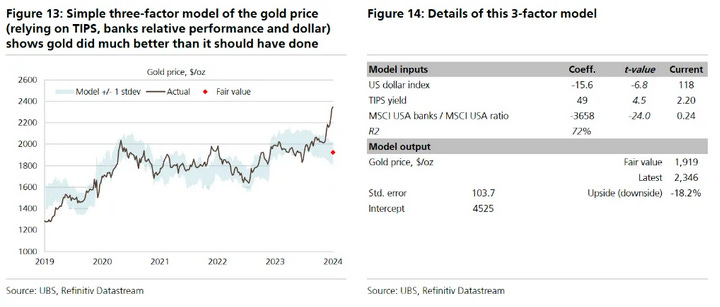

Meanwhile, macroeconomic headwinds are turning into tailwinds for gold: TIPS yields and a weakening U.S. dollar, these "conventional" macro factors may drive gold prices up by another 10%.

After adjusting for inflation, gold has not yet returned to its historical high in real terms (to reach this level, gold would need to rise by 40%),

Market positioning (i.e., overall investor positioning) has not fully reflected the recent movement in gold prices.

Gold stock valuations are low, with price-to-earnings (P/E) ratios 40% below normal levels., stock prices should rise by 45%.

More in Premium…

Market News:

US Secretary of State Blinken is to meet Chinese President Xi in Beijing on Friday 26th April, according to the US State Department.

Looking ahead, US PCE, Personal Income, Earnings from Colgate, Exxon, Chevron & Phillips 66.

Google Parent Beats With AI-Fueled Cloud Growth

Stronger Demand for Azure Cloud Computing Lifts MSFT

Geopolitics:

"US Secretary of State Blinken to visit Israel on Tuesday", according to Sky News Arabia

Hezbollah said it shelled an Israeli force with artillery at the site of Al-Malikiyah and achieved a direct hit, according to Al Jazeera.

US official said the US could announce as soon as Friday USD 6bln in new weapon purchases for Ukraine.

North Korean leader Kim supervised the test-firing of multiple launch rockets, according to KCNA.

China's Defence Ministry said Chinese and French militaries established a dialogue mechanism for cooperation between theatre commands, according to Reuters.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, APRIL 22None scheduledTUESDAY, APRIL 239:45 am S&P flash U.S. services PMIWEDNESDAY, APRIL 248:30 am Durable-goods orders MarchTHURSDAY, APRIL 258:30 am GDP Q1FRIDAY, APRIL 26 PCE1

Premium:

***DO NOT SHARE THIS***