We raise our prior bullish 0-3 month forecast to $28/oz (from $24/oz), our 6-12 month forecast to $30/oz (from $28/oz), and our annual average price forecast to $27/oz (from $25/oz) - Citi Report

SECTIONS

Market Summary— Debt Ceiling and VVIX

Week’s Analysis/Podcasts— Tokenization, Cold War, Silver

Research— Silver, Gold, Hartnett,

Charts— Metals, Energy, FX, Bonds, Crypto

Calendar— GDP, PCE

Technical Excerpts— GC, CL, BTC, S&P

Zen Moment— Herd Behavior

Full Analysis— silver train

1. Market Summary

Stocks suffered their worst week since March 10th (SVB collapse) with Nasdaq the biggest loser but Small Caps actually managing small gains. Energy stocks were the weakest this week while Staples and Real Estate outperformed.

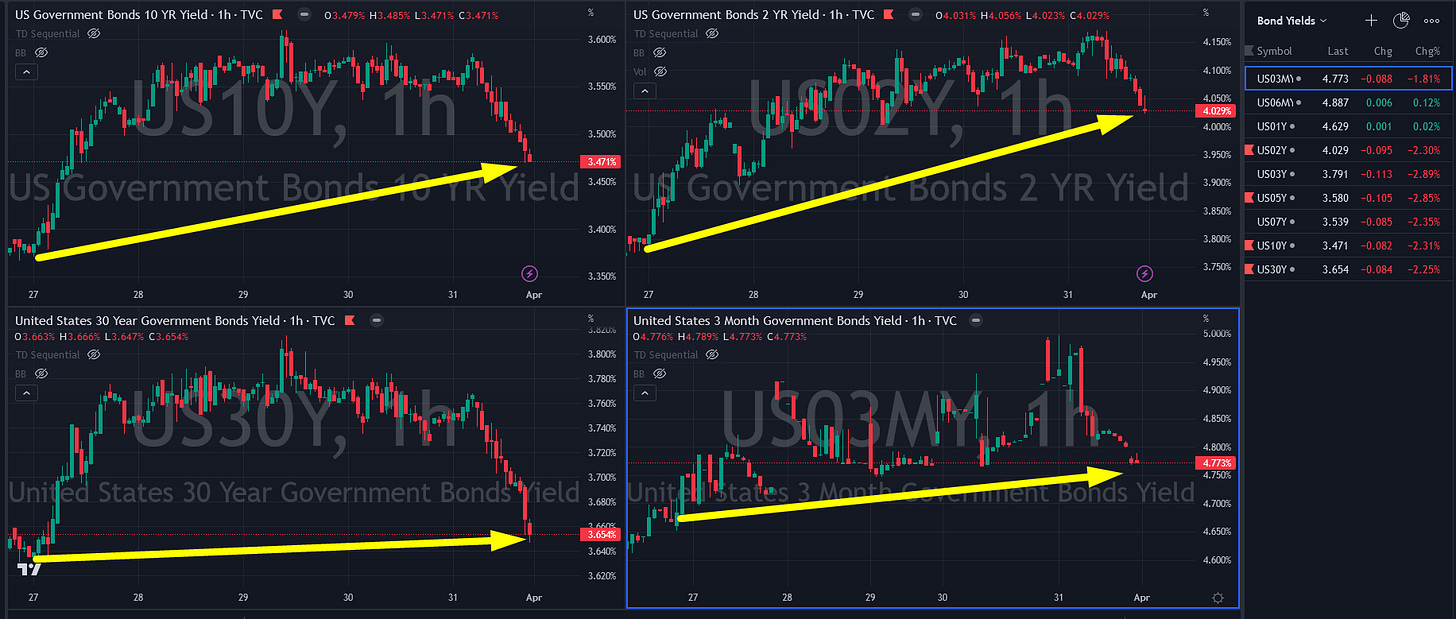

Defensives outperformed Cyclicals. Treasury yields ended the week higher (with the short-end underperforming) after Friday’s post-PMI spike changed the week

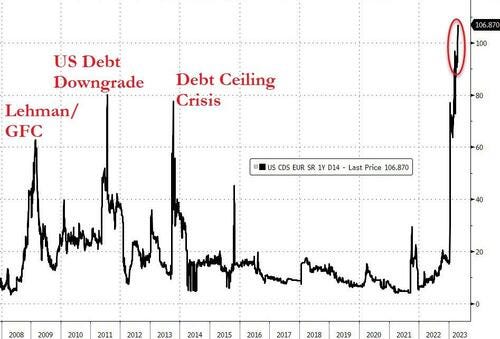

USA default risk is rising, US equity risk has been falling all week (to its lowest close since Nov '21)

VIX tumbled to cycle lows this week, but VVIX ( the volatility of volatility index) is notably decoupling from it, implying low volatility.. but risk of surprise vol spikes from event risk.. consistent with Debt ceiling risk

Sectors/Technicals:

We continue to see bifurcation within sub-sectors like Healthcare, Tech, Banking and Basic materials.

Commodities:

Grains had a very wild week, sinking almost relentlessly

The dollar saw its first weekly gain since 3/10 (but remains only marginally off the February lows)

Gold was choppy, but resolved lower, Silver did not!

OPEC+ production-cut spike gains... the West wins this week it seems

Bonds:

Volatile and slightly, uniformly weaker on the surface. kinks are firming due to pre-post debt ceiling risks

Rate-hike expectations continue to rise for next week (now 92% odds of a 25bps hike)

Fed Chair Powell's favorite yield-curve-based recession-signal (18m fwd 3m to spot 3m yield spread) hit its most inverted ever this week

Crypto:

Crypto suffered likely on growing risk of continued rate hike extensions

Ripple continues to recover well however.

2. Week’s Analysis/Podcasts:

"San Francisco's changing landscape raises questions on municipal solvency"

Zoltan Interview: "You basically see a commodity supercycle in embryonic form***

Fed Paradox: Raising Interest Rates accelerates inflation in core items

Silver Institute: Demand Set Records In Every Category In 2022

Inflation Bomb: Christine Lagarde Just Showed the West's Hand

3. Research Focus:

CITI Gets Aggressive on Silver***

GS Trader Updates on his Gold comment last week**

BOAs Hartnett believes structural inflation is here to stay

JPM on Default risk (technically)

FULL ANALYSIS AT BOTTOM…