Weekly Part 1: Tokenized Gold Gets Big

Weekly Part 2 will contain a full write up on the report discussed here and be sent later today.

Housekeeping: Welcome New Subscribers: We have a great many new premium subscribers and are grateful. The Weekend reports are different than the weekday posts. Weeklies are designed to be a recap with new research insights in the old Barrons style. Enjoy and thank you.

SECTIONS

Market Summary— Hikes will seemingly not end

Week’s Analysis/Podcasts— PetroDollar Death, Fed Instability

Research— Crypto Gold Grows

Charts— Metals, Energy, FX, Bonds, Crypto

Calendar— Beige Book, LEI, PMI.. Fed Speakers

Technicals— GC, CL, BTC, S&P

Zen Moment— Chipmunk goes nuts

Full Analysis— BOA, TD

1. Market Summary

US equities ended the week mixed with the Nasdaq basically unchanged and The Dow outperforming (these are changes from Friday's early futures close). The day was a bit chaotic as hawkish comments (and data) battled bonanza bank earnings (BA and UNH weighed the Dow down -177pts opposing GS and JPM's gains +90pts)

Gold was having a great week, rallying up to near record highs before today's news sent the precious overreacting back to $2000 area.

Banks bifurcated as everything else in this country now. The big boys did well, the small guys did poorly. Another week ended with a big divergence between defensives (lower) and cyclicals (higher).

The odds of a 25bs hike in May now up to 85% - almost back to pre-SVB levels.

Traders shifted views on The Fed hawkishly, spurred on by the UMich inflation exp spike. Feds Waller said: Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further.

We find this unsurprisingly disingenuous. It was less than 3 months ago Powell said that Financial conditions had gotten net much tighter and to ignore their recent improvement. Here is what he said on February 1 in response to easing Financial conditions where he essentially stated ‘they have a long way to go before we are worried again’

Investors came into Wednesday's news conference eager to hear Federal Reserve Chair Jerome Powell's take on a recent easing of financial conditions. His nuanced response appeared to spark a stock market bounce that saw major indexes erase losses to turn higher on the day. Marketwatch

Powell told reporters back then financial conditions had tightened significantly over the past year, notwithstanding the recent easing back then, and it was nothing to worry about.

Pause, But for How Long?

The Fed is now shifting away from the ‘we’re almost done hiking’ narrative. This reminds us of our two rules when listening to Fed speakers.

They Are Tape Watchers: Fed rhetoric changes according to market behavior (oil is back up with stocks stable), and biggest fear (inflation). “Data dependency” is used only as cover.

Head Bullsh*tter Only: Listen to no-one but Powell if you listen to anyone at all.

Therefore, we say with small but increasing confidence the Fed is not done tightening in May. And if they are done, post tightening, they are not easing any time soon unless something they (or Janet) cannot fix behind-the-scenes breaks.

We say “small” because we need to hear Powell himself (pursuant to rule #2 above) retract his Feb statement with something like Financial conditions are improving now and that worries us. If he says that stocks will start diving hard. Somewhere Tom Luongo lights a cigar.

Zerohedge summarizes the data week:

It was a hard week for both 'soft' data and 'real' data as they both showed serial disappointment (a positive for some assets in the case of inflation signals) but overall, 'hope' - the spread between hard and soft data - is at its lowest since March 2001

Sectors/Technicals

Financials loved the week, Ags, Basic materials as well

NOTE: sectors are getting mixed performances *within* each subdivision

Big tech did ok net, but MSFT was an anchor weighing it down.

Commodities:

Gasoline and Corn (Ethanol) are fully linked up

The dollar rebounded off the February lows today, reversing much of the week's losses BUT still down for the 5th week in a row

Gold is not looking good for a week or two, but can we complain?

Nat Gas had a long period when it traded under $2.00. It’s not crazy

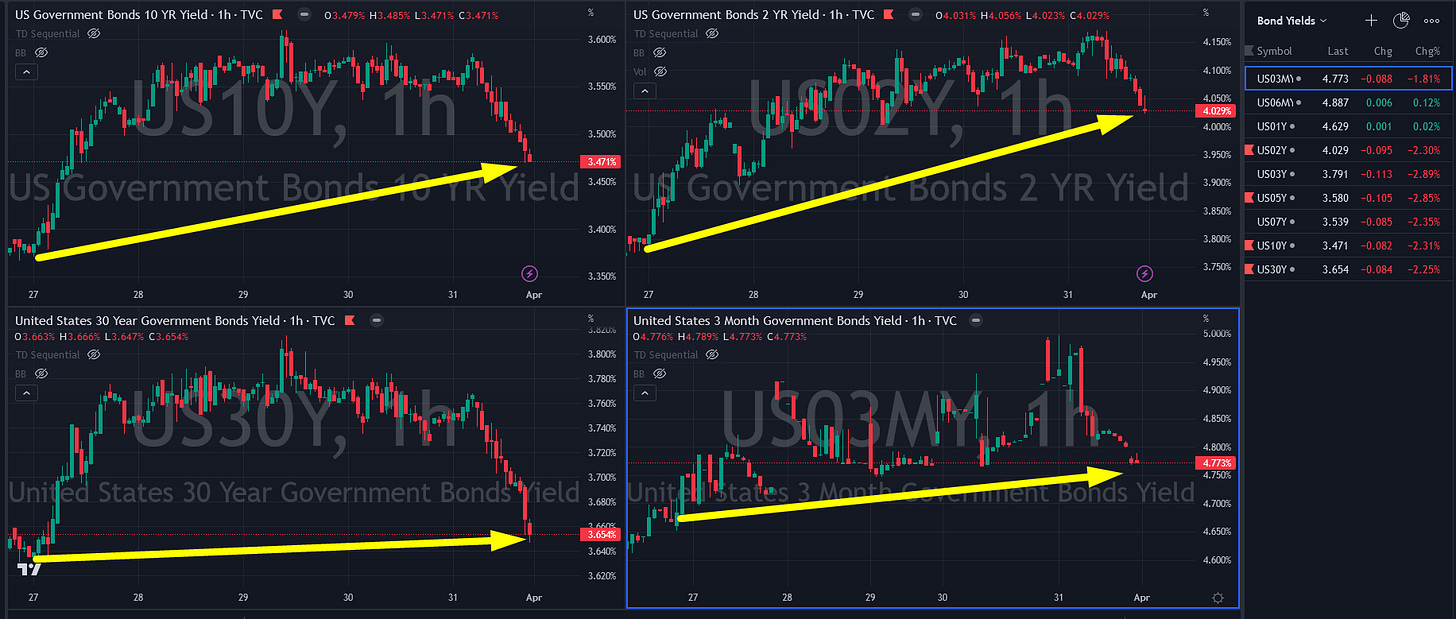

Bonds:

Bonds did poorly uniformly.. which implies no real differentiating flows

But later in the week, more size went back into them as stocks recovered

Crypto:

Ethereum outperformed Bitcoin

Many ETH alts did well

Ripple, which had been on fire, cooled later in the week

ZH notes: ETH notably underperformed BTC into the fork then ripped back to one-month highs relative to BTC after

2. Week’s Analysis/Podcasts:

3. Research Excerpts:

BOA: Tokenized gold’s market value reaches $1bn+

Hartnett Remains Bullish Gold Macro-macro but notes it is overbought

T.D. Gold CTA Report

BOA Flow monitor says a 2.8% drop in Gold will likely end any correction

ANALYSIS AT BOTTOM…