Housekeeping: Goldfix Weekly is different than the dailies. It is more like Barron's used to be. Content touches many markets with many types of content.The index helps

**This Week: Note we have changed the index order to accommodate added content. We hope you enjoy the additions

SECTIONS

Market Summary— Bad news is good again

Week’s Analysis/Podcasts— post compilation

Research— Stocks, Cars, and Recessions

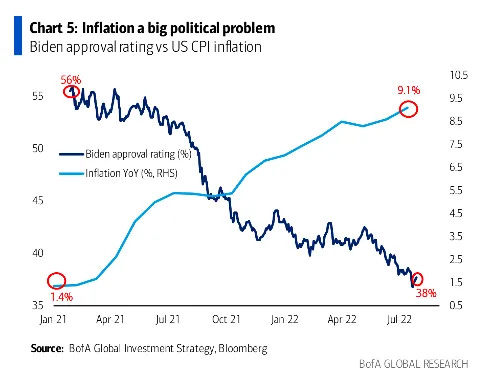

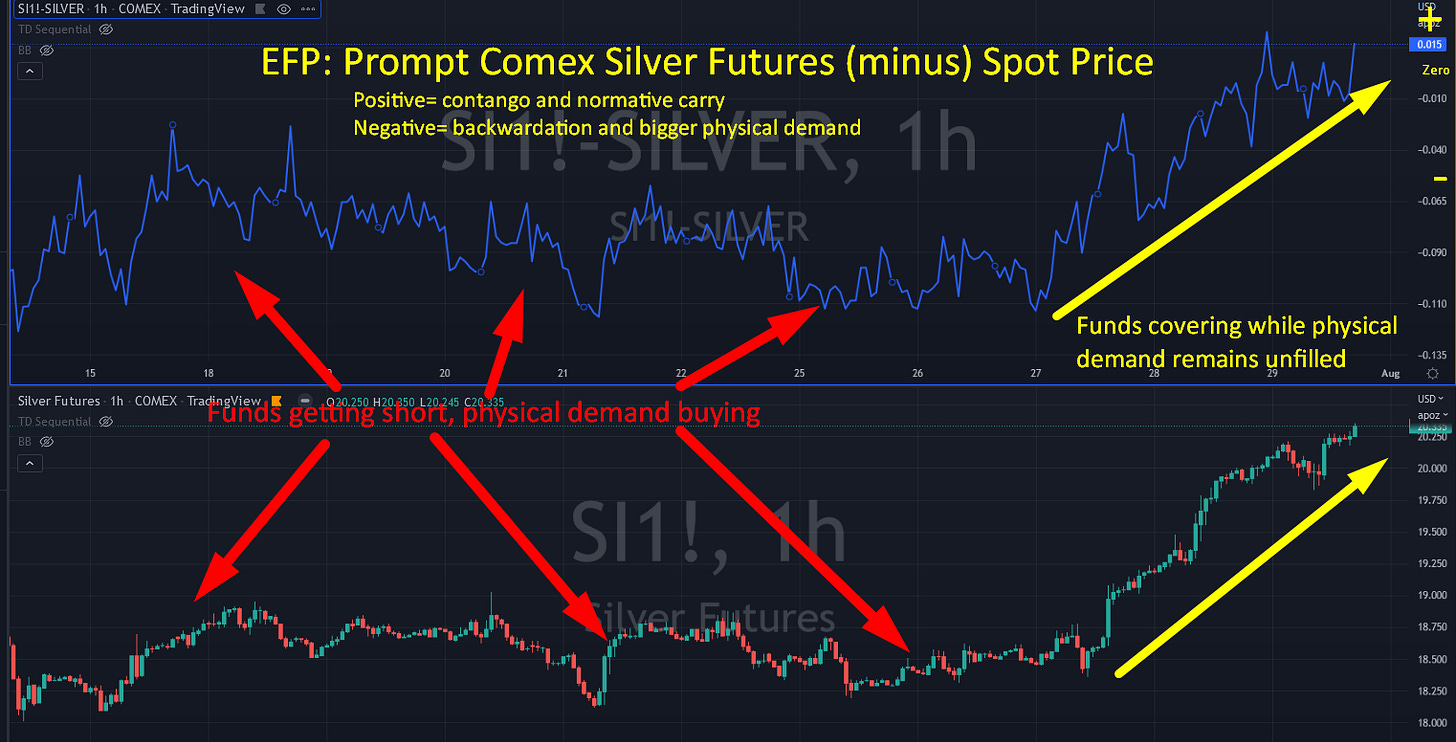

Charts— Gold, Silver CTA squeeze, and Biden Ratings

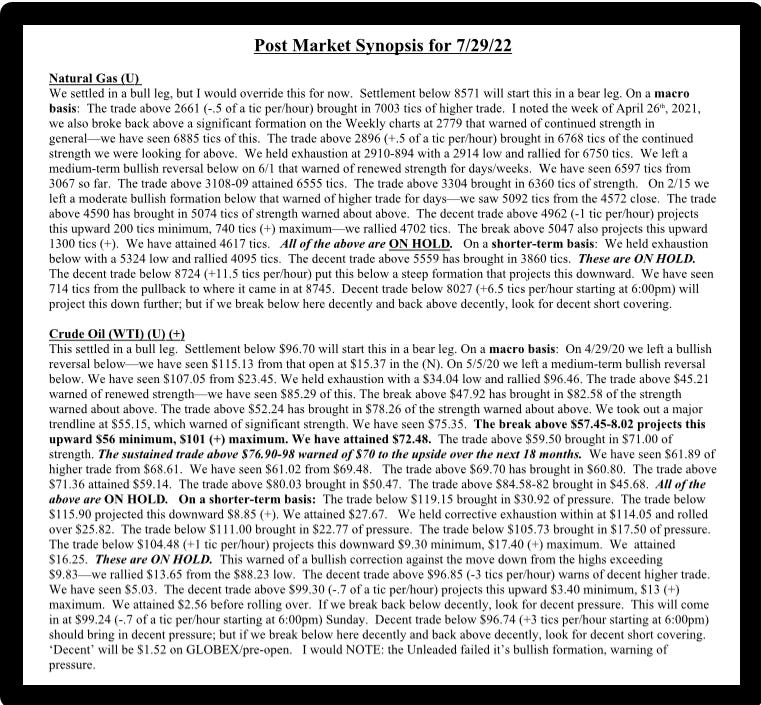

Technicals— Moor Analytics

Calendar— Credit Suisse

Zen Moments— “Nothing to see here”

Full Analysis— VanEck Gold and Miner Analysis**

1. Market Summaries

On the week, stocks dumped and pumped early and then exploded higher after the FOMC statement and Powell's presser. Nasdaq was up almost 5% from right before the FOMC statement to after it. So what happened?

The S&P 500 was up 1.9% this week

Nasdaq was the biggest gainer

S&P's best month since Nov 2020

best monthly gain since April 2020

For openers, stocks took bad news badly early in the week as suggested last Sunday (Earnings season is when things act as they should). Then post Wednesday’s FOMC, they only had eyes for Fed dovish flirtations, and bad news became good again.

From last week’s report:

….and absent Fed hand-holding, stocks will drop. That may continue until at least next Wednesday when the Fed ingratiates us again with more economic wisdom. So every once in a while markets behave as you think they should.

We want to say stocks will likely go up for the remainder of the summer based on money waiting for news like this and the inflation data that came out later in the week showed no signs of dissuading that mindset. But the fed may not be happy with the bounce.

We know Powell can’t be happy about the rally and is probably waiting to talk it down again in a week or so. Zerohedge sees the nuance here noting: “The Fed is well aware that tightening aggressively in one big batch will crush the market (and the economy), so perhaps a 'gently does it' approach is more palatable” for now. Therefore we see this as a bear market rally. They also note the amplitude similarities implying as much.

We believe the Fed will not take their foot off the brake for good until we see at least 2 consecutive very weak inflationary data points. Right now they are just letting the market off the canvas a bit. How long can the rally last? Maybe all of August. That is provided the Fed’s speakers don’t come out and talk tough again. Bulls should want a slow rally so as to not wake the bear.

H/t Zerohedge for data and some graphics.

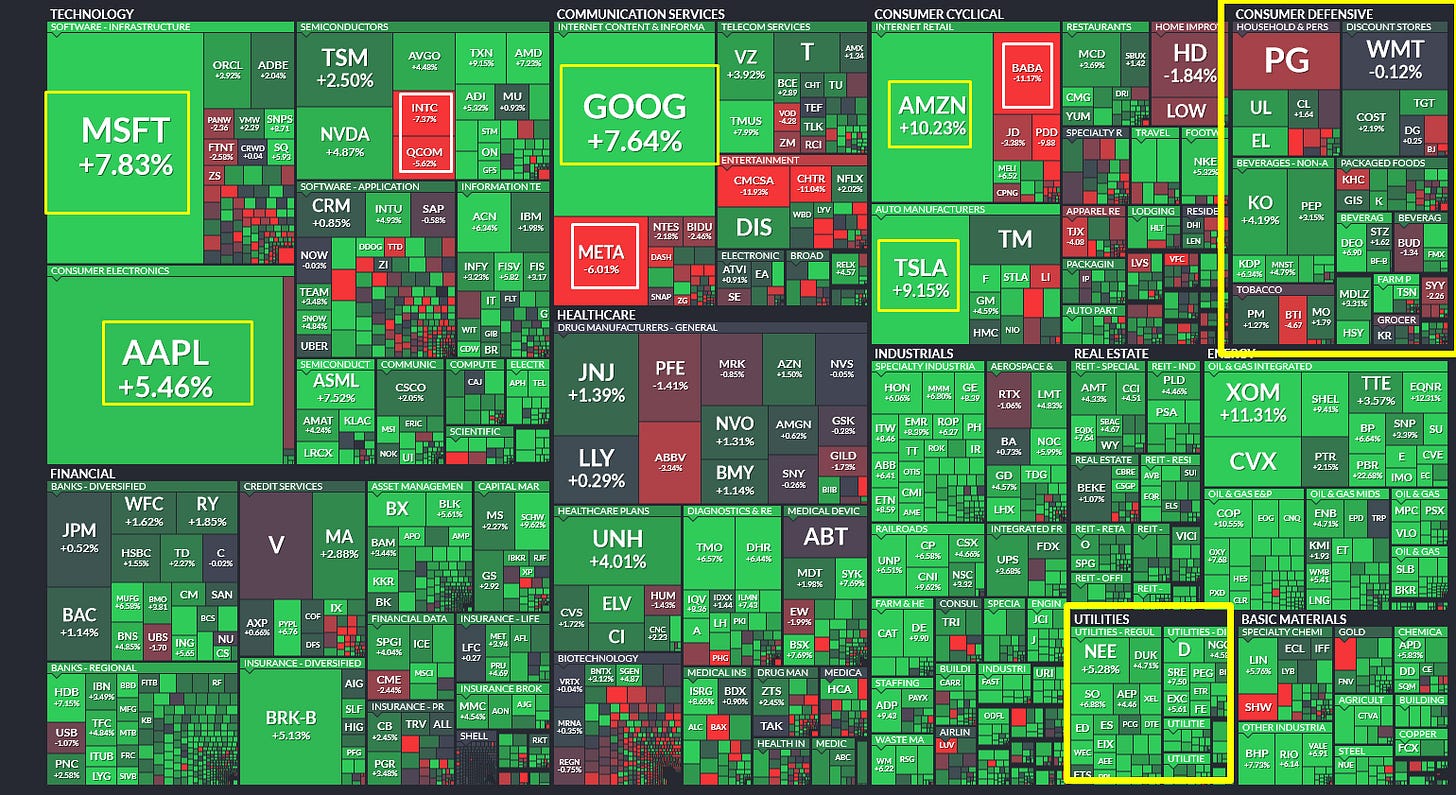

Sectors:

Utilities were the best-performing sector (+7.0%)

Communication Services was the worst-performing sector (-2.5%).

Commodities:

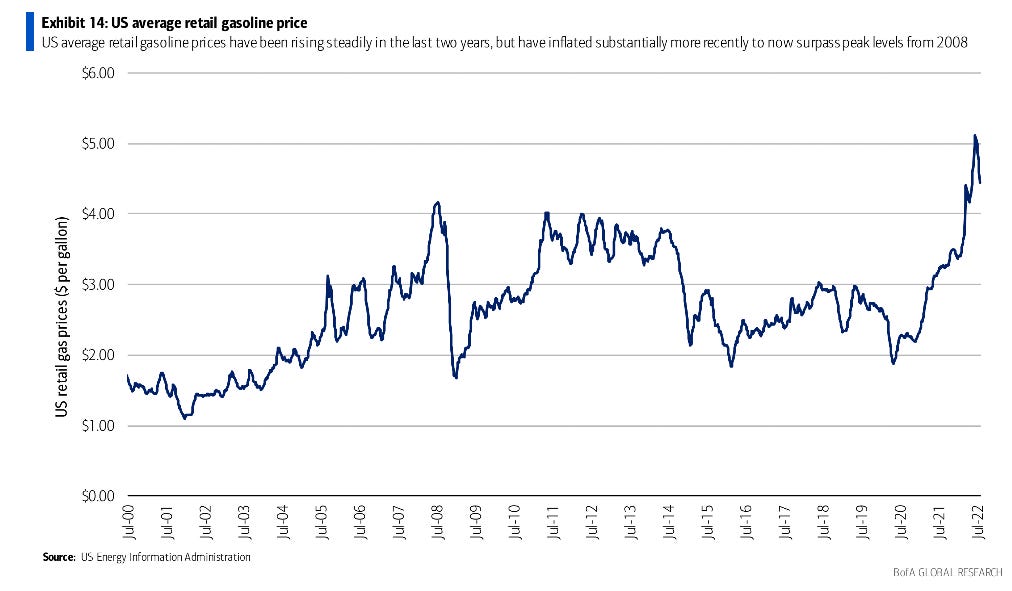

Oil prices rebounded notably with WTI back above $100 Friday

Gold traded (briefly) below $1700 during the month but has since rallied back above $1780

Silver rallied so hard the last 3 trading days it finished unchanged on the month

US NatGas exploded higher to 14 year highs.

Bonds:

July saw the 2nd best combined US bond and stock monthly return since March 2000 (April 2020 was the best)

Treasuries were aggressively bid this month.

Crypto:

Bitcoin and Ethereum had good weeks. Ethereum is the leader still with news of the merge coming. Bitcoin is starting to catch up but nowhere near the bounce of its smaller cousin.

Coinbase Insider Trading: Coinbase product manager Ishan Wahi tipped off two others and collectively raked in profits of up to $1.5M. The US DOJ is charging the trio with “wire fraud conspiracy.”

Three Arrows Capital: The founders broke their silence in a Bloomberg piece.

Ethereum Merge Update: The Goerli testnet, the final one before the Merge has been announced by Ethereum developers for August 6-12th.1

2. Analysis/Podcasts:

This week’s Precious Metals, Energy, and Economics pieces by GoldFix

Popular Last Week:

Silver Buyer "Up To a Billion Dollars" in Coins- 51,000 reads

Zoltan Pozsar: "Given [the Fed's] updated mandate, recession isn’t an option."- 30,000 reads

Gold and Silver: We Have the Gas, Now We Need a Fire- 12,000 reads

Must read for Silver rally catalyst last week

GoldFix Original Content Last Week:

Inflation May Re-Accelerate Unless People Stop Spending | PCE Report

Zoltan Pozsar: "Given the Fed's [and Biden's] updated mandate, recession isn’t an option.- Zerohedge

OIL: Winning the Price Battle, Losing the Supply War- Zerohedge

3. Research:

Overview: GoldFix on VanEck, GS on Stocks, JPM macro, BOA on Cars

1- GoldFix Analysis: What’s Driving Gold?

Key Points discussed

Gold remains range-bound

Dollar/Gold Inverse Trend Not As Strong This Year

Rate Hikes Haven’t Always Slowed Inflation

Cost Improvements Aiding With Higher Margins

Gold Miners Are Undervalued Based On Current Cash Flows

Attractive Valuations Aren’t Just On An Absolute Basis

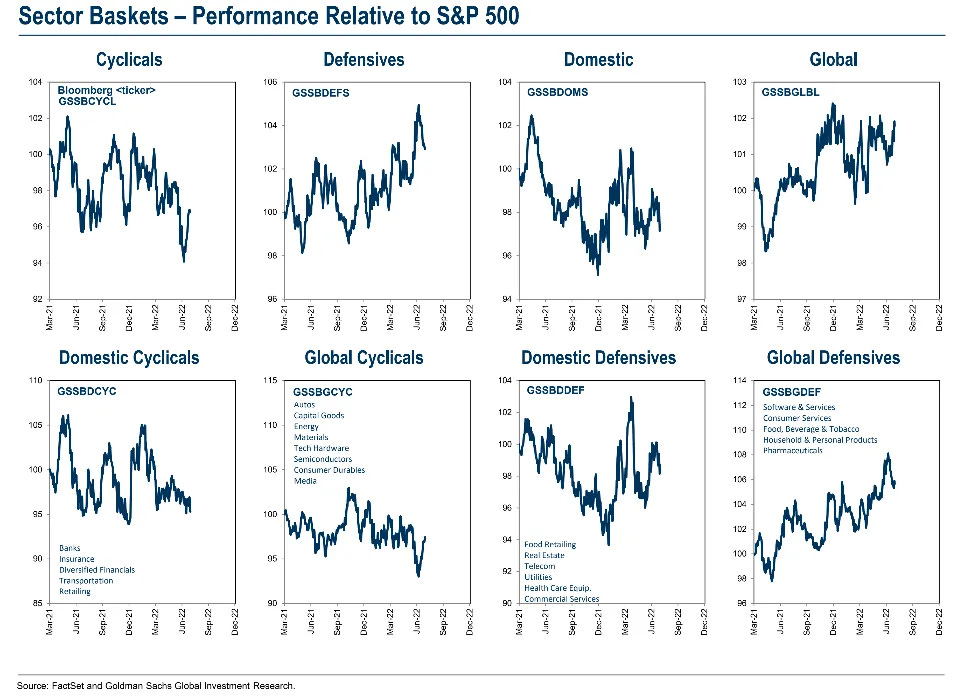

FULL ANALYSIS AND DETAILED CHARTS AT BOTTOM2- Goldman’s Stock-Picker’s Guide

The S&P 500 rallied to its highest level since June 7th this week as the busiest week of 2Q earnings season coincided with a busy macro calendar. We update our dispersion score framework. Comm Services and Consumer Discretionary offer the best stock-picking opportunities. Stocks with the highest dispersion scores: MRNA, ENPH, SEDG, BBWI, MOS….

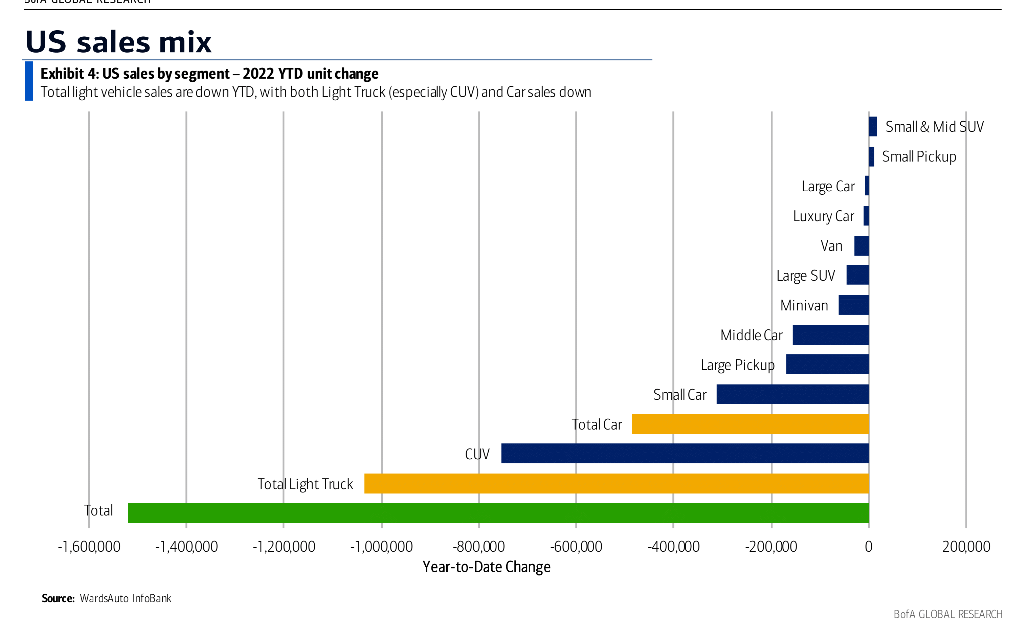

Continues at Bottom3- BOA: Automotive Industry Report

People are still buying cars: One point to suggest that demand is not yet being meaningfully impaired is that mix and price continue to improve month after month. Specifically, in June, light trucks (pickups, sports utility vehicles (SUVs)…

Continues at Bottom4- JPM: A mild recession is already priced in

A mild recession is already in the price, peak Fed pricing is behind us: While recession odds are increasing, a mild recession appears already priced in based on the YTD underperformance of Cyclical vs. Defensive equity sectors, the depth of negative earnings revisions that already matches past recession moves, and the shift in rates markets to price in an earlier and lower Fed Funds peak. With the peak in Fed pricing likely behind us, the worst for risk markets and market volatility should also be behind us.

Continues at Bottom

4. Charts:

Gold:

Silver:

Silver CTAs:

Full CTA and CoT reports in premium

Silver EFP Analysis:

Copper:

Dollar:

Caught Our Eye:

Charts by GoldFix using TradingView.com

5. Technicals

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold: Bullish, needs to clear $1780.90

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy: Bullish CL, Neutral NG

Bitcoin: Bullish above $22,540

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar

Some upcoming key data releases and market events

MONDAY, AUG. 1

9:45 am S&P U.S. manufacturing PMI (final) July 52.2 52.3

10 am ISM manufacturing index July 52.1% 53.0%

10 am Construction spending May 0.4% -0.1%

TUESDAY, AUG. 2

10 am Job openings June 11.0 million 11.3 million

10 am Quits June -- 4.3 million

10 am Rental vacancy rate Q2 -- 5.8%

10 am Homeowner vacancy rate Q2 -- 0.8%

11 am Real household debt Q2 -- 0.0%

6:45 pm St. Louis Fed President James Bullard speaks

Time varies Motor vehicle sales (SAAR) July -- 13.0 million

WEDNESDAY, AUG. 3

9:45 am S&P U.S. services PMI (final) July 47.5 47.0

10 am ISM services index July 53.9% 55.3%

10 am Factory orders June 1.0% 1.6%

10 am Core capital equipment orders (revision) June -- 0.5%

THURSDAY, AUG. 4

8:30 am Initial jobless claims July 30 255,000 256,000

8:30 am Continuing jobless claims July 23 -- 1.36 million

8:30 am Trade deficit June -$79.6 billion -$85.5 billion

12 noon Cleveland Fed President Loretta Mester speaks

FRIDAY, AUG. 5

8:30 am Nonfarm payrolls July 250,000 372,000

8:30 am Unemployment rate July 3.6% 3.6%

8:30 am Average hourly earnings July 0.3% 0.3%

8:30 am Labor-force participation rate, ages 25-54 July -- 82.3%

3 pm Consumer credit June -- $22 billion

Main Source: MarketWatch

7. Zen Moments:

They don’t write them like this anymore…

Nothing to see here…