Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. It is more like Barron's used to be. Content touches many areas of markets. The index may help.

**Please look for another email tomorrow outlining What, Where, and How to access new content we've been experimenting with.**Founders class: No Founders Class Sunday due to Father’s Day plans for several of the crew. Enjoy that and the Monday holiday as well.

SECTIONS

Market Summary

Technicals

Podcasts

Calendar

Charts

Analysis: Einhorn’s Play, Silver close.

Research: Gold, Oil, Commodities, Macro, Fed

1. Market Summary

The Fear

The US equity markets suffered their worst week since government locked down the US economy due to COVID in March 2020. Stocks are down 10 of the last 11 weeks. That’s a first since 1970. The Dow has now had 11 down weeks out of the last 12. This has never happened before. Finally, UMich sentiment is at record lows.

The Hope

Market breadth is about as bad as it has ever been- sign of capitulation

Oil dropping may signal relief for stocks- inflation fears begin to abate

Equity put-call volume ratio highest since April 2020.- sign of panic

Bloomberg's SMART Money Flow Indicator has been surging higher into this selloff- “smart” money buying

Inflation fears down now- recession fears will rise, Fed may back off

The questions are: how soon will these indicators drive the market, and for how long?

Last week the credit market started to crack and that shows no signs of abating yet. When you combine that with Japanese and European Bonds cratering (more below), it indicates the Fed backing off on its aggressiveness. The dollar thus should weaken. This *should* put a floor under stocks next week. At least a slowdown in descent. We will see.

S&P 500 and Nasdaq's worst weekly loss since Jan 2021

H/t Newsquawk and Zerohedge for data and some graphics.

Sectors:

Energy stocks have been hammered since CPI last week.

This week's energy stock losses are the worst since March 2020

Staples have held up relatively well on the week

Biotech did well

Commodities:

Two Weeks Ago: commodity rallies are almost all stalling now except for Oil. It is all about WTI now unless China really steps up demand or peace breaks out in Europe. If oil drops, the rally is over for most commodities. Gold will drop as well, but Gold is not a commodity in this sense long term.

Last Week: Oil dropped, it is over for commodities for a while. Sure they will rally over the next few weeks here and there, but flows will exit the long side in every general rally now as the second Fed goal (weakening Russia’s money machine, and stopping China’s reflation attempts) starts to hit its stride.

Dollar rallied on the week after finding support at pre-CPI lows

Commodities are all lower on the week amid recession and monetary-policy-tightening fears.

Crude and Copper, very China-centric demand based, were killed

PMs actually holding in around unchanged

Worst week for WTI since April

Worst week for wholesale gasoline longs since March 2020

Bonds:

Bottom line: US Bonds are weaker, but may be slowing their selloff now. Why? One new factor: The rest of the world’s bonds, from Europe to Japan are cratering for different but related reasons.

Market is still pricing in 10 more rate-hikes by the end of 2022 and then 3 rate-cuts following it- won’t happen if history is a guide

Treasury yields were marginally higher with no change in flattening/inversion potential net on the week- lots of new shorts in the market, adn EU/Japan worries attracting flows

The curve is notably flatter with 2Y up over 30bps and 30Y up around 10bps sinc CPI- we fully expect the long bond to drop again (Broken Bond Ladder Concept) as they heighten the backend eventually, but with mortgage rates over 6% now, maybe they will let it breathe a little.

Looking at how far rates have come since Zoltan Pozser suggested the concept in Cure Inflation "By Forcing Long Term Rates Higher". Any higher and the housing mkt could crash. The end game is definitely to get long term yields higher, but the timing is tactically flexible.

The yield curve (2s30s) down to cycle lows, briefly re-inverting once again

The 10Y Yield touched around the 3.50% level this week.

Japanese bond markets were making headlines this week as traders bet they could break through the Yield Curve Control1 ceiling and bet on that break at this week's BoJ meeting. No luck yet

European bonds were also at the center of chaos as The ECB was forced to address 'fragmentation’. They intend to do this by creating a vehicle for emergency fund releases for Italian bonds to be bought. This emergency vehicle would be used *while* they are raising rates for all of Europe.

Here’s what that looks like to us…

What could go wrong?

Crypto:

Worst week for bitcoin (down 30%) since March 2020, but Ethereum was down worse, losing 35% this week alone

Amid crises at several crypto lenders (you know the ones that promise 10% yields) Ethereum has been destroyed. This has nothing to do with Ethereum proper but it amounts to a much smaller use case for the ETH backbone. That said, ETH still has its own problems with the 2.0 launch

Note that on a weekly basis, by some measures, Bitcoin has never been this oversold- the market has some players in its sites, it wont be over until someone cries Uncle we think. $20,000 has to be breached to test Saylor’s intestinal fortitude.

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

Continues to be technically violently neutral. Advise to focus on micro until above 1870 or below 1830.

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Oil flipped bearish the first time in a long time

Bitcoin

Downside should pause soon

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

Jordan from The Daily Gold circled back to us Friday and we had a nice chat on Friday’s post CPI action and the potential for it being a pivotal moment in the investment world.

Companion broadcast to the PRE FOMC prep

More GoldFix Broadcasts HERE

More Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, JUNE 20 Juneteenth holiday. No indicators scheduled

12:45 pm St. Louis Fed President James Bullard speaks

TUESDAY, JUNE 21

8:30 am Chicago Fed national activity index May -- 0.47

10 am Existing home sales (SAAR) May 5.41 million 5.61 million

12 noon Cleveland Fed President Loretta Mester speaks

3:30 pm Richmond Fed President Tom Barkin speaks

WEDNESDAY, JUNE 22

9:30 am Fed Chair Jerome Powell testifies on monetary policy at Senate

12:50 pm Chicago Fed President James Bullard speaks

THURSDAY, JUNE 23

8:30 am Initial jobless claims June 18 225,000 229,000

8:30 am Continuing jobless claims June 11 -- 1.31 million

8:30 am Current account deficit Q1 -$274 billion -$218 billion

9:45 am S&P Global U.S. manufacturing PMI (flash) June 56.1 57.0

9:45 am S&P Global U.S. services PMI (flash) June 53.5 53.4

10 am Fed Chair Jerome Powell testifies on monetary policy at House Financial Services Committee

FRIDAY, JUNE 24

7:30 am St. Louis Fed President James Bullard speaks

10 am UMich consumer sentiment index (final) June 50.2 50.2

10 am 5-year inflation expectations (final) June -- 3.3%

10 am New home sales (SAAR) May 600,000 591,000

4 pm San Francisco Fed President Mary Daly speaks

Main Source: MarketWatch

5. Charts

Gold

Silver

When is the last time you saw Silver up relative to Gold on theweek with the dollar net stronger?

Dollar

That selloff Thursday was a start of something possibly bigger as it came on the heels of Japan and Europe news on Bonds.

Oil

Charts by GoldFix using TradingView.com

6. Analysis: GoldFix Commentary

To be blunt, this week has seen a return of a mediocre research report deluge. It has been hard to pick something to focus on that was killer. We had a lot of good stuff these past few months to write on.The influx also was painful to sort through this week. Thus today’s format is a little different to accommodate the extra content.

There are eleven good reports (out of 50) below on everything from gold to inflation to stocks. Look at it as a reading menu. All by reputable analysts we read as much of as we can to help inform our own opinions. But, nothing compelling jumped out at us behaviorally except for possibly a short-covering rally setting up in stocks and a steeper decline possibly in oil was worth mentioning. So we stuck with curation this week.

In Gold terms there were very few good reports. The best by far was the Greenlight capital slidedeck which we have attached.

Silver is oversold, and has big potential to rally now (that means a $1.00 to $4.00 move only, not moon stuff) due to the large short CTA positions being back. But the Fed tightening and China slowing down even more makes it all difficult. No layups this week in metals.

But the floor under Gold’s behavior continues to tell us it is higher than it has been in the past. The best trade may be to trade shorter term or, as we have done, short oil a little and cover way too soon.2 other than that we are friendly to Silver but watching only for now.

Happy Reading

7. Research:

Precious

Einhorn’s Slide Deck

Einhorn’s Full Gold Presentation- Very clear, very good. Doesn’t think Fed can do what it says

Absolute Return’s Gold and Silver Analysis- seen it all before, but not without merit

TD’s CTA report

***More at bottom***Stocks

Greed and Fear- always good

BOA- Week ahead

Oil/Commodities/ Crypto

BBG Oil Daily - morning comment Friday

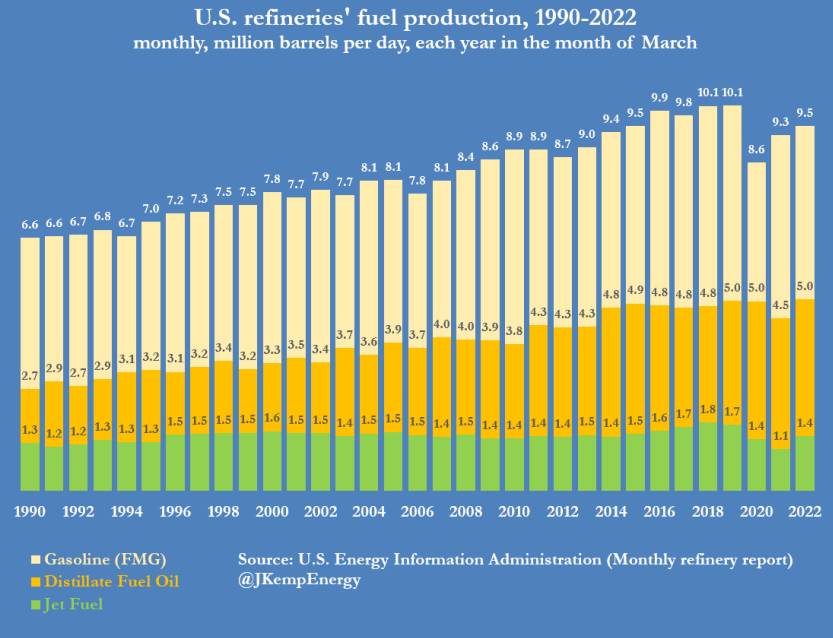

Reuters/Goldman- Oil Refining charts

***More at bottom***Macro / Stocks/ Geopolitical

JPM Midyear Outlook

DB- Macro Week Ahead

Flow Show- great charts

***More at bottom***Zen Moments

The last one may not be what you think it is…