Weekly: Russian Oil Gets "Capped" and CNBC Reanimates Goldilocks

GS on Oil, BOA on Stocks, RBC on Commodities

Housekeeping: ***FOUNDERS CLASS RESUMES ** Tomorrow 2p.m. Look for a separate post with the link and info Enjoy the holiday. We may send something out if it seems timely

SECTIONS

Market Summary— R.I.P. Goldilocks

Research—GS /JPM on oil, BOA on stocks, and a lot of shorts in Gold

Week’s Analysis/Podcasts— Pozsar’s Monetary Statecraft Preview

Charts— Gc, Si, Dx, CL, Ng, Hg, and Gold/Silver

Technicals— Everything is range-bound except NG

Calendar— Holiday week, less data

Zen Moment— Camels exercising, Demons exorcised

Full Analysis

1. Market Summaries

After the Job numbers came out Friday CNBC couldn’t stop themselves from declaring: this was a great report, the Fed was doing a great job, and a soft landing was in the works.

“Goldilocks” was the word used over and over. Incredibly they are trying to bring back a word that is the absolute anti-thesis of where we are now. That word was thrown around all morning with regard to the labor market data.

Mind you they conveniently ignored the parts of the report that were not so good. Things like: a new record of people carrying two full time jobs, a new significant drop in wage growth, and… hours-worked keeps dropping (Zerohedge notes this is another recessionary sign) etc.

The collective of traders who bought into this narrative subsequently ramped stocks higher. They were briefly forgetful of what Jerome Powell said just last week about not being afraid to cause some pain to quell inflation:

But their forgetfulness did not last long. It was Vladimir Putin’s Natural Gas pipeline that reminded them soon thereafter. This was the announcement that did it:

BREAKING NEWS: Nord Stream 1 gas flows to Europe to remain suspended indefinitely – Russia’s Gazprom

Nord Stream 1 found an oil leak and as a result decided to keep the crucial pipeline closed to Europe. This was just after the G-7 announced it would enact the much talked about (and potentially disastrous) price caps on oil, which we discussed before and do again in this report.

The combined effect of a “good” jobs report and a “bad” energy item sent stocks back lower. Which also sent rate hike expectations back down. But, unlike past moves in rate hikes, this did not feed back into stocks ( you know, recession is bullish for stocks etc). Why? We are in a different world now. This is how Anti-Goldilocks manifests in markets.

More specifically, the recession (post Powell’s tough-love speech) is currently being seen as something we cannot simply print our way out of. Hopes for a Powell Pivot are being methodically destroyed by Geopolitics on the physical/supply-side, and by Fed intractability on the monetary/demand-side.

Sectors/ Technicals

All S&P Sectors ended the week in the red

Tech and Materials were the worst performers

Energy stocks were the most volatile

Note Oil & Gas Exploration as stronger than producers

Nasdaq down around 8% since Powell's J-Hole

The S&P 500 is now below its 200-DMA over 100 trading days straight

Longest time sub 200- DMA since the Financial Crisis

The S&P rallied up to its 50DMA and then reversed... Putin's timing was perfect

Goldman noted: Liquidity in the ES1 - the most liquid future in the world declined by -50% this week compared to last week

Commodities:

The dollar extended post-Powell gains

Gold rallied on Friday extending Thursday’s gains after bouncing off $1700.

Zinc headed for its biggest weekly loss in over a decade on concern Chinese demand will be hamstrung by new virus restrictions. ( why you should not get crazy bullish silver yet)

Oil tanked this week again with WTI back below $90 but 3 new bullish events entered the radar last week (1) Price caps will go into effect (2) The last Iran talk news was negative and (3) price caps risk a major rally in Oil as well as Natural Gas.

Bonds:

Yield curves became a little less inverted with the 2 year bond yield dropping tiny and the 10 through 30 year yields rising. This implies less inflation fighting/concern ever so slightly,

Friday sent rate-hike odds tumbling, with the odds of a 75bps hike this month dropping from 75% to 55%

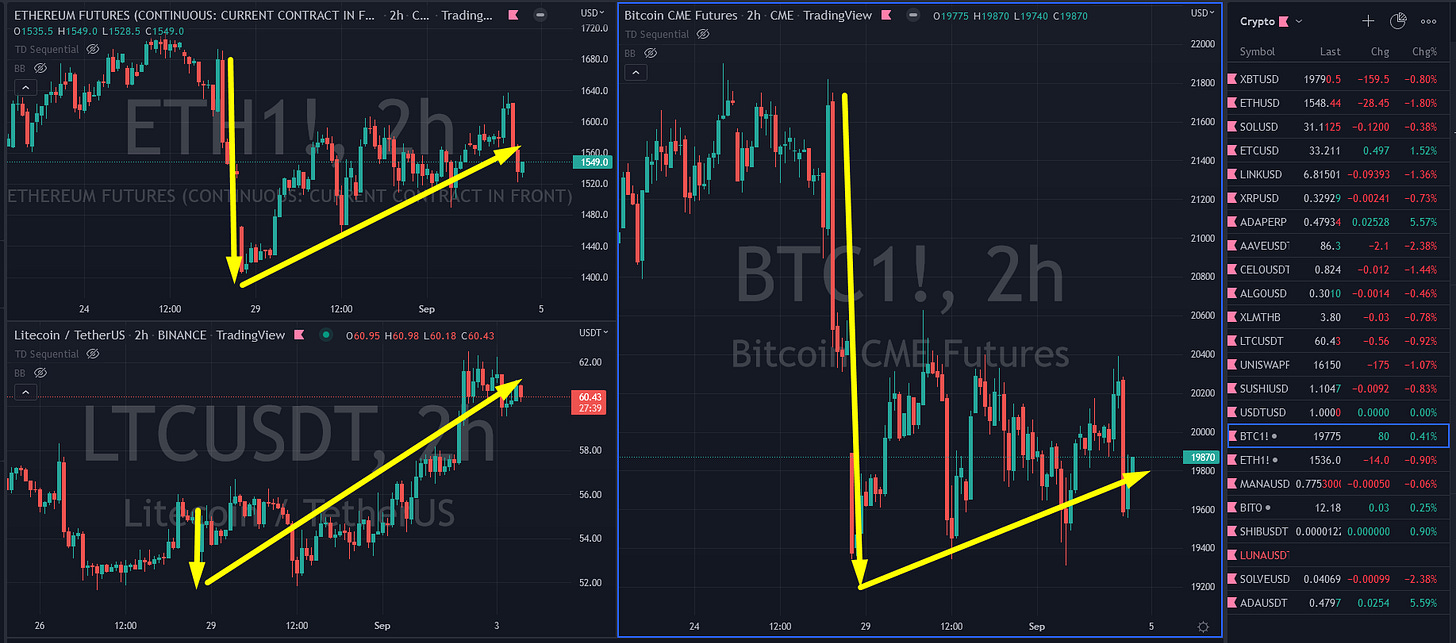

Crypto:

Litecoin managed some gains on the week but the rest of crypto was dumped with Bitcoin underperforming Ethereum

Bitcoin has now hovered around $20,000 for 10 days

H/t Zerohedge for data and some graphics.

2. Research:

BOA’s Hartnett Says New Highs and New Lows Coming

Goldman Says Oil Price Cap Won’t Work w/ comments

REREAD: JPMs $380 Oil Report Analyzed

TD CTA Report- Shorter Gold

RBC on Commodities

CONTINUES AT BOTTOM…3. Week’s Analysis/Podcasts

This week’s Precious Metals, Energy, and Economics pieces by GoldFix

Most Popular Last Week:

Weekly Part 1: Gold and Monetary Statecraft.- 45,000 views/downloads

REREAD: JPM Says $380 Oil Possible - Price Caps now approved

Meet Oil's Widow-Maker: Volatility Explodes in Spreads- Brynne Kelly

Special Silver Note | GoldFix Technical Video- 32,000 views

GoldFix Content Last Week: original pieces and more

Energy Podcast Excerpt and Metals Refinery Risk- Moor/Goldfix

SPECIAL: Oil & Nat Gas Podcast (Excerpt)- MoorAnalytics

Special Silver Note - on ZeroHedge

Elon Musk Exposes Twitter's Woke Underbelly- Tom Luongo

China Dominates the Solar Panel Supply Chain- Visual Capitalist

Gold and Monetary Statecraft: What's Coming Next- on ZeroHedge

The OG Widow-Maker: Volatility Explodes in Gas to Heat Spreads- on ZH

Fed Paper Admits Central Bank Can't Control Inflation; Finger-Points At Federal Government- Schiff

DOLLAR DEMISE: THE ANSWER KEY TO WHAT IS GOING ON NOW AS OUTLINED IN 2009- PDF- Academic Paper

We Had a Higher Standard of Living on Gold- Mises Institute

How Rising Food and Energy Prices Impact the Economy- Elements

4. Charts:

With comments in captions now

Dollar:

Gold:

Silver:

Gold-Silver Ratio:

Oil:

NG:

Copper:

Charts by GoldFix using TradingView.com

5. Technicals

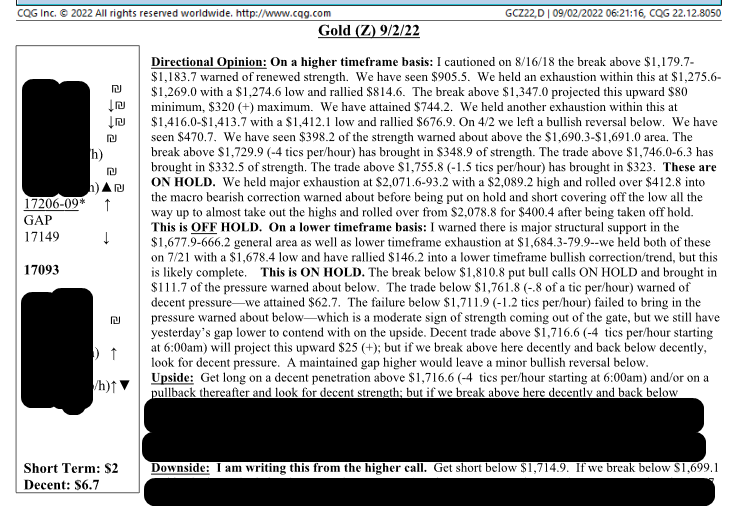

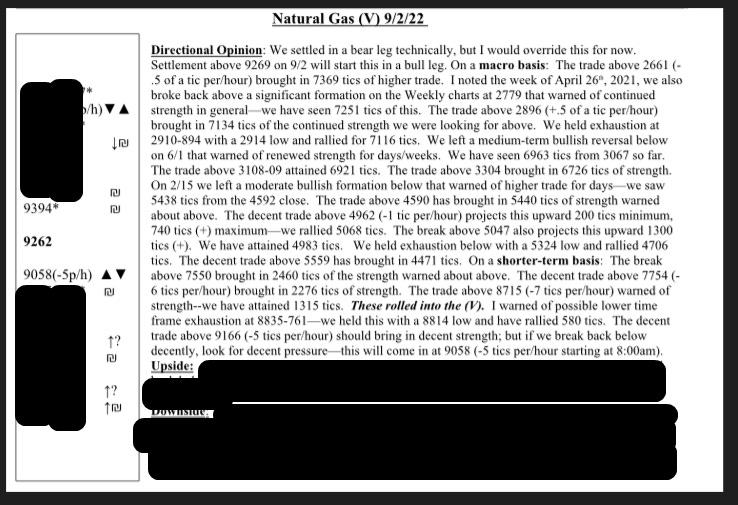

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold:

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions.

Oil:

Nat Gas:

Bitcoin:

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

6. Calendar:

MONDAY, SEPT. 5

Labor Day holiday. None scheduled.

TUESDAY, SEPT. 6

9:45 am S&P U.S. services PMI (final) Aug. -- 44.1

10 am ISM services index Aug. 55.5% 56.7

WEDNESDAY, SEPT. 7

8 am Cleveland Fed President Loretta Mester speaks

8:30 am International trade balance July -$70.1 billion -$79.6 billion

2 pm Beige Book

THURSDAY, SEPT. 8

8:30 am Initial jobless claims Sept. 3 239,000 232,000

8:30 am Continuing jobless claims Aug. 27 -- 1.44 million

10 am Quarterly services Q2 -- 3 pm Consumer credit July -- $40 billion

FRIDAY, SEPT. 2

10 am Wholesale inventories revision July -- 0.8%

Main Source: MarketWatch

7. Zen Moment:

Casting Shadows in the Desert

How to Exorcise Demons