Weekly: Sleepwalking into a Selloff

But Gold May Have Just Woken up to one

SECTIONS

Market Summary— Sleepwalking into a Selloff

Research— Stocks, CTAs, Technicals, Fed

Week’s Analysis/Podcasts— IMF, Mining, Zoltan analysis

Charts— metals, energy, and FX

Calendar— UMish, NY Fed Inflation gauges.

Technicals— GC, CL, BTC, SPX

Zen Moment— Cats cheating

Full Analysis— Hartnett, BBG, GS, TD, JPM

1. Market Summary

The “most painful trade” is always the “apocalypse postponed,” a team led by Michael Hartnett wrote in a note. Hartnett recommends investors start selling the S&P 500 when it’s over 4,200 points — 0.5% higher from its most recent close. He expects the benchmark to hit its first-quarter highs before Feb. 14.

There were two “events” that moved markets wildly this past week.

Wednesday saw stocks soar after Powell undermined (on purpose or by accident?) his own hawkish talk with a comment during the presser he just wasn’t that concerned with the recent trend of easing financial conditions aka the FCI1. Stocks rallied, and the FCI got even looser.

Friday’s "good" NFP news sparked an aggressively hawkish response in STIRs and muted but did not kill the whole stock market rally from Wednesday.

Stocks soared on the week led by big-tech (Nasdaq +3%)

Nasdaq Composite's best start to a year since 1975.

The Dow ended the week in the red (-0.5)

Here are the two most likely scenarios using flows as a barometer:

EITHER… Put a Fork in It

The stock rally is over and the Friday news that was digested bearishly by bonds will hit the Stock market like a ton of bricks next week.

Evidence corroborating this:

Hedge funds were sellers all the way up in the rally taking profits as CTA types bought (same as in Gold)

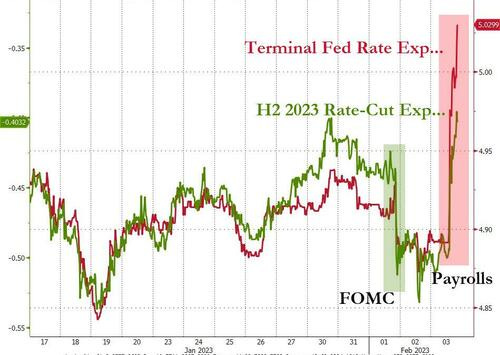

STIRS which assess the Fed’s intent have moved up higher indicating no pivot yet, and a possible delay to the pause everyone thinks is coming

OR… Let it bake a little more

The stock rally is not over and the bond move was just a bond-specific overbought correction scenario. The Stirs are higher again, but not enough to warrant another 25 bp hike after May just yet.. Plus the S&P just had a Golden cross (in premium) which will attract buying.

Next Week For Stocks:

We have a bias that the Fed is not kind to bulls—and will look at how the market reacts to the next inflation data. Remember that is what the Fed wants to see more of to determine policy tweaks now. We will also watch those 0date options volumes for in-the-know players acting.

Comment: Fed bashing aside.. they are looking good right now in their own minds. And as long as the market keeps getting a little ahead of itself, they can let the data speak for itself. So we kind of think sideways or lower. If sideways.. then not bullish until it breaches a specific level and stops go off above Wednesday’s highs. If lower.. then see how it reacts to inflationary data.

Why lean bearish? Because bonds lead stocks and the short squeeze in most shorted stocks (ZH watches this closely) is petering out.

Finally, we think the market is a degenerate yet to get the big picture: Every fiscal ease the US digests (subsidies, strikes, war, debt ceiling hikes) the Fed feels must be balanced ( rightly or wrongly) somewhat by monetary restraint.

Powell wants to be absolutely sure inflation is dead or he truly risks the post 1976 inflation ignition we keep going on about. Look at what happened to Gold (chart below) when inflation wasn’t entirely extinguished in 1976 (graph above) after the 1975 stock market rally. So either he gets more inflation data that shows it’s dead next week.. or he keeps hiking. That all said: If he does get the low inflation data.. look out above.

Here is the full post-mortem for Wednesday to Friday with all the gory details about Metals as well.

Gold:

Last week was not manipulation.. ok maybe a little stop-running manipulation. Here’s what happened. All the buying dried up when Gold rallied but not much on Wednesday’s FOMC news. The CTAs came back, but weakly on the longside.

The banks saw the buying volumes dropping off. When it stopped, they hit it. Short term CTAs then started liquidating. Then buyers of Silver who had added during the sideways weeks began selling. The banks “let it breathe” on the way down.

Buy season is over. It was a great January.. really good!. But between that ending and the Chinese New Year (hangover as we used to call it).. the buying stopped. Assume Gold was overvalued at $1970. Assume it will get undervalued at $1800 as the same CTA guys push it too far and be happy if it stays above $1875.

Here’s the potential Silver lining: After meaningful Januaries in both stocks and commodities.. historically if an asset is anywhere near the highs come October, the investors will come back in force and the year will end as it starts. The old saying was “ as goes January, so goes the year”.

A horrible February will be surprising, but not shocking. We will talk more on this stuff Monday on our Arcadia Economics podcast.

Sector/Technicals

Tech had a huge up week- Meta was Mega

Energy and Commodity stocks in general were hammered

Pharma lagged horribly

Commodities:

The dollar roared higher off Wednesday’s post-Powell lows

Crude was clubbed — WTI tumbling to a $73 handle

Gold also collapsed this week (post-Powell), tumbling $100 from high to low

Bonds:

Yields were net higher but saw violent moves day to day on the week

The short end getting whipped down by the FOMC on Wednesday and then up on the NFP Friday

2Y Yield exploded 20bps higher today

Crypto:

Last week we asked if crypto was tracking metals or stocks..

This past week they decided to stay with stocks..therefore this crypto rally is all about Fed pausing.. and that rally was muted last week.

2. Research Excerpts:

Hartnett- apocalypse postponed:

Several strategists share Hartnett’s view. Morgan Stanley’s Michael Wilson said investors flocking to the equity rally will be disappointed as they’re in direct defiance of the Federal Reserve. JPMorgan Chase & Co.’s Marko Kolanovic said the economy is headed for a downturn at a time stocks are rallying, setting up for a “clash.

Golden Cross for Stocks

Goldman on the Payrolls Jump

JPM: Nice piece on Jobs and policy by one of their good guys

The January jobs report was shockingly strong, as the 517,000 nonfarm job growth figure was almost double the December outturn and nearly three times greater than expectations. Just as surprising, average weekly hours surged 0.3 hour to 34.7 hours. The combination of the two—total hours worked—increased a whopping 1.2%, one of the strongest prints outside the immediate post-pandemic period.

Nomura: Fed rate cuts delayed

TD: CTA flows

CONTINUES AT BOTTOM…

3. Week’s Analysis/Podcasts:

IMF Paper- Gold as International Reserves: A Barbarous Relic No More?

Smart Money: "The Metals and Mining Share Revaluation is in its Infancy."

Seth Klarman: 20 Forgotten (and 10 False) Lessons from the 2008 Crisis

FED DAY: Market Thinks "One and Done" After Today. What will the Fed Think

YCC needs to "keep the wheels on the cart" or the dollar is dead.

“Golden ruble 3.0” – How Russia can change the infrastructure of foreign trade