CTA Maven: "Don't fade the rally in gold"

Silver started the week like a Precious metal, strong.. and finished like a risk on metal.. strong

Housekeeping: Welcome New Subscribers. We have a great many new premium subscribers and are grateful. This report is different than the weekday posts. Weeklies are designed to be a recap with new research insights in the old Barrons style. Enjoy and thank you.

SECTIONS

Market Summary— Bonds say rate hikes done, YCC/QE coming

Research— Gold, ETH, Middle-Class, Banks

Week’s Analysis/Podcasts— Bank Bloodbath, Hartnett

Charts— Metals, Energy, FX, Bonds, Crypto

Calendar— CPI, PPI

Technicals— GC, CL, BTC, S&P

Zen Moment— A Dog’s Life Rescued

Full Analysis— GS, GSTrader, TD, JEF, UNI,

1. Market Summary

Powell and Yellen will work to save US sovereign debt credit-rating by suppressing long-term yields, using yield curve control…real rates will go even more negative over the next five years …You had better own something to hedge this risk. because it’s a reality. (More at bottom1 )

The market's expectations for The Fed tumbled dovishly this week as Powell hinted it's over.

Markets are now pricing in rates being 75bps lower than current levels by year-end.

Despite Friday’s bounce, only Nasdaq made it back into the green for the week (but the last few minutes saw selling push it back red) while The Dow fared worst. rotation out of cyclicals and into duration may have started again

Credit risk was higher on the week

Sectors/Technicals

Energy was destroyed, rotation to duration while oil dropped?

Note: Gold doing well while basic materials/ industrials do not.. stagflation fears?

Regionals bounced off lows, but asset mgrs get killed

Big tech is the way again

Commodities:

Oil took it on the chin, someone capitulated, and we may have seen a bottom

Gold spiked, and nded just shy of a record weekly closing record high.

Silver started the week like a Precious metal, strong.. and finished like a risk on metal.. strong

Grains may also have seen capitulation

Dollar down notably again (7th of last 9 weeks)

Bonds:

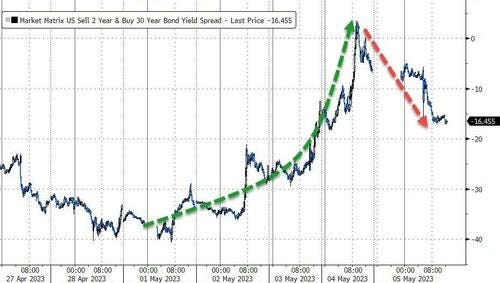

Let the Un-Inversion begin.. (end of rate backwardation)

If Powell is done raising (probably), while Yellen (and foreign holders) fret about the Debt ceiling headlines crushing US Credit ratings, then her new YCC/QE deal coinciding with Powell stopping rate hikes make a shit-ton of sense.

Crypto:

ETH stronger than Bitcoin again on the week (GS important analysis on ETH at bottom)

Solana stronger than both. Ripple hated again

2. Research Excerpts:

***Good report week***

Anti-Goldilocks Effect on Gold.

After The China Gold Spike, TD’s Commodity Strategist adn Macro maven, the very good Daniel Ghali put out a note wehappen to agree with.

Don't fade the rally in gold. The melt-up in prices overnight associated with ongoing stress in the banking sector revealed that traders are willing to deploy their hoard of dry-powder. After all, our gauge of discretionary trader positioning still suggests this cohort has yet to participate in the rally in gold.

Our take is a little different but largely supportive.

Remember, when a trader says do not fade the rally, he is not saying to get long, he is saying selling strength, unless you are booking profits, is not a very smart thing to do at all. He is saying the pieces are there for a much bigger move now. Betting on reversals is not a good play.

Here’s why in our opinion. First, his report is saying that this rally is underinvested, which is true. So far this rally has been all about Fear-based buying, not normal macro buying.

CONTINUES AT BOTTOM…

Also:

GS: Gold Does Well Despite Risk On Behavior:

Goldman Trader on Ethereum’s deflationary behavior***

BOA: How are Middle Income Consumers doing really?***

JEF: Regional Bank Update

TD: Gold CoT, CTA

FULL ANALYSIS AT BOTTOM…

3. Week’s Analysis/Podcasts:

JP Morgan Gold Traders Contempt for the Law, Plan to Appeal their Convictions

Dave Kranzler: 'Stocks May Now Be Whistling by Two Graveyards'

UNLOCKED: Moor Technical Podcast for Gold With Updated Macro

So Many Open Signs of Financial Disaster Ahead and Gold Working

**BREAKING: Bank Bloodbath Continues, Gold Soars above $2,000 Again