Housekeeping: Good Morning.

Remember the Toilet paper panic during Covid?

Now imagine that for Gold…

Today:

Commentary: Markets

Premium: Cot swap desks

Equity Recap:

US equities rallied on Friday after Fed Chair Powell signaled rate cuts are coming. Large caps lagged small caps: S&P 500 (+1.15%) vs. Russell 2000 (+3.19%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) rose 1.67% and 1.83% respectively.

Premium Markets:

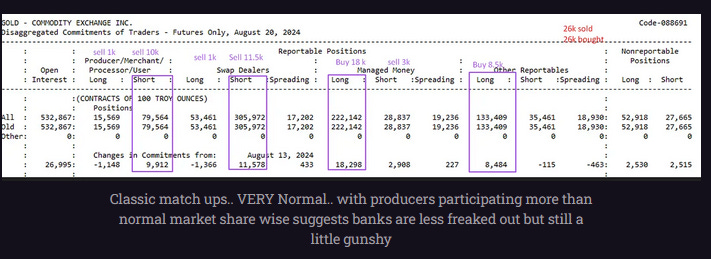

Bank Swap Dealers and Their Role in the Market

Bank swap dealers play a crucial yet often misunderstood role in financial markets, especially within the precious metals sector. These entities act as intermediaries or "middlemen," providing liquidity for market participants who wish to express a market opinion through futures contracts. Essentially, they make it possible for buyers and sellers to find each other in markets that aren't continuously liquid.

COT Banks versus Funds…

In a recent discussion, a precious metals expert noted that the net gold position of swap dealers on the COMEX nearly perfectly inverses managed money positions. This means that bullion banks facilitate hedge funds to speculate, underscoring their role in the broader financial ecosystem.

Continues at bottom

Market News:

"Fed Chair Jerome Powell laid the groundwork Friday for interest rate cuts ahead, though he declined to provide exact indications on timing or extent. CNBC

"Hours after 100 Israeli warplanes swooped over southern Lebanon, taking out thousands of Hezbollah missile launchers in what was called a pre-emptive strike,: Bloomberg

"SpaceX is set to orchestrate the first-ever spacewalk involving private citizens, an operation that will count as one of the company’s riskiest.- Business owns space to the moon, nasa owns beyond the moon

"Most of the world’s biggest private equity firms, including Blackstone, KKR and Carlyle, have put the brakes on deals in China this year as geopolitical tensions rise and Beijing exerts tighter control over business.: FT- financial pressure applied

"The plug-in hybrid, long a fringe technology in the car business, is gaining some traction. WSJ- return to senses as economics prevails over ideology

"Apple is still in the early stages of figuring out the best way to use robotics. Bloomberg- no they are not.

"Meta Platforms has canceled plans for a premium mixed-reality headset intended to compete with Apple's Vision Pro." Source: The Information- more money for buybacks

"The European Central Bank’s chief economist has cautioned that the bank’s goal of getting inflation back to 2 per cent is “not yet secure” Source: FT- this is odd.. but maybe a preemptive hedge against winter energy costs

Politics/Geopolitics:

Escalation in Lebanon is significant and Ukraine remains active in its defense both militarily and politically as the US election closes in.

Some headlines via NewSquawk or DataTrek

Data on Deck: PCE, Housing, and Gaggle of Fed Speakers

MONDAY, Aug. 26 Durable-goods orders Daly interview

TUESDAY, Aug. 27S&P Case-Shiller home price index

WEDNESDAY, Aug. 28 6:00 pm Atlanta Fed President Raphael Bostic speech

THURSDAY, Aug. 29 Trade, inventories, home sales 3:30 pm Atlanta Fed President Raphael Bostic speech

FRIDAY, Aug. 30 PCE1

Final Market Check…

Premium:

Market Rundown and Swap Dealer text

Bonus:

***DO NOT SHARE THIS***