Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: "There are increasing risks of a [silver] short-squeeze"

Premium: DailyNews

Discussion:

Fed Day. Qt or not Qt? That is the question

As the Federal Reserve's two-day interest-rate-setting meeting concludes, the central bank is widely expected to keep interest rates unchanged. However, analysts believe that the Fed may slow or pause bond holdings under quantitative tightening.

"There are increasing risks of a [silver] short-squeeze"

Report Topics include: LBMA shortage, supply deficit, above ground compensatory limitations, demand inelasticity, tariff implications and more, all illustrated. And their iconic “Scorecard” graphic. Full analysis out later today

Silver’s price is up 17% this year, aided by gold’s unrelenting rally.

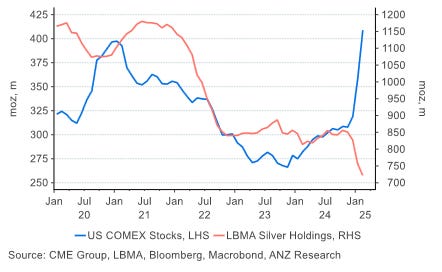

The ratio of LBMA silver stocks to silver-back ETF holdings has fallen to a historical low of 1. Furthermore, there are increasing risks of a short-squeeze, as swap-dealer positions are net short at the highest since 2020.

A tight physical market is expected to persist for the fifth consecutive year, although the deficit is expected to narrow in 2025.

Industrial demand is likely to be resilient despite tariff-related headwinds. Improving manufacturing activity in China is another supportive factor for silver demand.

Nevertheless, US investment demand will be crucial now…. without it, time will likely bail out the short squeeze candidates.

Full Analysis noon today…

News/Analysis:

Markets Recap:

Stocks ended sharply down as investors remained cautious ahead of the Federal Reserve’s monetary policy decision. Treasury yields fell on strong demand for 20-year bond auction. The dollar weakened further, while gold hit a new record high. Oil prices eased as Ukraine peace talks offset Mideast instability worries.

Market News: Stable Coins are Coming for Gold

Fintechs and crypto companies seek bank charters for growth

Financial technology firms and crypto companies are seeking to become state or national banks in a bid to expand their business under the Trump administration that they view as more industry-friendly, according to more than half a dozen industry executives. Discussions and preparations for bank charters have increased significantly, according to two sources who are working on potential applications.

Nvidia CEO Huang says chipmaker well positioned for shift in AI.

Alphabet to buy Wiz for $32 billion in its biggest deal to boost cloud security

Nasdaq to open new Texas headquarters as companies relocate to state

Automakers, tech industry urge Trump to speed self-driving car deployment Major automakers and tech groups

Costco is pressuring suppliers in mainland China to cut prices, FT reports

Stories continue below…

Geopolitics/ Politics:

Israeli army attacked Khan Yunis and conducted heavy shelling in the southern Gaza Strip, according to Al Jazeera.

Hamas leader said continuation of the Israeli bombardment of Gaza will lead to the death of many Israeli prisoners and the movement is communicating with mediators to force Israel to respect its commitments to the ceasefire.

US bombed targets in areas east of Hodeidah in Yemen and there were at least 10 US strikes that targeted areas in Yemen, according to Houthi media.

Russia's Medvedev said the Putin-Trump call showed there is only Russia and the US in the 'dining room' eating a 'Kyiv-style cutlet' as a main course.

Finland President Stubb says if Russia refuses to agree, will need to increase its efforts to strengthen Ukraine and ratchet up pressure on Russia to convince it to come to the negotiating table.

H/t Newsquawk for Geopol

Data on Deck: Fed Decision

MONDAY, MARCH 17 U.S. retail sales

TUESDAY, MARCH 18 Housing starts

WEDNESDAY, MARCH 19 FOMC interest-rate decision

THURSDAY, MARCH 20 Existing home sales

FRIDAY, MARCH 21 None scheduled1

Summary and Final Market Check