Housekeeping: Good Morning.

Goldman on Gold/ Copper Gold Silver/ Bitcoin History Lesson

Contents

Yesterday’s Activity

Today’s Prices

Today’s Data

Markets/Metals Commentary

What We’re Reading- TBD

Markets:

Commodities, Stocks, Precious Metals, Bonds, BTC, FX

Yesterday’s Activity:

US equities gained on Monday, led higher by tech shares after they sold off last week.

Technology (+2.75%) and consumer discretionary (+1.77%) outperformed the broader market indices, while energy (-1.16%) and materials (+0.41%) lagged. Salesforce (+3.88%) and Intel (+3.33%) led the Dowhigher; Boeing (-8.03%) and Chevron (-0.60%) were the index's worst performers.

The Nasdaq gained 2.20%, the G7 rallied

The VIX dropped 2.02% to 13.08. Bonds rallied

Bitcoin

Current Prices:

Today’s Data:

TUESDAY, Jan. 9

8:30 am Trade deficit Nov. -- -$64.3B

Thursday matters- CPI, Jobless claims

Total Calendar1

Bitcoin History Lesson

Markets/Metals Commentary: Silver, Gold, Copper

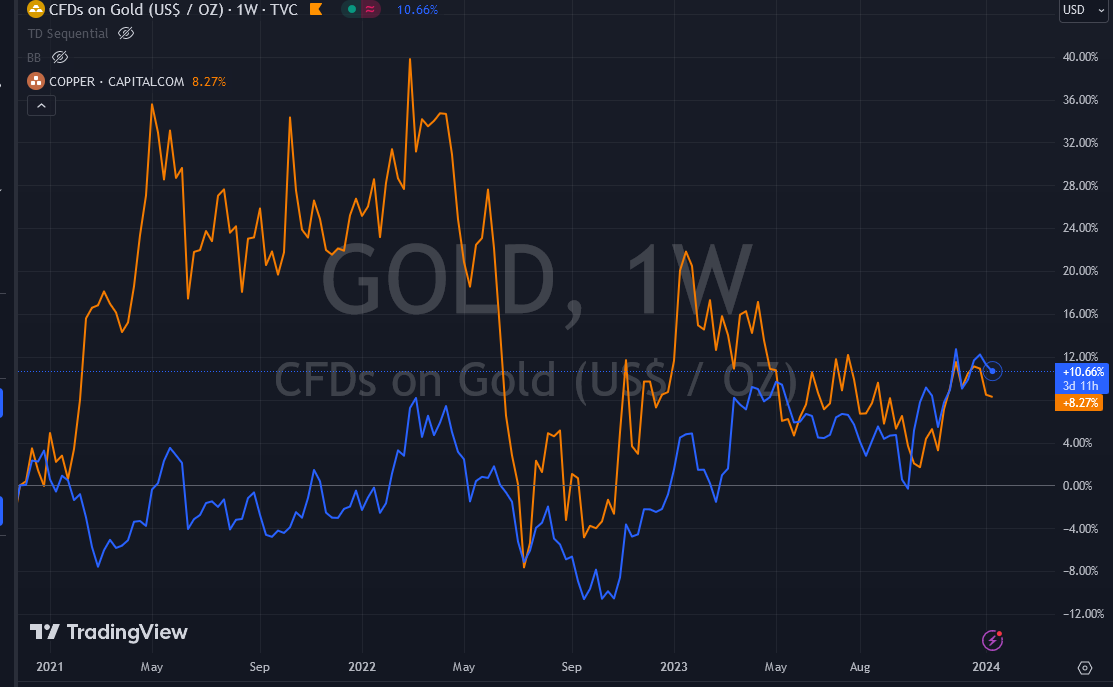

CITI: Monday Mining Minutes - Copper-to-gold ratio continues to highlight near-term risk; recent spike is likely to fade MUSINGS – The copper-to-gold ratio indicator has remained c4x in recent months, highlighting near-term risks in the sector.

There has been marginal increase recently from 4x in Oct to 4.15x in Dec as copper price rose (driven by Fed shift, supply disruptions) while gold remaining broadly flat. Copper prices are likely to be under pressure in 2Q/3Q 2024 as developed market growth headwinds take hold while gold benefits from rate cuts.

Sunday: What (Goldman's) Gold CTA Report Says

Goldman CTA analysis attached: