Housekeeping: Good Morning.

“The LBMA is a National Security Risk to US and UK Sovereignty ”

Today

Topic: The China Hunt Brother is Back

Topic 2: Goldman Identifies More China Buying

Topic 3: The LBMA is a National Security Risk

Analysis:

1- The China Hunt Brother is Back

In July 2024 GoldFix identified the China Whale that took on JPMorgan in Gold and won. We identified him as Bian Ximing, a Chinese industrialist and trusted member of the CCP who had turned fund manager. To this day, noone in the west has covered this except for GoldFix.

Bloomberg1 reports that Bian Ximing, the Chinese billionaire who profited $1.5 billion from gold futures trades based on a de-dollarization and inflation hedge thesis, has now become the largest known copper bull in China.

According to individuals with access to Shanghai Futures Exchange (SHFE) data, Ximing has accumulated the largest net long copper futures position on the exchange. The position is estimated at roughly 90,000 metric tons, acquired over the past ten months.

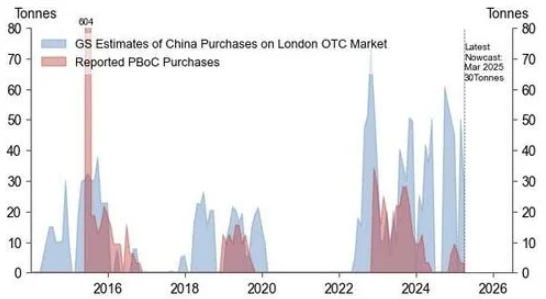

2- Goldman Identifies More China Buying

Despite a recalibration in market expectations—most notably a delay in anticipated Fed rate cuts and a lowered probability of U.S. recession (now 35% over the next 12 months, down from 45%)—Goldman maintains its gold price targets of $3,700/toz by year-end and $4,000/toz by mid-2026.

GS Reiterates Buy Rec (Again) on Continued China Stealth Buying

China Was Again the Largest Identifiable Buyer In March At 30 Tonnes

We maintain our gold price forecast of $3,700/toz by year-end and $4,000/toz by mid-2026, despite delayed Fed cuts and lower US recession risk (35% recession odds in the next 12 month vs. 45% prior) for two reasons…

Continues in GS Reiterates Buy Rec

3- The LBMA is a National Security Risk

Data on Deck:

TUESDAY, MAY 20 Many Speakers2

Related Posts:

Summary and Final Market Check…