Housekeeping: Good Morning.

Gold Revaluation is happening (quite literally) before our eyes

Today:

Commentary: Gold’s New ATH Close

Premium: BOA Likes Silver

Equity Recap:

US equities closed slightly higher on Monday ahead of July's producer price index report tomorrow, consumer price index report on Wednesday, and retail sales data on Thursday.

Premium Markets:

Gold’s New ATH Close

Players who desire to cap a market like to make their actions count. Those actions are best taken in thinly traded markets.. aka spoofing. But when an opportunity to act in that way does not present itself ( like in the growth of a 24 hour actively traded market and they get a little concerned.. they then move to acting right after big events, where they can exaggerate and paint data that looks bad for a market.. or mute data that looks good. All this in the hopes of shaking out participants already invested.

BOA Likes Silver

2025 Price: $35 to 38/oz

Reasons

The silver market has rebalanced on production discipline and demand from new applications including solar panels.

As more spending on solar panels come through, silver should rally.

Bottoming out of the global economy in 2024 should also help industrial demand

Upside/Downside Surprise Risk

U: Investors returning to the market

U: China’s imports to rise

D: More supply

Report Excerpts

China Wants More Silver than they have

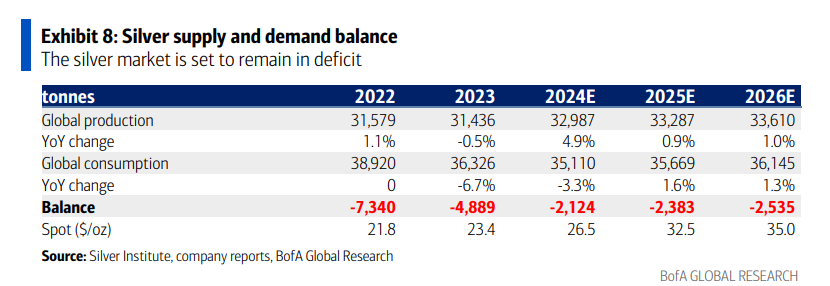

Silver Market Deficit: BOA expects the silver market to remain in deficit, with declining inventories making these deficits more impactful.

The Stock is Down, The Flow must compensate: This had been heavily influenced by healthy inventories. But those inventories are now too low to drain further without replenishing. The Silver must now come from elsewhere

This increasingly helps make the deficits more obvious, especially as industrial demand is bouncing back too.

China's Silver Trade Dynamics: China has shifted to a net importer of silver, driven by both increased imports and reduced exports, signaling a rebalancing domestic market.

Less By-Product Silver-China’s domestic silver market has tended to be oversupplied partly because its producers churned out silver as a by-product at its base metals smelters…. but no more due to scouring reported

Silver Demand ex-China rising as well

Increased Silver Demand in Solar PV

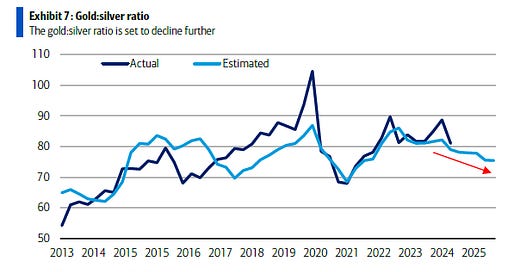

Gold-to-Silver Ratio Drop Expected

Accompanying all this, silver prices on China’s domestic market have been trading at a premium to quotations ex-China.

Full analysis at bottom including BOA’s full commodity price grid…

Market News:

"Ride-hailing and taxi drivers are among the first workers globally to face the threat of job loss from artificial intelligence as thousands of robotaxis hit Chinese streets Fast Company

"Waymo plans to start testing its fully autonomous vehicles with no human safety driver on freeways in the San Francisco Bay Area this week TechCrunch

"Consumers grew more confident in July that inflation will be less of a problem in the coming years, according to a New York Federal Reserve report Monday that showed the three-year outlook at a new low. Source: CNBC

"McDonald’s for decades has exerted outsize influence on Americans’ meals. Now the Golden Arches are playing a growing role in politics, as the company and its franchisees spend millions of dollars on donations to candidates for public office and political action groups, and have engaged in lobbying in at least 10 states.... WSJ

Politics/Geopolitics: Mercantilism manifest

"China’s bond market, the world’s second largest, is on edge following a turbulent week in which the central bank started intervening heavily to stem a plunge in yields even as the economy is struggling. But die-hard investors say the bull market in government bonds still has legs, citing China’s wobbly economy, deflationary pressures and low investor appetite for riskier assets." Source: CNBC

"Within the moneyed circles of the Middle East, there’s increasing talk of a shifting power dynamic in the upper echelons of high finance. The Middle East’s biggest state-controlled funds are increasingly asking asset managers what they’ll do in return for an investment." Source: Bloomberg

Some headlines via NewSquawk or DataTrek

Data on Deck: CPI, PPI, Housing Starts

MONDAY, AUG. 12 2:00 pm Monthly U.S. federal budget

TUESDAY, AUG. 13 Producer price index July

WEDNESDAY, AUG. 14 CPI year over year 3.0% 3.0% 8:30 am

THURSDAY, AUG. 15 8:30 am Empire State manufacturing survey Aug

FRIDAY, AUG. 16 Housing starts July 1.35 million 1.35 million 1

Final Market Check…

Premium:

***DO NOT SHARE THIS***