Housekeeping: Good Morning.

China isn’t Cornering Gold and Silver, The West is too over leveraged and is cornering itself.

Today:

Premium: Goldman on Tesla

Commentary: China and the missing gold

Session Recap:

US equities advanced on Tuesday amid a rebound in Nvidia (+6.76%).

Premium / Markets:

China’s Gold Reserve Numbers Don’t Add Up

China’s overall gold demand is consistently strong. China imported over 1,400 tonnes of gold in 2023, making it the largest gold importer in the world.

China is also the world’s largest gold producer, producing 375 tonnes last year.

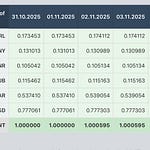

While The PBOC has added Gold reserves, China’s Commercial Banks have cut their holdings in the past two years from 2,064 tonnes to 785 tonnes, with Bank of China cutting the most by 533 tonnes

China’s total gold production and net imports were about 1,775 tonnes last year, resulting in a gap of over 1,300 tonnes. This gap represents the amount of gold that has “gone missing” from the figures.

A new report estimates that 2,700 metric tons of gold are ‘missing,’ even as China’s central bank boosts its reserves of the monetary metal. Could it be that 2,700 metric tons of gold — more than half of the world’s annual global production — is being hidden in Communist China?

The question arises in a new report from a Singapore-based newspaper and adds to mounting speculation that China has amassed a larger-than-reported stockpile of the metal that is the basis of monetary value.

The four-figure gap was discovered by economist Chen Long after he compared the total gold holdings in China — incorporating reported holdings of retail buyers, regional banks, and the People’s Bank of China — with the country’s import and production numbers.

China, we believe, is not trying to corner the gold market with these actions, although that will be the net result as moreleveraged players scramble for physical to secure paper posoitons they cannot finance.

China is protecting itself from collateral shortage in case of financial crisis. China learned a very very important lesson back when Oil went negative in 2020, and has no intentions of ever letting it happen again.

We will connect the Dots for premium subscribers on this Friday— as it goes back to 2020 when Oil went Negative— in what we are pretty sure will be a news story down the road

To that end we will leave you with this to think about:

China has misplaced a significant amount of its PBOC gold

Production plus imports nets out to 1300 tonnes purchased or added but not accounted for- Where is it? Was it clandestinely sold? Or was it put in a secret stash?

Its commercial banks are reducing their holdings, presumably giving the Gold up to the PBOC

China’s commercial banks are reducing their Gold supply while the official party reserves are increasing from purchases.

The availability of Gold for financially based asset investment has decreased, driving demand into physical

Continues in Premium Friday

Yesterday: Gold’s Price Action…

Market News:

"There is a new space race, this time between the U.S. and China. On Tuesday, China took an important step forward. A Chinese spacecraft touched down on grasslands in China’s Inner Mongolia region, carrying the first-ever rock samples from the far side of the moon. A scientific breakthrough in itself, the success also advanced China’s plan to put astronauts on the moon by 2030 and build a lunar base by 2035. Such momentum is worrying American space officials and lawmakers, who have their own ambitions to build moon bases." Source: WSJ

"Waymo is opening up its robotaxi service to anyone who wants to ride in San Francisco. Source: The Verge

"KKR has completed its largest-ever purchase of apartment buildings, the latest in a string of big-ticket deals, Source: WSJ

"Brussels has accused Microsoft of anti-competitive behaviour by bundling its Teams app with its Office suite, Source: FT

"Federal Reserve Governor Michelle Bowman said Tuesday the time is not right yet to start lowering interest rates Source: CNBC

"Volkswagen Group is investing $1 billion in electric-pickup maker Rivian Automotive, Source: WSJ

Geopolitics:

Russian Defence Minister Belousov warned US Defense Secretary Austin regarding the dangers of an escalation of continued US arms supplies to Ukraine, according to the Russian Ministry.

North Korea launched a suspected ballistic missile which was believed to have fallen outside of Japan's EEZ shortly after with no damage reported.

South Korean marines are to conduct live fire drills, according to Dong-A.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, JUNE 24speechesTUESDAY, JUNE 25speeches, S&P Case-Shiller home price index (20 cities)WEDNESDAY, JUNE 26 10:00 am New home sales May

THURSDAY, JUNE 27 Pending home sales May 1.0% -7.7%

FRIDAY, JUNE 28 8:30 am PCE (year-over-year) 2.6% 2.7% 8:30 am 1

Premium:

***DO NOT SHARE THIS***