Housekeeping: Good Morning. Recapping last night

Bretton Woods Three is a Process, Not an Event

Today:

Yesterday and Last Night

Premium: HSBC Raises its price target

Yesterday’s Activity:

US equities retreated on Wednesday as investors weighed a hotter than expected inflation report and the timing of rate cuts by the Fed.

Market Commentary

Excerpted from ZeroHedge

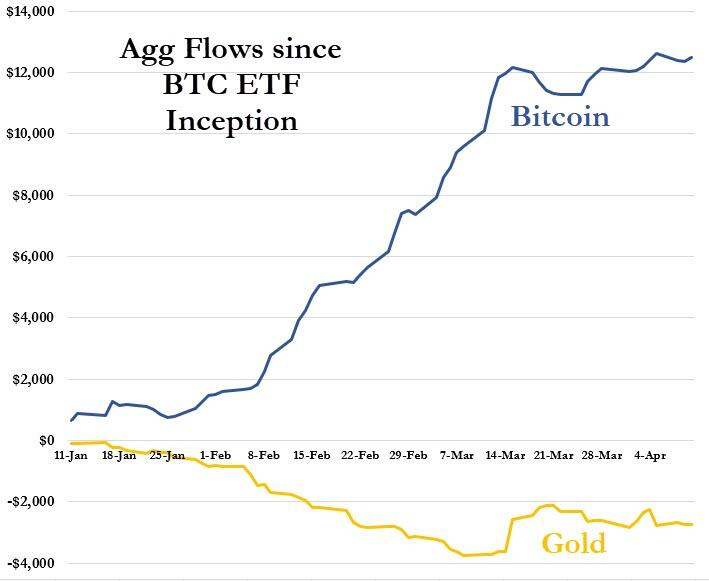

While bitcoin was rampaging higher, goldbugs stared in disgust, wondering why their non-fiat god had forsaken them... after all, when the collapse of the dollar, and fiat in general, finally arrives gold will be one of the very few currency alternatives still standing. Alas, ETF flows have not provided any respite, because while bitcoin ETFs soaked up most money in the past 3 months, aggregate gold flows continued to shrink.

And yet, starting in the beginning of March, gold finally broke out from the black hole gravitational attraction of the Bank of International Settlements trading desk, and has soared some $300 dollars in just 6 weeks, its fastest ascent in decades.

Fast forward to tonight when, with most other assets quiet, gold suddenly surged higher, and after closing at an all time high, the precious metals spiked by another $15 in a matter of seconds, a move which for the otherwise hyperlethargic assets, is the equivalent of turbo boost.

And while it's now just a matter of hours if not minutes, before spot rises above $2,400, gold futures are already there: the active, June contract just hit a new all time high of $2,406.9 moments ago around the time Chinese buy orders started rolling in...

... and contrary to speculation that this is just a fat finger, or a another one-off buy orders, gold future volumes are solid, especially given volumes would have already been very high in the last few days. GCM4 volumes are now 23.5k lots vs. 5-day average of 17.85k lots.

While it wasn't clear what sparked the buying frenzy, UBS' trading desk notes that "gold futures gapped up $10 as they traded through Thursday's high on what felt like stop losses being triggered; 0.5moz of futures volume were behind the move."

What happens next is also unclear although, the current divergence between gold prices and 10Y real rates, suggests that something awful is about to happen...

HSBC report below Much more in premium

Price Action

Gold-

Silver-

Miners-

Oil- doesn’t care about your opinion

BTC/ETH-

Stocks-

Bonds- YCC is coming

Dollar- steady as she goes.

Market News:

See what happens when Janet Yellen goes to China?

GEOPOLITICS

Pax Americana is over, and US is financing local nations to build their own defenses

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY1 pm Chicago Fed President Austan Goolsbee radio interview None scheduledTUESDAY, APRIL 96:00 am NFIB optimism index March 89.7 89.4WEDNESDAY, APRIL 108:30 am Consumer price index March 0.3% pm Minutes of Fed's March FOMC meetingTHURSDAY, APRIL 118:30 am Initial jobless claims April 6 215,000 221,000 8:30 am Producer price index MarchFRIDAY, APRIL 12 10:00 am Consumer sentiment (prelim) April 78.6% 79.4% 2:30 pm1

Premium:

HSBC Price target raised

Full analysis attached below