Housekeeping: Good Morning.

“The reset is a process, not an event.”

Today

Discussion 1: Gold Backtests Argue for Pullback

Discussion 2: Fund Selling to Physical Buyers now

Analysis: Gold Backtests Argue for Pullback

Several times we've made the point here that historically gold rarely goes up more than 2% in a day. When it does so, statistically it was almost always 2 to 6% lower over the next two weeks. Admittedly and happily, it hasn't done that in a long long time.

Gold Backtests Argue for Pullback

Housekeeping: This was alluded to in **JPM's $4,000 Walkthrough and Analysis and in the Founders post of a similar name.

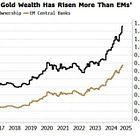

As such, all of gold’s short term correlation risk factors have been blown out of the water these past 2 years. But here is what one of Wall Street's best quants sees looking at some intermediate timeframe correlations that have yet to be tested.

Simply put: When gold gets too far away from its 200 day moving average, a retracement is frequently seen.

Note: Since this analysis was presented, physical buying is likely in the market again between $3250 and $3175 underpinning things above $3275 thus far as banks buy in front of it. While the chart looks bad on a monthly basis, the initial “shooting star” type impulse has been negated. We’ve seen this before, and while its not bullish. its not as bearish as it used to be…

Gold is not out of the woods for a big retracement… But it is at least halfway through the woods.

Much more in Premium…

Featured:

Markets Recap:

Market News:

US President Trump said he is going to make a fair deal with China on trade; predicts that China will eat the tariffs.

Stocks trade tentatively ahead of a slew of key risk events, including US GDP/PCE and earnings from Microsoft & Meta.

Looking ahead, US ADP, GDP, PCE (Q1 & for March), ECI, BoC Minutes, Comments from BoE’s Lombardelli, US Quarterly Refunding.

Earnings from, Microsoft, Meta, Robinhood, Qualcomm, Albemarle, eBay, Humana, Caterpillar, International Paper, GE Healthcare, Hess.

Data on Deck: PCE/GDP/ NFP

MONDAY, APRIL 28 None scheduled

TUESDAY, APRIL 29 U.S. trade balance

WEDNESDAY, APRIL 30 GDP/ PCE

THURSDAY, MAY 1 U.S. manufacturing PMI

FRIDAY, MAY 2 U.S. nonfarm payrolls1

Summary and Final Market Check