Housekeeping: We just received a Gold report from a very elusive large bank and will write this up for you all for tomorrow morning. It is very constructive

Sections

0:00- Overview of Global Reserve Currencies

7:00- Power shift from US to China

14:00- Gold announces the new Champion

**Bonus: Find attached BOAs CTA analysis for Gold and DeutscheBank’s charts on the same topic**

Background:

Right before the BRICs summer summit last year many wanted to know more on the dedollarization talked about so feverishly1.

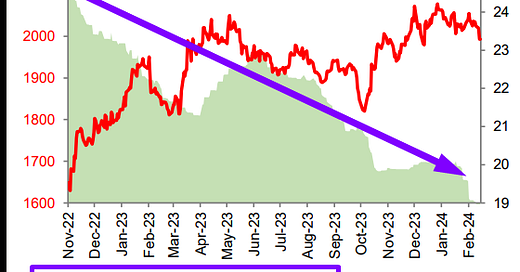

We recorded the attached podcast as a response to that interest2. In it, we put forth an answer-key describing how de-dollarization (if it was truly occurring) would reveal itself simply by watching regional gold prices; specifically the COMEX versus China’s SFE/SGE complex

That was proven correct. Specifically: Volumes grew in China, Gold and Silver now vacate the Comex regularly, and price differentials between China and US metals remain divided with China’s SFE/SGE exchanges consistently fetching higher prices than their Western cousins.

Most importantly, we revealed gold most definitely has been traveling from NY Comex to China SGE vaults in Exclusive: China Took Delivery of US Based Gold Last Month

“[T]he Chinese have now taken delivery of a bunch of physical New York gold in response to that arb.”

This happened soon after the SGE/ Comex price differential reached ATHs and right after our Silver coverage of the same behavior in Exclusive: China's Monster Silver Buyer Revealed was released.

Zip Codes Matter

As it turns out zip codes matter, and The US gold was in truth moving to the better one.

The conclusion then as now was the following:

Dedollarization in trade settlement manifests first in commodity trade.

As that grows and persists, it spills over into visible exchange pricing revealing regional price differences (beyond delivery/insurance costs) for the same exact fungible commodity3.

Unless regional prices equalize (higher if more China demand, lower if more US supply), US supply will move towards higher Eastern priced demand.

Those price have not equalized, and western supply has begun relocating in earnest, at least some of it most definitely to China

Here is that post again. It will be must listen as the next BRICS summit approaches.

Bonus: BOA Gold CTA Analysis.