Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today

Discussion: Goldman:-Will central banks continue to accumulate gold?

Premium: Apollo asks about Inflation

Discussion: Gold and Inflation

Will central banks continue to accumulate gold?

In this Precious Comment, we share our latest October GS nowcast of central bank and other institutional gold demand on the London OTC market—where most central bank purchases occur, including both reported and unreported activity—and address why we believe this trend is set to continue.

From: Goldman: Central Banks (China) Double Down on OTC Gold Buying

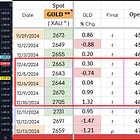

Q1: How much gold have central banks purchased in October on the London OTC market?

Q2: Why are central banks now buying so much gold?

Q3: Will central banks continue to accumulate gold?

Q4: What are the implications of the strong GS central bank nowcast for your $3,000/toz end-2025 gold forecast?

Q3: Will central banks continue to accumulate gold?

Yes. Even if Russia’s central bank assets were to be unfrozen, the 2022 freeze precedent has reshaped how central banks view tail risks. Moreover, China and other EM central banks tend to hold relatively small shares of their reserves in reported gold compared to their developed market counterparts, leaving significant room for growth.4

While developed markets like the US, France, Germany, and Italy hold about 70% of their reserves in gold, China — the world’s second-largest economy — reports just 5%.

Goldmans Full Q & A Analysis here

News/Analysis:

Equity Recap:

US equities ended mostly flat on Friday ahead of the Fed's rate decision on Wednesday. Large caps bested small caps: S&P 500 (0.00%) vs. Russell 2000 (-0.60%). MSCI Emerging Markets (EEM) added 0.09% and MSCI EAFE (EFA) lost 0.28%.

Market News:

"Apple is preparing a series of major design and format changes to its lineup of iPhones and potentially other products, a bid to revive growth after years of offering largely incremental upgrades. WSJ

"MicroStrategy, which has become a play on [BTC], will be joining the Nasdaq 100 index, effective Dec. 23. CNBC

"The London Stock Exchange is on course for its worst year for departures since the financial crisis, as fears mount that more FTSE 100 businesses will quit the UK in favour of New York. FT

"If you’re just getting up to speed on chatbots and copilots, you’re already falling behind. Bloomberg

"Amazon CEO Andy Jassy’s decision to bring workers back to the office full time was one of the biggest post-pandemic work headlines of 2024. CNBC

"OpenAI’s Sam Altman is reckoning with an unpredictable force that threatens his ambition of transforming the start-up into a trillion-dollar company: Elon Musk. Since Donald Trump was elected president in November, executives at the ChatGPT-maker have been preparing to deal with the incoming US administration FT

Politics/Geopolitics:

"Progress in the negotiations of the exchange deal and may be completed after the Jewish holidays at the end of this month", according to Al Jazeera citing an informed source via Israeli press.

US President-elect Trump and Israeli PM discussed the Gaza hostage deal bid and Syria on Sunday, according to Reuters.

Israeli PM Netanyahu’s government approved a plan to expand settlements on Israeli-occupied Golan Heights.

Russia is pulling back its military in Syria but is not withdrawing from its main military bases, Syrian sources say, according to Reuters.

Trump's Middle East envoy has met with the Saudi crown prince, according to Axios.

"Syrian media: Strong explosions in the countryside of Tartous and Latakia resulting from an Israeli attack" according to Asharq News. Note: Russia has two bases in Syria – a naval base in Tartous and the Khmeimim Air Base near the port city of Latakia..

US Treasury Secretary Yellen said the Treasury continues to warn China about the potential for bank sanctions over transactions aiding Russia's war effort in Ukraine and will not rule out sanctions on Chinese banks.

Data on Deck: FOMC/ PCE

MONDAY, DEC. 16 S&P flash U.S. services PMI

TUESDAY, DEC. 17 U.S. retail sales

WEDNESDAY, DEC. 18 Housing starts 2:00 pm FOMC rate decision/presser

THURSDAY, DEC. 19 Existing home sales

FRIDAY, DEC. 20 PCE index Nov1

FINAL MARKET CHECK…