Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today:

Discussion: End The Fed Carefully

FOMC Recap

Fed Cuts 25 bps as expected

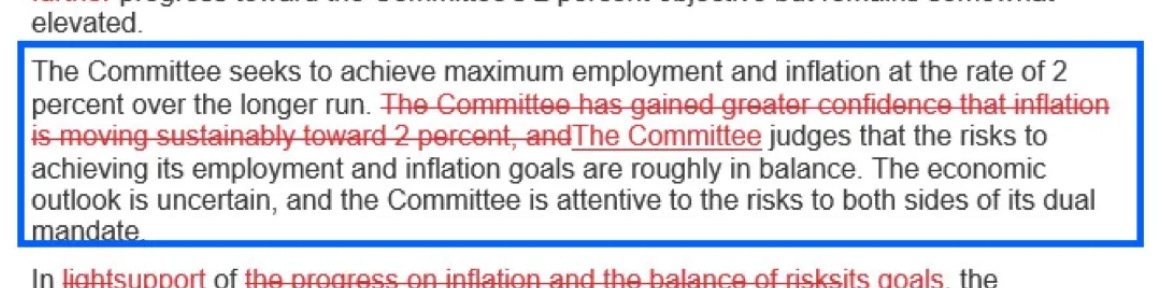

The Statement

Full changes footnoted here1

The Press Conference Was Dovish

He added that even with today’s cut, that policy is still restrictive, with the potential to still accelerate the pace/size of cuts if the labor market cools faster than anticipated.

Just Say No to Trump

In a question planted by the Fed to be asked and answered, Powell was asked (in multiple ways) if he would leave the Fed if asked by President-Elect Trump, he plainly stated:“no”

End The Fed Carefully

Whether the Fed is independent or not is up for debate. We don’t see how they can be 100% independent ever…. it’s not possible.

But to make that statement well after Trump had already said he would not ask Powell to resign, is to Pre-address any changes of Heart Trump may have or to put on a suit of armor against any future pressures Trump may levy

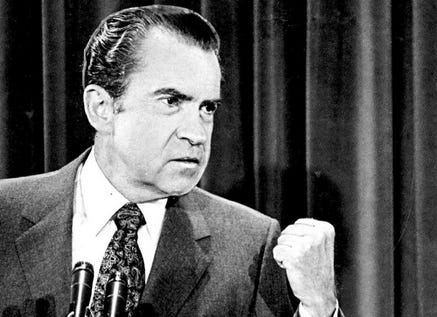

It also more importantly directly addresses others who are concerned about a possible collapse in resolve over the next 2 years under what could be relentless pressure from Trump. Nixon successfully did this in 1970’s which was a large instigator of the relapse in inflation back then.

In the 70s Nixon didn't want the fed to raise rates during his reelection and Burns went along with it.

Burns and Nixon have a private telephone conversation. Burns states that “I wanted you to know that we lowered the discount rate...got it down to 4.5 percent.” “Good, good, good,” replies Nixon. Burns indicates that the announcement of the discount rate reduction would be accompanied by the usual statement that it was done in order to bring the rate into line with market conditions,

Since then the fed has tried very hard to remind people it wont happen again.. at least as obviously as it did back then

You can’t fire Powell individually. You can ask him to step down, and he can say no. His board is ultimately who fires him. if he loses their confidence, he would step down.. The pressure to get Powell to leave, if trump wants to must be indirect… that said.

But….Jerome Powell can't stay in office if there's no office for him to stay in.

If you end the Fed, then there is no need to fire the Chair. There is no chair.

But if you fold the Fed into the Treasury, as mushroom head Yellen’s acolytes want, then you castrate the position entirely and you pave the way for true MMT.

You don’t need monetary policy under MMT… and ending the Fed or folding it more closely under the Treasuries control is a step in that direction.. End the Fed, but replace it with something stable like a Gold Standard, as opposed to a Marxist regime.

Continues at Bottom…

News/Analysis:

Equity Recap:

The S&P 500 and Nasdaq Comp closed at record highs on Thursday after the Fed cut near-term rates and one day following Donald Trump's US presidential election win. Large caps bested small caps: S&P 500 (+0.74%) vs. Russell 2000 (-0.43%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) rose 2.21% and 1.52% respectively.

Market News:

"The Federal Reserve approved a quarter-point interest rate cut Thursday but signaled a little more uncertainty over how quickly it would continue lowering rates, as it seeks to prevent large rate increases of the prior 2½ years from unnecessarily slowing the economy. WSJ

"President-elect Donald Trump likely will return to cornerstones of his previous economic platform such as tariffs, lower taxes and sanctions when he assumes office in January, his former Treasury secretary said Thursday. Steven Mnuchin, who held the post throughout Trump’s first term from 2017-21, told CNBC that he sees those items as critical to the Republican’s agenda." Source: CNBC

"The [virtual currency] industry poured millions of dollars into the presidential and congressional races, but its most salient election victory is likely to be the departure of US [SEC] Chair Gary Gensler. Bloomberg

"Nissan has launched an emergency turnaround plan that includes 9,000 job losses and a voluntary 50 per cent pay cut for chief executive Makoto Uchida Source: FT

"The Bank of England cut interest rates to 4.75 per cent but signalled that a further move is unlikely before early 2025, as it forecast that last week’s UK Budget would increase inflationary pressures." Source: FT

Politics/Geopolitics:

Data on Deck: FOMC Decision

MONDAY, NOV. 4 10:00 am Factory orders

TUESDAY, NOV. 5 10:00 am ISM services

WEDNESDAY, NOV. 6 9:45 am S&P final U.S. services PMI

THURSDAY, NOV. 7 2:00 pm FOMC interest-rate decision + conference

FRIDAY, NOV. 8 10:00 am Consumer sentiment

***FINAL MARKET CHECK***