Housekeeping: Good Morning. Nice ING Commodity report at bottom.

Fed Put, Treasury Call

The Fed is not in charge of upside now, but the Fed put is very much alive.. The Fed is the Put again, if we need it. The Treasury owns the call now and that has been exercised. The Fed can and has dampened market euphoria induced by Treasury spending… and if that is the case, then at best inflation has been dampened. Whether he likes it or not Powell is Burns 2.0

Contents

Current Prices

Yesterday’s Activity

Data Due

News

Top of Mind title starts 8:03

Markets/Metals Commentary

Market Gameplan

Attached: ING Commodity Analysis

Yesterday’s Activity:

Commodities- up all day, then down.. oil big.. gold small

US equities- started weak, got weaker

Bonds- up all day

DX- down all day, then strong close

Crypto- like Gold.. up then down

Data Due:

US JOLTs & Earnings from GOOG & MSFT due

MONDAY, JAN .29 QRA

TUESDAY, JAN. 30 9:00 am S&P Case-Shiller home price 10:00 am Consumer confidence

WEDNESDAY, JAN. 31 Day 2 QRA, 2:00 pm Fed interest-rate decisionTHURSDAY, FEB. 1 8:30 am Initial jobless claims Jan.

FRIDAY, FEB. 2 8:30 am NFP, Unemployment, Wages

Total Calendar1

News:

NOTABLE HEADLINES

BARRONS: A Fed Rate Cut in March Is Possible, Why Jobs Data Are Key, and 5 Other Things to Know Before the Stock Market Opens2

GOLDFIX: based on Powell’s statement and tone, FOMC is likely not Easing in March and BTFP is likely being terminated in its current form

US House voted 357-70 to pass a bill to expand the child tax credit and restore full business deductions for research and equipment investments.

GEOPOLITICS- safety signalling

US fighter jets targeted 10 unmanned Houthi drones and a ground control centre in western Yemen, while it was also reported that US Central Command said a Houthi anti-ship ballistic missile and Iranian UAVs were shot down in the Gulf of Aden.

White House said National Security Adviser Sullivan and UK Defence Secretary Shapps discussed preventing escalation in the Middle East and ongoing efforts to defend against Houthi attacks, while they reaffirmed support for Ukraine, according to Reuters.

White House said National Security Advisor Sullivan and Israeli official Dermer met to discuss the flow of humanitarian aid to Gaza and hostage talks, while it also said the US is not looking for war with Iran.

US senior cybersecurity official Easterly said the US has ‘found and eradicated’ Chinese cyber intrusions in aviation, water, energy and transportation infrastructure.

some headlines via NewSquawk

Top of Mind:

ZH: So, what did The Fed do (and say)...

The FOMC voted unanimously to leave benchmark rate unchanged - as expected - in target range of 5.25%-5.5% for fourth straight meeting while making significant changes to statement

The statement was very much more hawkish than expected:

The Fed pushed back aggressively against the dovish market stance:

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

The Fed did leave the door open for cuts at some point...

“The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance.”

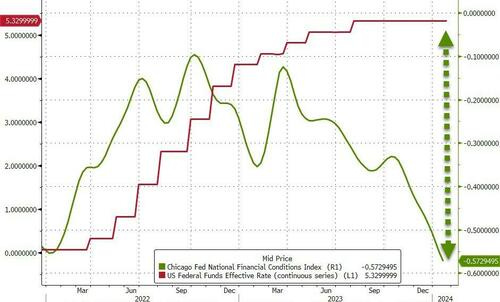

The Fed removed any reference to "tighter financial conditions", which makes sense given that financial conditions have massively loosened...

In what appears an implicit nod to 'animal spirits' in the economy, The Fed removed any reference to "growth slowing from its strong pace."

[EDIT: The Fed is the Put, it is not the call anymore- VBL]

Perhaps most notably, The Fed removed the following sentence from the statement:

"The U.S. banking system is sound and resilient."

Which makes sense given the shitshow at NYCB today (and the March chaos ahead).

Does the Fed no longer saying that "the U.S. banking system is sound and resilient" mean the banking system is no longer sound and resilient, or was it just a lie before to convince the population of something which was not the case?

[EDIT: They cant in good conscience say that given they know more banks will go belly up and they will not stop that form happening.. this is a culling of the herd- VBL]

Market Gameplan (Charts):

Gold

Silver- CTAs are shorting again

Oil

Stocks

BTC/ETH

Bonds

Attached:

Very nice recap of Yesterday’s Commodity activity with a focus on metals and some LME commentary